NewFortress Energy 2Q23 Results

(in thousands of $)

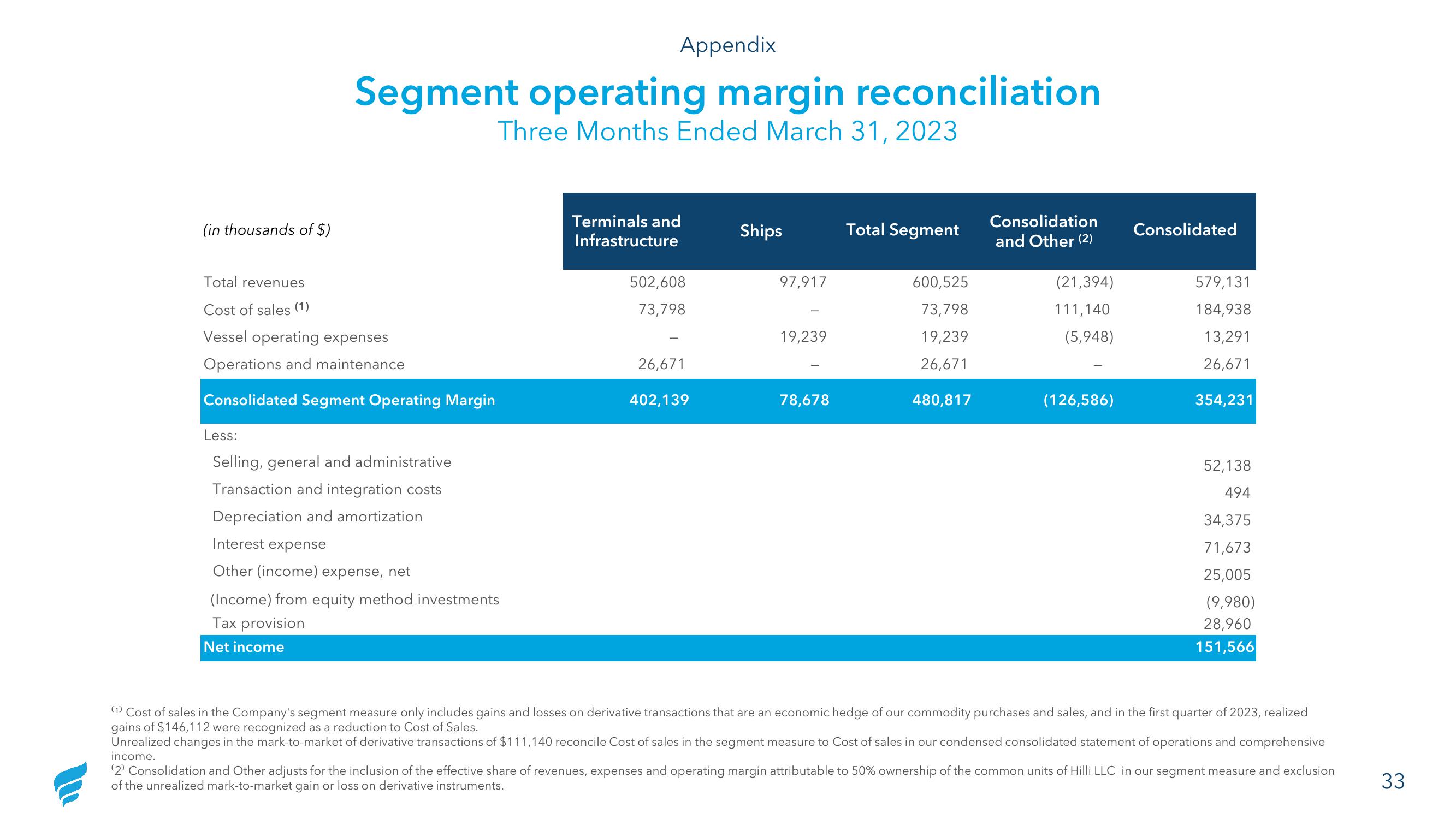

Appendix

Segment operating margin reconciliation

Three Months Ended March 31, 2023

Total revenues

Cost of sales (1)

Vessel operating expenses

Operations and maintenance

Consolidated Segment Operating Margin

Less:

Selling, general and administrative

Transaction and integration costs

Depreciation and amortization

Interest expense

Other (income) expense, net

(Income) from equity method investments

Tax provision

Net income

Terminals and

Infrastructure

502,608

73,798

26,671

402,139

Ships

97,917

19,239

78,678

Total Segment

600,525

73,798

19,239

26,671

480,817

Consolidation

and Other (2)

(21,394)

111,140

(5,948)

(126,586)

Consolidated

579,131

184,938

13,291

26,671

354,231

52,138

494

34,375

71,673

25,005

(9,980)

28,960

151,566

(1) Cost of sales in the Company's segment measure only includes gains and losses on derivative transactions that are an economic hedge of our commodity purchases and sales, and in the first quarter of 2023, realized

gains of $146,112 were recognized as a reduction to Cost of Sales.

Unrealized changes in the mark-to-market of derivative transactions of $111,140 reconcile Cost of sales in the segment measure to Cost of sales in our condensed consolidated statement of operations and comprehensive

income.

(2) Consolidation and Other adjusts for the inclusion of the effective share of revenues, expenses and operating margin attributable to 50% ownership of the common units of Hilli LLC in our segment measure and exclusion

of the unrealized mark-to-market gain or loss on derivative instruments.

33View entire presentation