Marti Results Presentation Deck

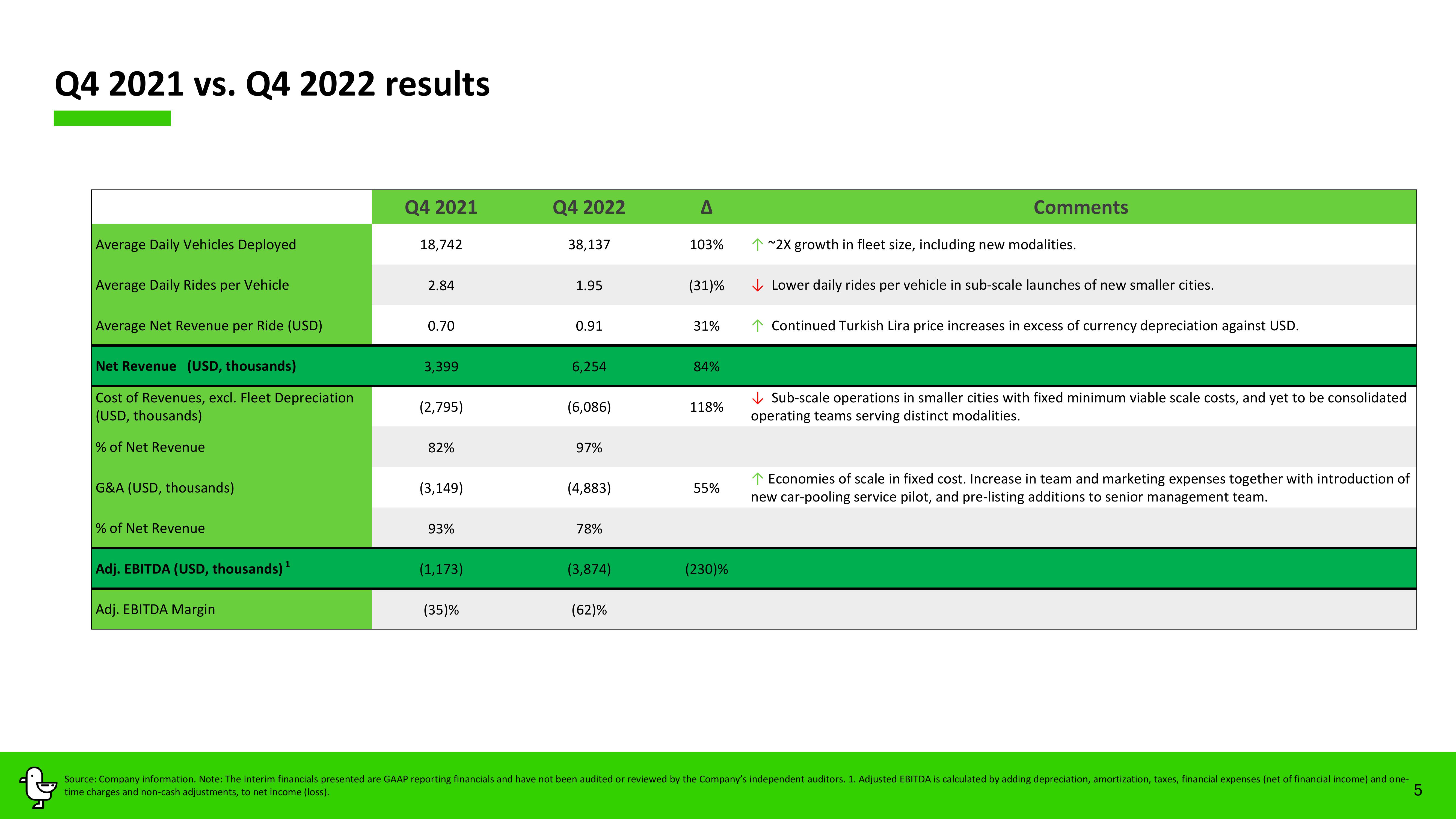

Q4 2021 vs. Q4 2022 results

Average Daily Vehicles Deployed

Average Daily Rides per Vehicle

Average Net Revenue per Ride (USD)

Net Revenue (USD, thousands)

Cost of Revenues, excl. Fleet Depreciation

(USD, thousands)

% of Net Revenue

G&A (USD, thousands)

% of Net Revenue

Adj. EBITDA (USD, thousands) ¹

1

Adj. EBITDA Margin

Q4 2021

18,742

2.84

0.70

3,399

(2,795)

82%

(3,149)

93%

(1,173)

(35)%

Q4 2022

38,137

1.95

0.91

6,254

(6,086)

97%

(4,883)

78%

(3,874)

(62)%

A

103%

(31)%

31%

84%

118%

55%

(230)%

Comments

↑ ~2X growth in fleet size, including new modalities.

✓ Lower daily rides per vehicle in sub-scale launches of new smaller cities.

↑ Continued Turkish Lira price increases in excess of currency depreciation against USD.

Sub-scale operations in smaller cities with fixed minimum viable scale costs, and yet to be consolidated

operating teams serving distinct modalities.

↑ Economies of scale in fixed cost. Increase in team and marketing expenses together with introduction of

new car-pooling service pilot, and pre-listing additions to senior management team.

Source: Company information. Note: The interim financials presented are GAAP reporting financials and have not been audited or reviewed by the Company's independent auditors. 1. Adjusted EBITDA is calculated by adding depreciation, amortization, taxes, financial expenses (net of financial income) and one-

time charges and non-cash adjustments, to net income (loss).

5View entire presentation