SoftBank Results Presentation Deck

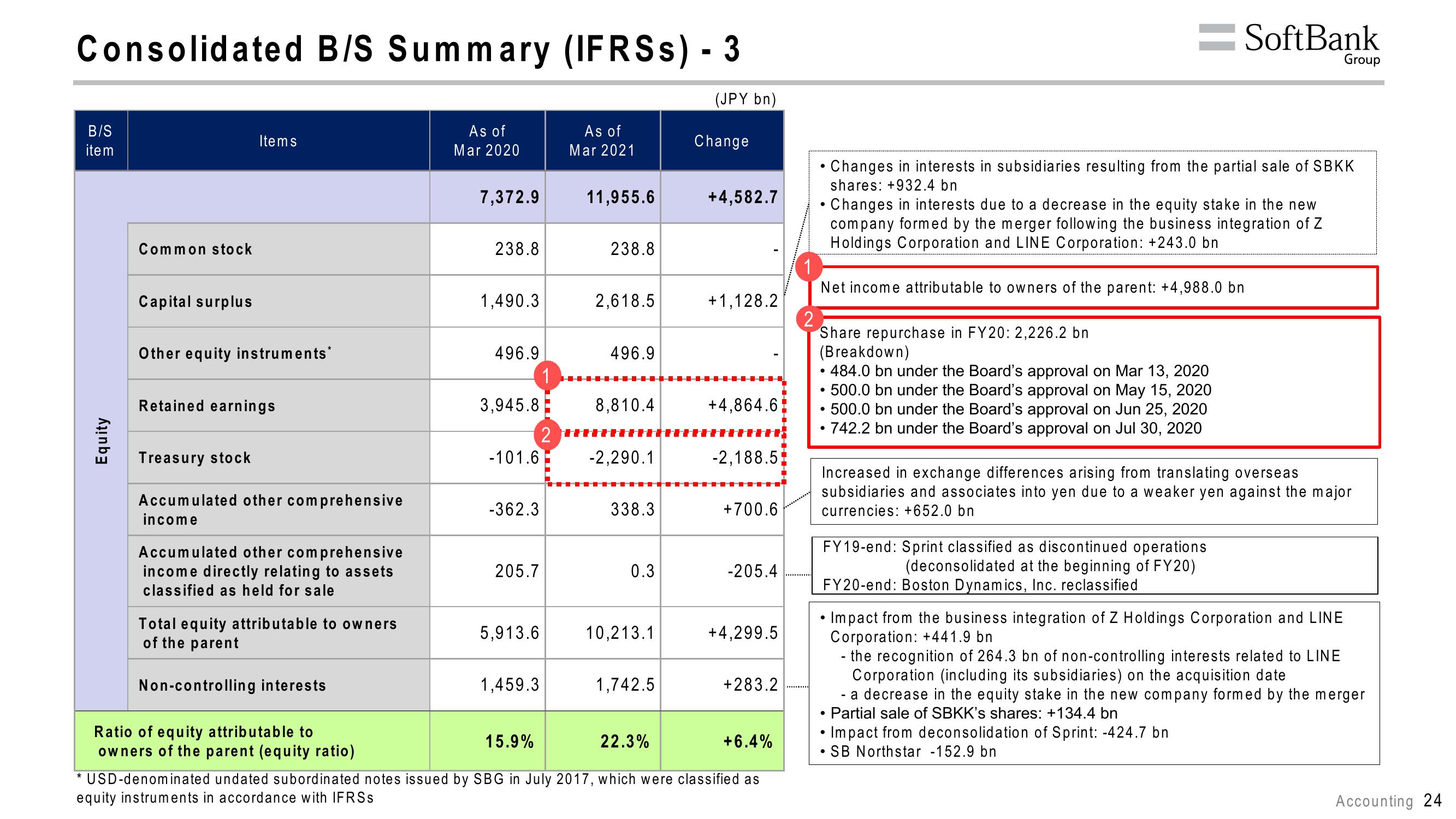

Consolidated B/S Summary (IFRSs) - 3

(JPY bn)

B/S

item

Equity

Common stock

Capital surplus

Items

Other equity instruments*

Retained earnings

Treasury stock

Accumulated other comprehensive

income

Accumulated other comprehensive

income directly relating to assets

classified as held for sale

Total equity attributable to owners

of the parent

Non-controlling interests

Ratio of equity attributable to

owners of the parent (equity ratio)

As of

Mar 2020

7,372.9

238.8

1,490.3

496.9

3,945.8

- 101.6

-362.3

205.7

5,913.6

1,459.3

2

As of

Mar 2021

11,955.6

238.8

2,618.5

496.9

HH

8,810.4

-2,290.1

338.3

0.3

10,213.1

1,742.5

Change

+4,582.7

+1,128.2

HH

+4,864.6

TH

-2,188.5)

+700.6

-205.4

+4,299.5

+283.2

15.9%

22.3%

+6.4%

USD-denominated undated subordinated notes issued by SBG in July 2017, which were classified as

equity instruments in accordance with IFRSs

• Changes in interests in subsidiaries resulting from the partial sale of SBKK

shares: +932.4 bn

• Changes in interests due to a decrease in the equity stake in the new

company formed by the merger following the business integration of Z

Holdings Corporation and LINE Corporation: +243.0 bn

1

Net income attributable to owners of the parent: +4,988.0 bn

2

Share repurchase in FY20: 2,226.2 bn

(Breakdown)

●

› 484.0 bn under the Board's approval on Mar 13, 2020

• 500.0 bn under the Board's approval on May 15, 2020

500.0 bn under the Board's approval on Jun 25, 2020

742.2 bn under the Board's approval on Jul 30, 2020

●

FY19-end: Sprint classified as discontinued operations

(deconsolidated at the beginning of FY20)

SoftBank

Increased in exchange differences arising from translating overseas

subsidiaries and associates into yen due to a weaker yen against the major

currencies: +652.0 bn

FY20-end: Boston Dynamics, Inc. reclassified

• Impact from the business integration of Z Holdings Corporation and LINE

Corporation: +441.9 bn

●

Group

-

the recognition of 264.3 bn of non-controlling interests related to LINE

Corporation (including its subsidiaries) on the acquisition date

- a decrease in the equity stake in the new company formed by the merger

Partial sale of SBKK's shares: +134.4 bn

• Impact from deconsolidation of Sprint: -424.7 bn

• SB Northstar -152.9 bn

Accounting 24View entire presentation