Advent Capital Balanced Strategy Update

BALANCED STRATEGY CHARACTERISTICS

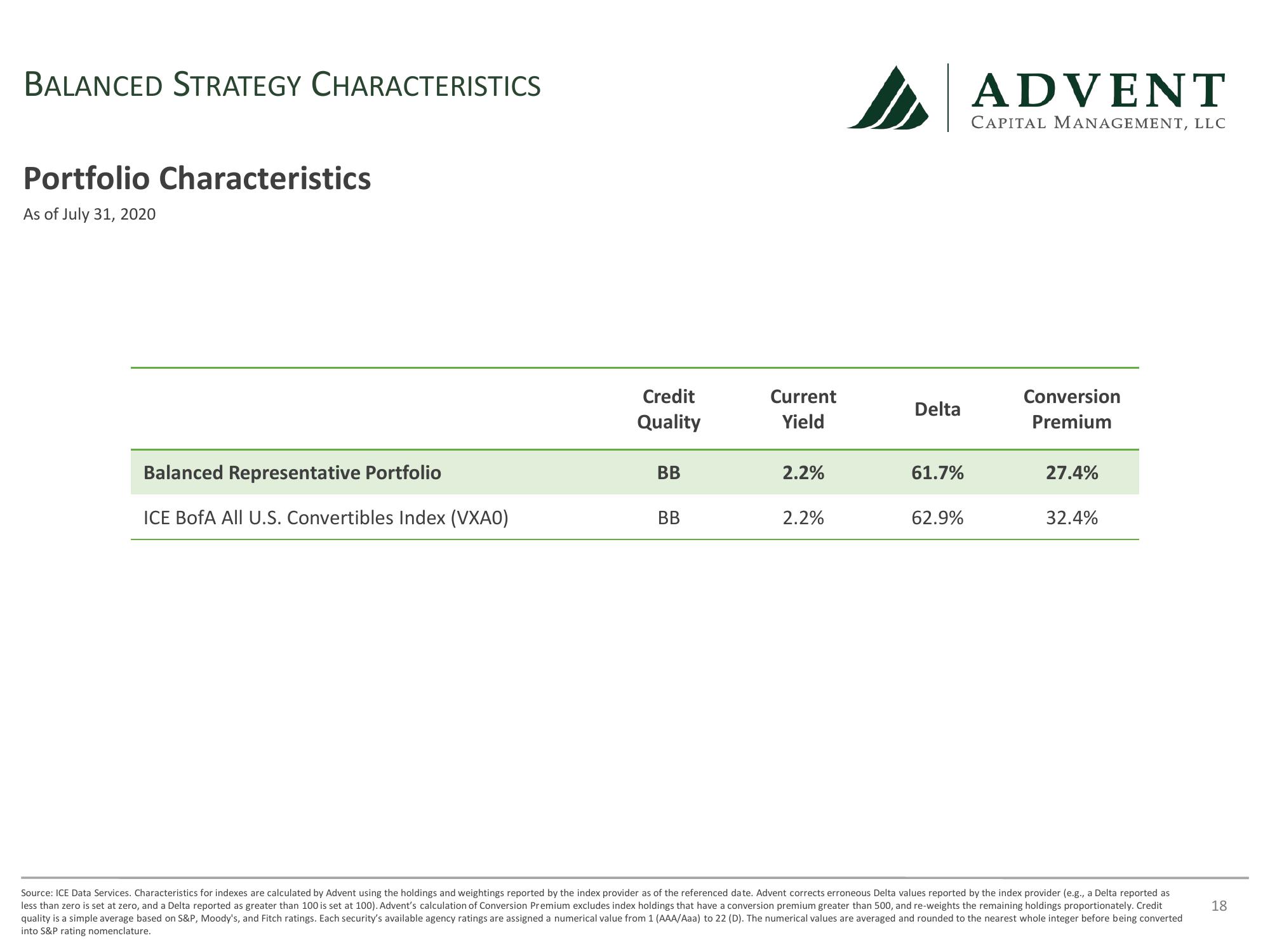

Portfolio Characteristics

As of July 31, 2020

Balanced Representative Portfolio

ICE BofA All U.S. Convertibles Index (VXAO)

Credit

Quality

BB

BB

Current

Yield

2.2%

2.2%

Delta

61.7%

62.9%

ADVENT

CAPITAL MANAGEMENT, LLC

Conversion

Premium

27.4%

32.4%

Source: ICE Data Services. Characteristics for indexes are calculated by Advent using the holdings and weightings reported by the index provider as of the referenced date. Advent corrects erroneous Delta values reported by the index provider (e.g., a Delta reported as

less than zero is set at zero, and a Delta reported as greater than 100 is set at 100). Advent's calculation of Conversion Premium excludes index holdings that have a conversion premium greater than 500, and re-weights the remaining holdings proportionately. Credit

quality is a simple average based on S&P, Moody's, and Fitch ratings. Each security's available agency ratings are assigned a numerical value from 1 (AAA/Aaa) to 22 (D). The numerical values are averaged and rounded to the nearest whole integer before being converted

into S&P rating nomenclature.

18View entire presentation