a16z: Crypto Applications

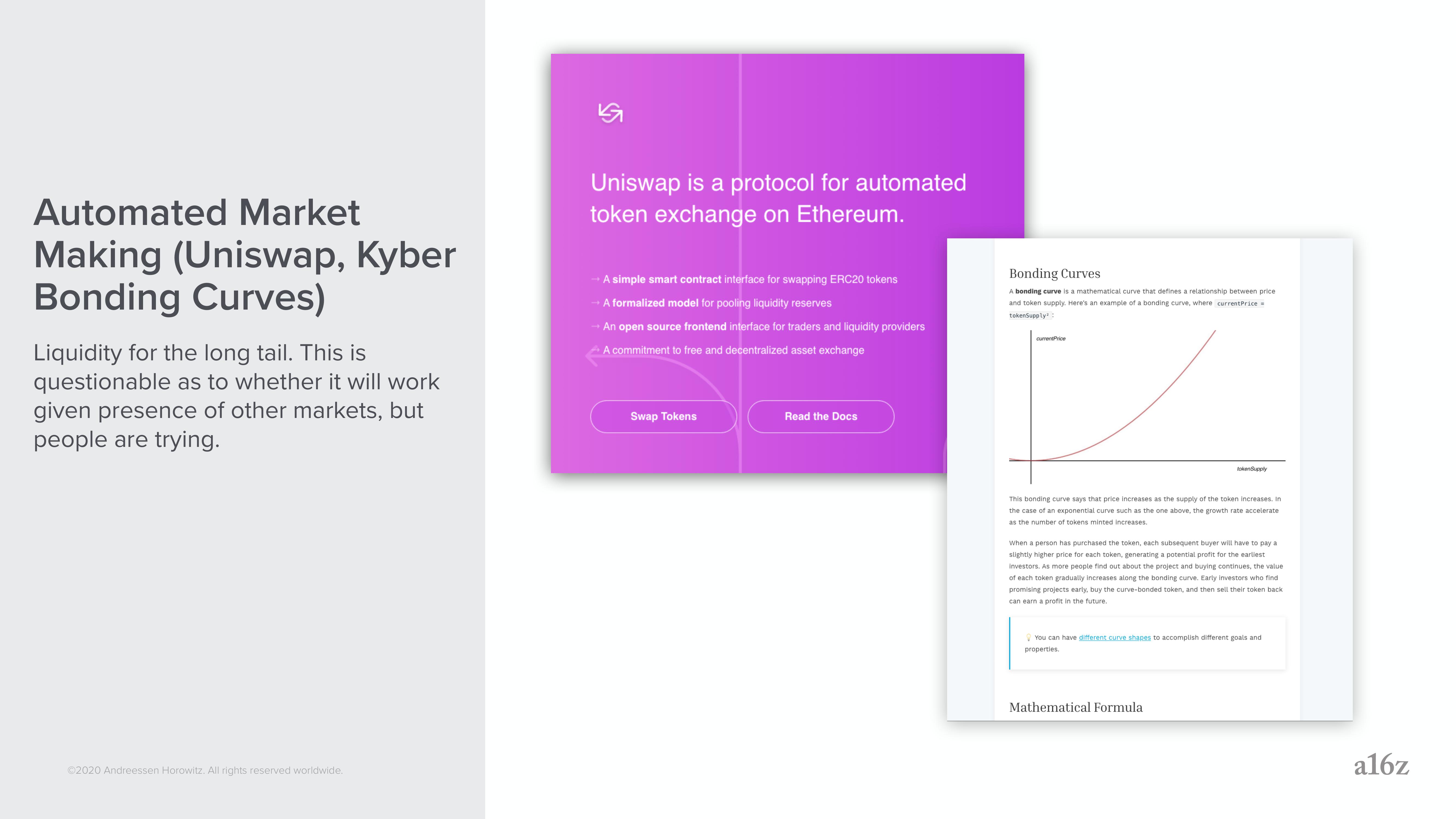

Automated Market

Making (Uniswap, Kyber

Bonding Curves)

Liquidity for the long tail. This is

questionable as to whether it will work

given presence of other markets, but

people are trying.

Ⓒ2020 Andreessen Horowitz. All rights reserved worldwide.

S

Uniswap is a protocol for automated

token exchange on Ethereum.

A simple smart contract interface for swapping ERC20 tokens

A formalized model for pooling liquidity reserves

An open source frontend interface for traders and liquidity providers

A commitment to free and decentralized asset exchange

Swap Tokens

Read the Docs

Bonding Curves

A bonding curve is a mathematical curve that defines a relationship between price

and token supply. Here's an example of a bonding curve, where current Price =

tokenSupply:

currentPrice

tokenSupply

This bonding curve says that price increases as the supply of the token increases. In

the case of an exponential curve such as the one above, the growth rate accelerate

as the number of tokens minted increases.

When a person has purchased the token, each subsequent buyer will have to pay a

slightly higher price for each token, generating a potential profit for the earliest

investors. As more people find out about the project and buying continues, the value

of each token gradually increases along the bonding curve. Early investors who find

promising projects early, buy the curve-bonded token, and then sell their token back

can earn a profit in the future.

You can have different curve shapes to accomplish different goals and

properties.

Mathematical Formula

a16zView entire presentation