Allego SPAC Presentation Deck

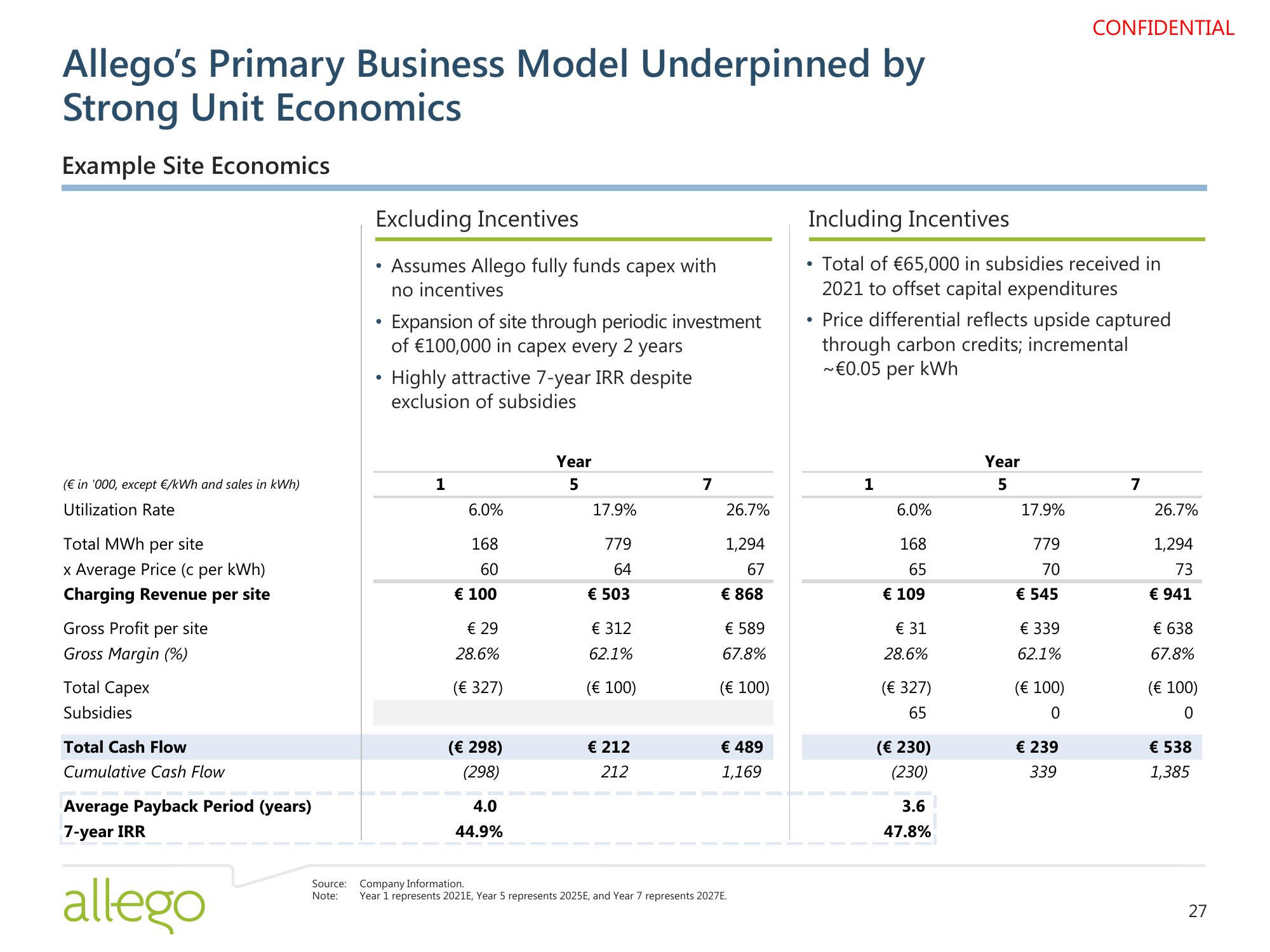

Allego's Primary Business Model Underpinned by

Strong Unit Economics

Example Site Economics

(€ in '000, except €/kWh and sales in kWh)

Utilization Rate

Total MWh per site

x Average Price (c per kWh)

Charging Revenue per site

Gross Profit per site

Gross Margin (%)

Total Capex

Subsidies

Total Cash Flow

Cumulative Cash Flow

Average Payback Period (years)

7-year IRR

allego

Excluding Incentives

• Assumes Allego fully funds capex with

no incentives

.

Expansion of site through periodic investment

of €100,000 in capex every 2 years

• Highly attractive 7-year IRR despite

exclusion of subsidies

1

6.0%

168

60

€ 100

€ 29

28.6%

(€ 327)

(€ 298)

(298)

4.0

44.9%

Source: Company Information.

Note:

Year

5

17.9%

779

64

€ 503

€ 312

62.1%

(€ 100)

€ 212

212

7

26.7%

1,294

67

€ 868

€ 589

67.8%

(€ 100)

€ 489

1,169

Year 1 represents 2021E, Year 5 represents 2025E, and Year 7 represents 2027E.

Including Incentives

Total of €65,000 in subsidies received in

2021 to offset capital expenditures

●

●

Price differential reflects upside captured

through carbon credits; incremental

~ €0.05 per kWh

1

6.0%

168

65

€ 109

€ 31

28.6%

(€ 327)

65

(€ 230)

(230)

3.6

47.8%

Year

5

17.9%

779

70

€ 545

€ 339

62.1%

CONFIDENTIAL

(€ 100)

0

€ 239

339

7

26.7%

1,294

73

€ 941

€ 638

67.8%

(€ 100)

0

€ 538

1,385

27View entire presentation