Investor Presentation

Our Strategy

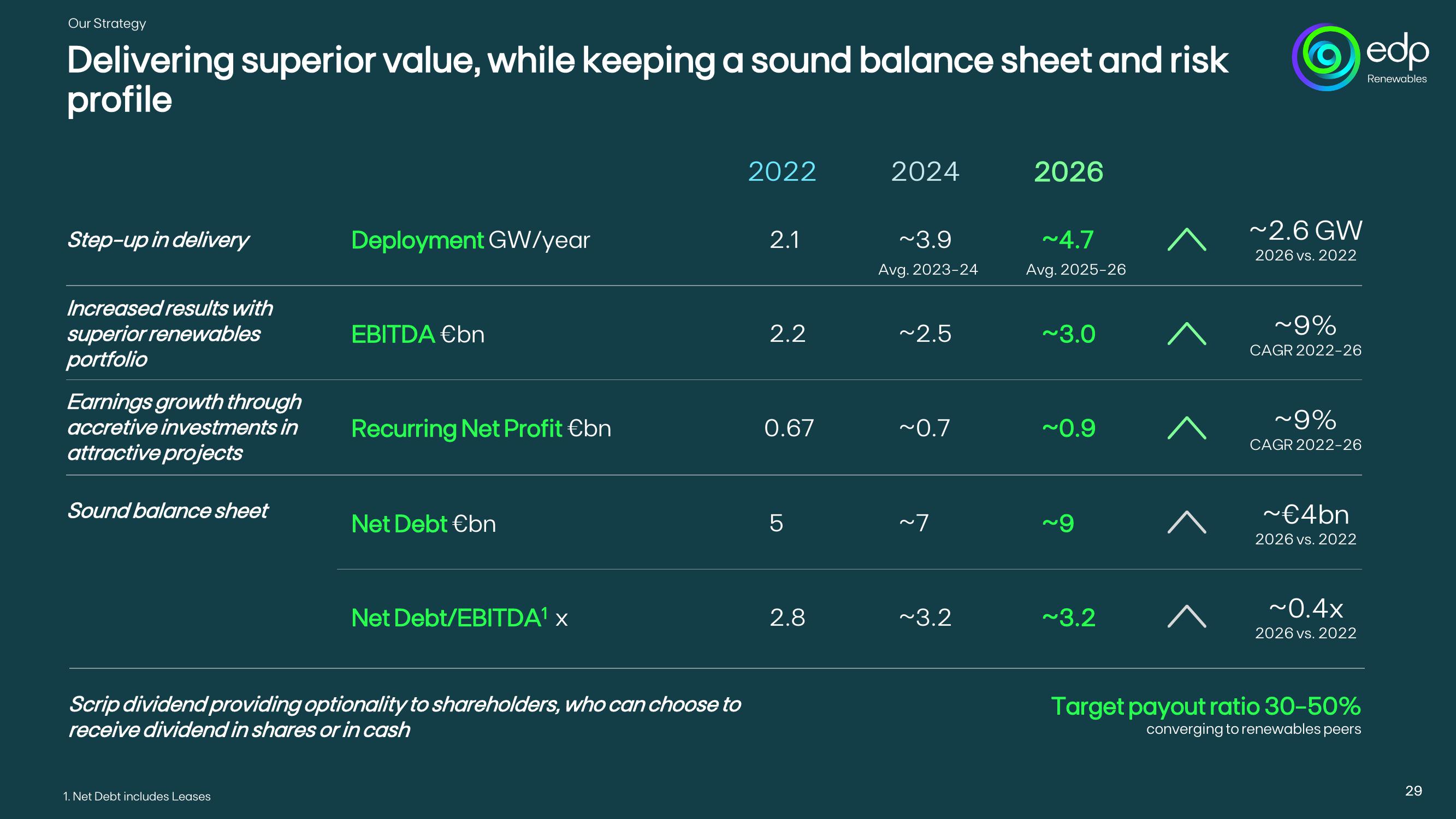

Delivering superior value, while keeping a sound balance sheet and risk

profile

edp

Renewables

Step-up in delivery

2022

2024

2026

Deployment GW/year

2.1

~3.9

~4.7

Avg. 2023-24

Avg. 2025-26

Increased results with

superior renewables

portfolio

EBITDA €bn

2.2

~2.5

~3.0

^

Earnings growth through

accretive investments in

attractive projects

Recurring Net Profit €bn

0.67

~0.7

~0.9

Sound balance sheet

Net Debt €bn

LO

5

~7

~9

^

Net Debt/EBITDA1 x

Scrip dividend providing optionality to shareholders, who can choose to

receive dividend in shares or in cash

1. Net Debt includes Leases

2.8

~3.2

~3.2

^

~2.6 GW

2026 vs. 2022

~9%

CAGR 2022-26

~9%

CAGR 2022-26

~€4bn

2026 vs. 2022

~0.4x

2026 vs. 2022

Target payout ratio 30-50%

converging to renewables peers

29View entire presentation