Amplitude Results Presentation Deck

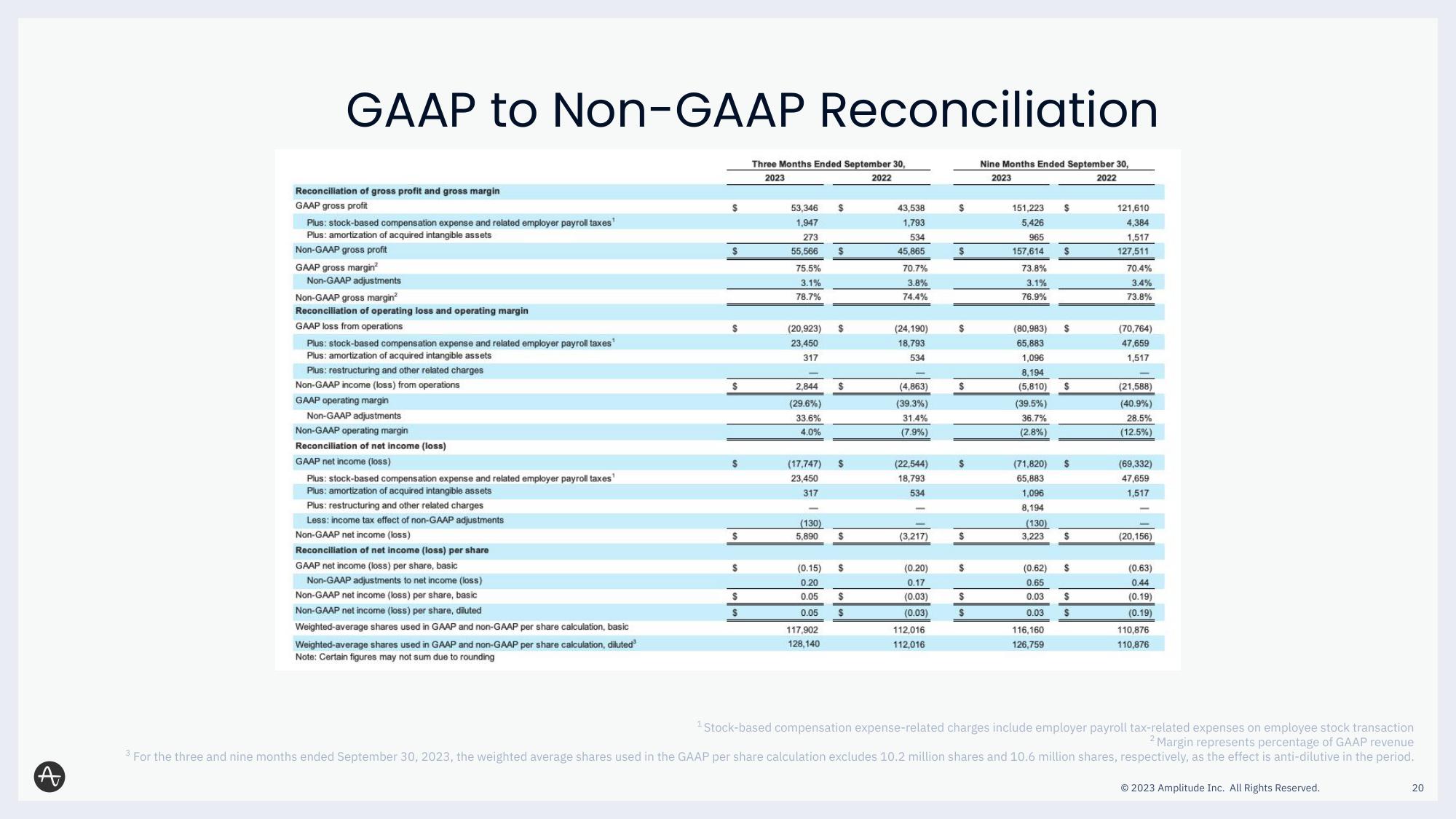

GAAP to Non-GAAP Reconciliation

Nine Months Ended September 30,

2023

2022

Reconciliation of gross profit and gross margin

GAAP gross profit

Plus: stock-based compensation expense and related employer payroll taxes¹

Plus: amortization of acquired intangible assets

Non-GAAP gross profit

GAAP gross margin²

Non-GAAP adjustments

Non-GAAP gross margin²

Reconciliation of operating loss and operating margin

GAAP loss from operations

Plus: stock-based compensation expense and related employer payroll taxes¹

Plus: amortization of acquired intangible assets

Plus: restructuring and other related charges

Non-GAAP income (loss) from operations

GAAP operating margin

Non-GAAP adjustments

Non-GAAP operating margin

Reconciliation of net income (loss)

GAAP net income (loss)

Plus: stock-based compensation expense and related employer payroll taxes¹

Plus: amortization of acquired intangible assets

Plus: restructuring and other related charges

Less: income tax effect of non-GAAP adjustments

Non-GAAP net income (loss)

Reconciliation of net income (loss) per share

GAAP net income (loss) per share, basic

Non-GAAP adjustments to net income (loss)

Non-GAAP net income (loss) per share, basic

Non-GAAP net income (loss) per share, diluted

Weighted-average shares used in GAAP and non-GAAP per share calculation, basic

Weighted-average shares used in GAAP and non-GAAP per share calculation, diluted

Note: Certain figures may not sum due to rounding

$

S

S

$

S

Three Months Ended September 30,

2023

2022

53,346 S

1,947

273

55,566

75.5%

3.1%

78.7%

(20,923) $

23,450

317

2.844

(29.6%)

33.6%

4.0%

(17,747)

23,450

317

(130)

5,890

$

117,902

128,140

$

S

(0.15) $

0.20

0.05

0.05

$

S

43,538

1,793

534

45,865

70.7%

3.8%

74.4%

(24,190)

18,793

534

(4,863)

(39.3%)

31.4%

(7.9%)

(22,544)

18,793

534

(3,217)

(0.20)

0.17

(0.03)

(0.03)

112,016

112,016

$

$

$

$

$

$

$

$

$

151,223 $

5,426

965

157,614

73.8%

3.1%

76.9%

(80,983)

65,883

1,096

8,194

(5,810)

(39.5%)

36.7%

(2.8%)

(71,820)

65,883

1,096

8,194

(130)

3,223

(0.62)

0.65

0.03

0.03

116,160

126,759

$

S

$

S

$

$

S

121,610

4,384

1,517

127,511

70.4%

3.4%

73.8%

(70,764)

47,659

1,517

(21,588)

(40.9%)

28.5%

(12.5%)

(69,332)

47,659

1,517

(20,156)

(0.63)

0.44

(0.19)

(0.19)

110,876

110,876

¹ Stock-based compensation expense-related charges include employer payroll tax-related expenses on employee stock transaction

2 Margin represents percentage of GAAP revenue

3

For the three and nine months ended September 30, 2023, the weighted average shares used in the GAAP per share calculation excludes 10.2 million shares and 10.6 million shares, respectively, as the effect is anti-dilutive in the period.

© 2023 Amplitude Inc. All Rights Reserved.

20View entire presentation