Oatly IPO Presentation Deck

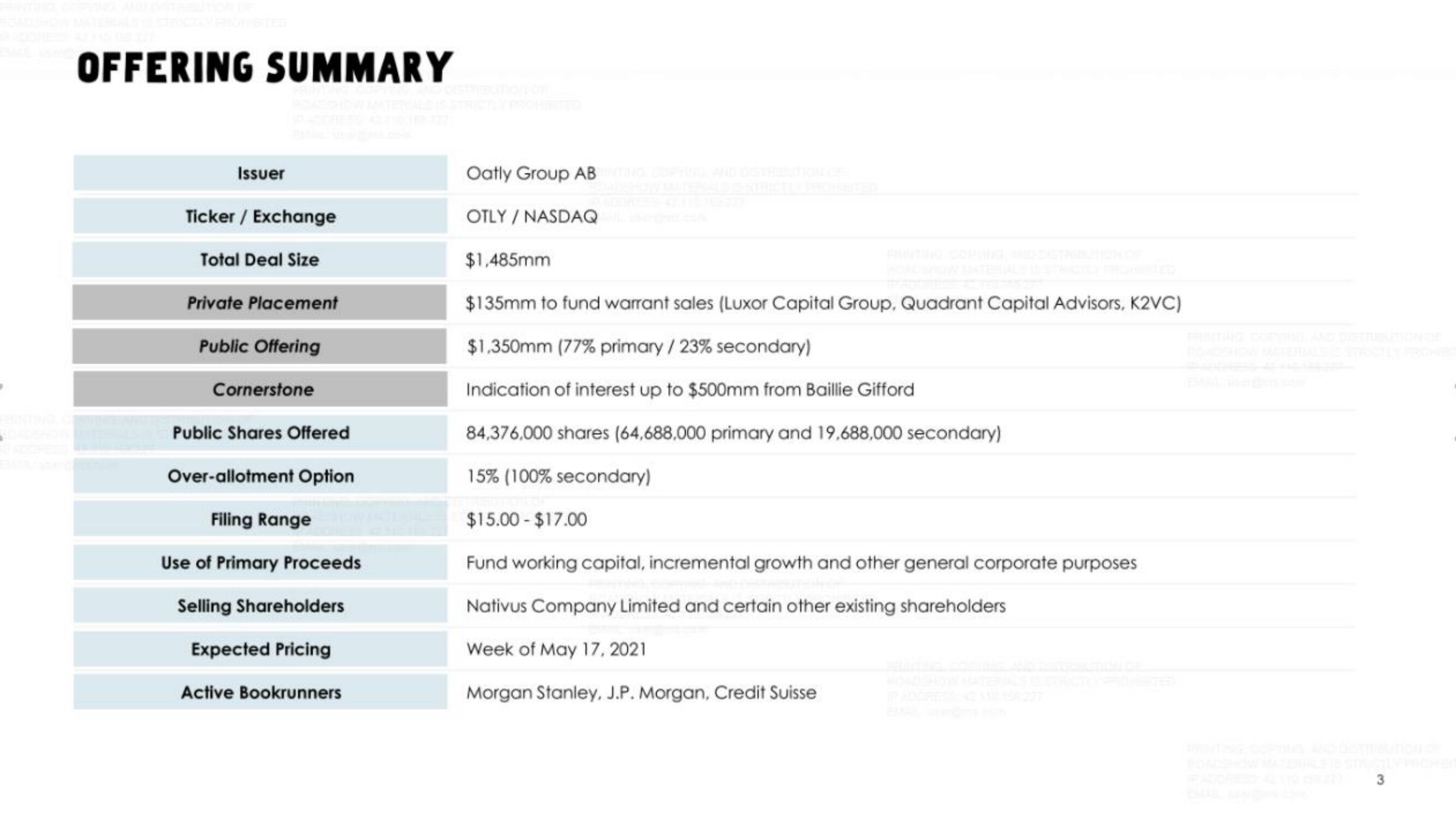

OFFERING SUMMARY

Issuer

Ticker/ Exchange

Total Deal Size

Private Placement

Public Offering

Cornerstone

Public Shares Offered

Over-allotment Option

Filing Range

Use of Primary Proceeds

Selling Shareholders

Expected Pricing

Active Bookrunners

Oatly Group AB UNTING COPYING, AND DISTRIBUTION DE

OTLY / NASDAQ.co

$1,485mm

$135mm to fund warrant sales (Luxor Capital Group, Quadrant Capital Advisors, K2VC)

$1,350mm (77% primary / 23% secondary)

Indication of interest up to $500mm from Baillie Gifford

84,376,000 shares (64,688,000 primary and 19,688,000 secondary)

15% (100% secondary)

$15.00-$17.00

Fund working capital, incremental growth and other general corporate purposes

Nativus Company Limited and certain other existing shareholders

Week of May 17, 2021

Morgan Stanley, J.P. Morgan, Credit Suisse

3View entire presentation