SoftBank Results Presentation Deck

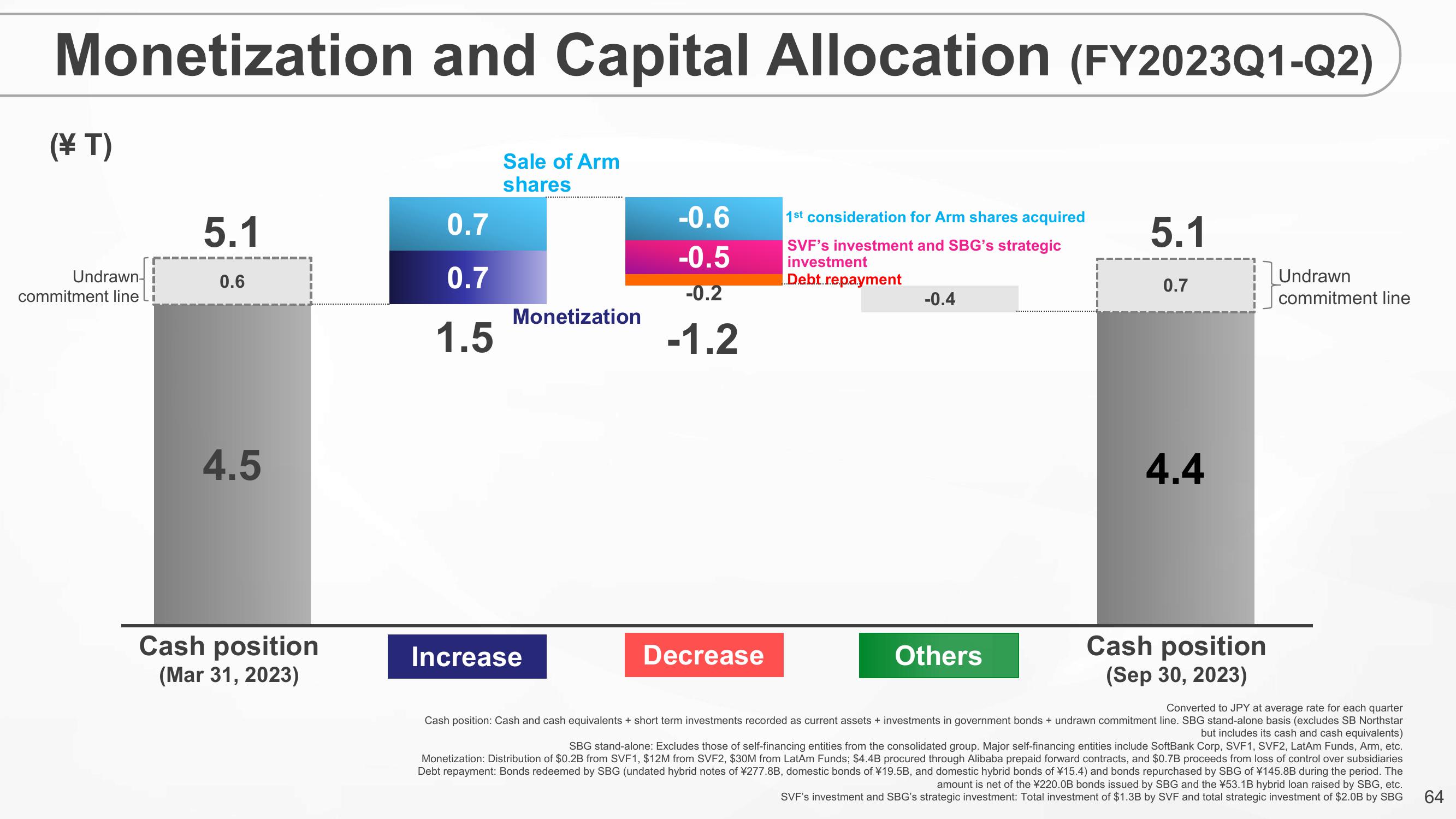

Monetization and Capital Allocation (FY2023Q1-Q2)

Sale of Arm

shares

(T)

Undrawn-

commitment line Li

5.1

0.6

4.5

Cash position

(Mar 31, 2023)

0.7

0.7

1.5

Monetization

Increase

-0.6

-0.5

-0.2

-1.2

Decrease

1st consideration for Arm shares acquired

SVF's investment and SBG's strategic

investment

Debt repayment

-0.4

Others

5.1

0.7

4.4

Cash position

(Sep 30, 2023)

Undrawn

commitment line

Converted to JPY at average rate for each quarter

Cash position: Cash and cash equivalents + short term investments recorded as current assets + investments in government bonds + undrawn commitment line. SBG stand-alone basis (excludes SB Northstar

but includes its cash and cash equivalents)

SBG stand-alone: Excludes those of self-financing entities from the consolidated group. Major self-financing entities include SoftBank Corp, SVF1, SVF2, LatAm Funds, Arm, etc.

Monetization: Distribution of $0.2B from SVF1, $12M from SVF2, $30M from LatAm Funds; $4.4B procured through Alibaba prepaid forward contracts, and $0.7B proceeds from loss of control over subsidiaries

Debt repayment: Bonds redeemed by SBG (undated hybrid notes of ¥277.8B, domestic bonds of ¥19.5B, and domestic hybrid bonds of ¥15.4) and bonds repurchased by SBG of ¥145.8B during the period. The

amount is net of the ¥220.0B bonds issued by SBG and the ¥53.1B hybrid loan raised by SBG, etc.

SVF's investment and SBG's strategic investment: Total investment of $1.3B by SVF and total strategic investment of $2.0B by SBG

64View entire presentation