PowerSchool Investor Presentation Deck

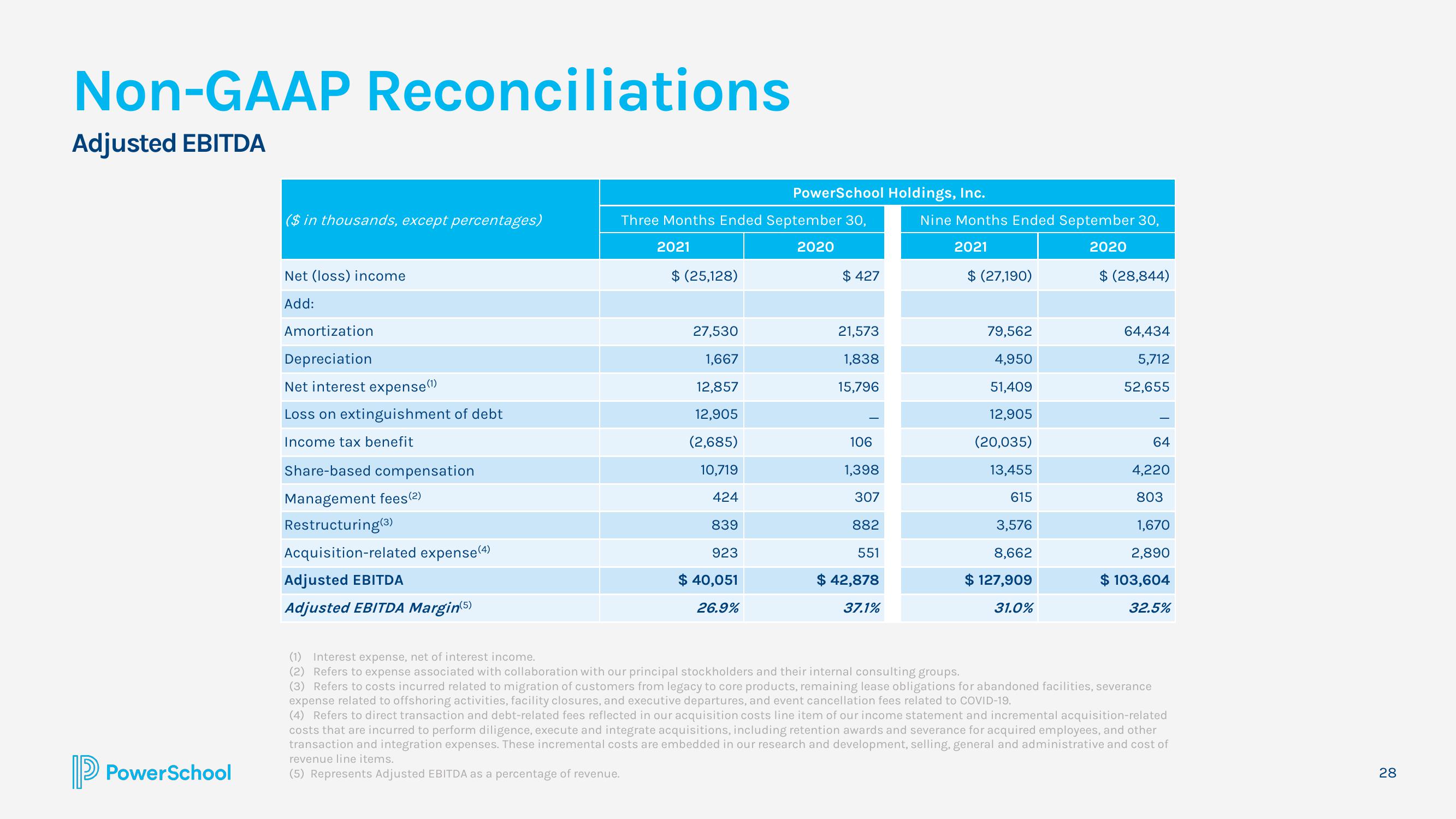

Non-GAAP Reconciliations

Adjusted EBITDA

PowerSchool

($ in thousands, except percentages)

Net (loss) income

Add:

Amortization

Depreciation

Net interest expense (¹)

Loss on extinguishment of debt

Income tax benefit

Share-based compensation

Management fees(2)

Restructuring (3)

Acquisition-related expense (4)

Adjusted EBITDA

Adjusted EBITDA Margin(5)

Three Months Ended September 30,

2020

2021

$ (25,128)

PowerSchool Holdings, Inc.

27,530

1,667

12,857

12,905

(2,685)

10,719

424

839

923

$ 40,051

26.9%

$ 427

21,573

1,838

15,796

106

1,398

307

882

551

$ 42,878

37.1%

Nine Months Ended September 30,

2021

2020

$ (27,190)

(1) Interest expense, net of interest income.

(2) Refers to expense associated with collaboration with our principal stockholders and their internal consulting groups.

79,562

4,950

51,409

12,905

(20,035)

13,455

615

3,576

8,662

$ 127,909

31.0%

$ (28,844)

64,434

5,712

52,655

64

4,220

803

1,670

2,890

$ 103,604

32.5%

(3) Refers to costs incurred related to migration of customers from legacy to core products, remaining lease obligations for abandoned facilities, severance

expense related to offshoring activities, facility closures, and executive departures, and event cancellation fees related to COVID-19.

(4) Refers to direct transaction and debt-related fees reflected in our acquisition costs line item of our income statement and incremental acquisition-related

costs that are incurred to perform diligence, execute and integrate acquisitions, including retention awards and severance for acquired employees, and other

transaction and integration expenses. These incremental costs are embedded in our research and development, selling, general and administrative and cost of

revenue line items.

(5) Represents Adjusted EBITDA as a percentage of revenue.

28View entire presentation