Forbes SPAC Presentation Deck

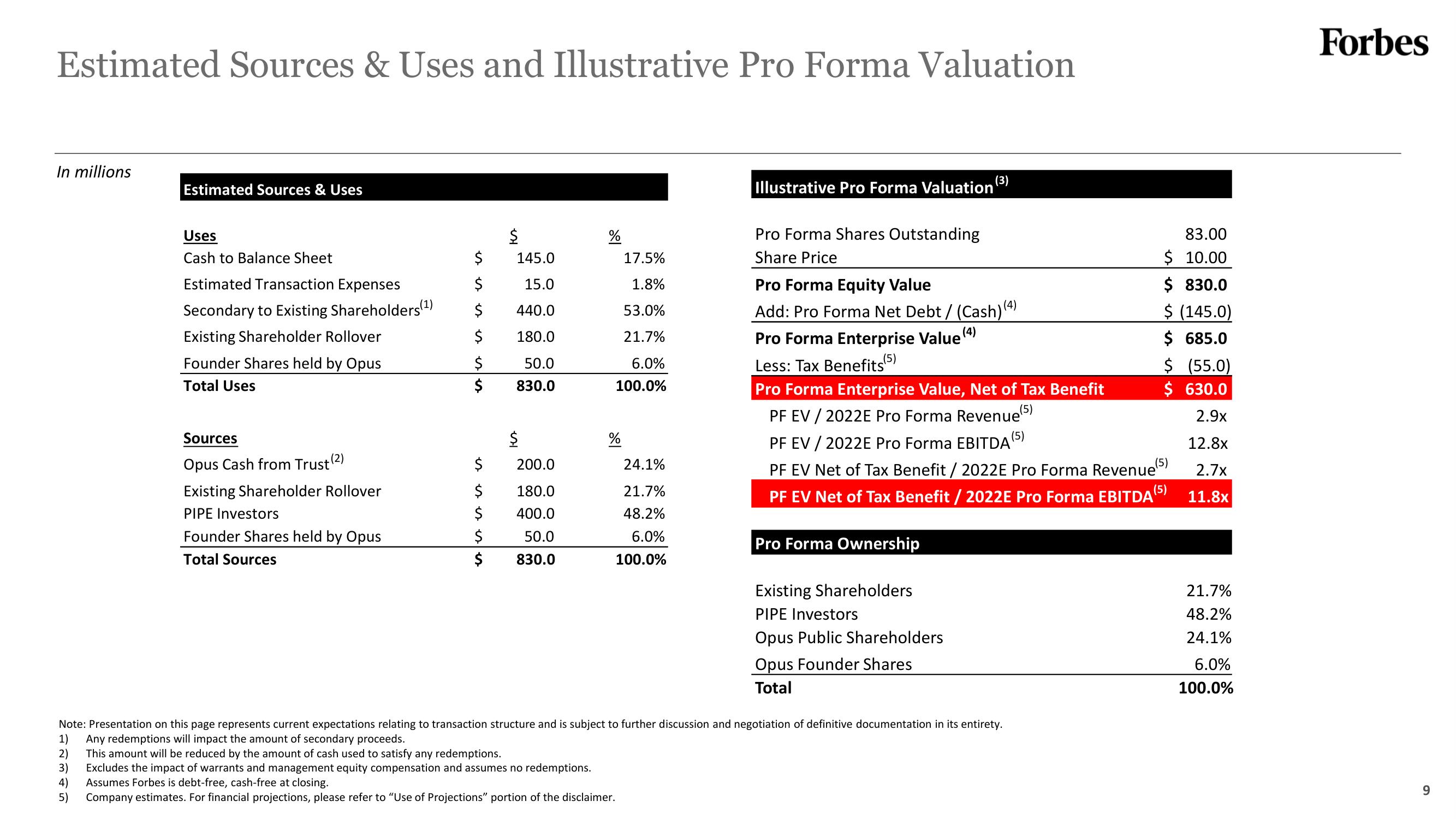

Estimated Sources & Uses and Illustrative Pro Forma Valuation

In millions

Estimated Sources & Uses

1)

2)

3)

4)

5)

Uses

Cash to Balance Sheet

Estimated Transaction Expenses

Secondary to Existing Shareholders(¹)

Existing Shareholder Rollover

Founder Shares held by Opus

Total Uses

Sources

(2)

Opus Cash from Trust (2

Existing Shareholder Rollover

PIPE Investors

Founder Shares held by Opus

Total Sources

$

$

$

$

$

$

$

$

$

is ee

$

$

$

145.0

15.0

440.0

180.0

50.0

830.0

200.0

180.0

400.0

50.0

830.0

17.5%

1.8%

53.0%

21.7%

6.0%

100.0%

%

24.1%

21.7%

48.2%

6.0%

100.0%

Illustrative Pro Forma Valuation

Pro Forma Shares Outstanding

Share Price

(3)

Pro Forma Equity Value

Add: Pro Forma Net Debt / (Cash) (4)

Pro Forma Enterprise Value (4)

(5)

Opus Founder Shares

Total

Note: Presentation on this page represents current expectations relating to transaction structure and is subject to further discussion and negotiation of definitive documentation in its entirety.

Any redemptions will impact the amount of secondary proceeds.

This amount will be reduced by the amount of cash used to satisfy any redemptions.

Excludes the impact of warrants and management equity compensation and assumes no redemptions.

Assumes Forbes is debt-free, cash-free at closing.

Company estimates. For financial projections, please refer to "Use of Projections" portion of the disclaimer.

83.00

$ 10.00

$ 830.0

$ (145.0)

$ 685.0

Less: Tax Benefits

Pro Forma Enterprise Value, Net of Tax Benefit

PF EV / 2022E Pro Forma Revenue(5

PF EV / 2022E Pro Forma EBITDA (5)

PF EV Net of Tax Benefit / 2022E Pro Forma Revenue(5)

PF EV Net of Tax Benefit / 2022E Pro Forma EBITDA

(5)

Pro Forma Ownership

Existing Shareholders

PIPE Investors

Opus Public Shareholders

$ (55.0)

$ 630.0

2.9x

12.8x

2.7x

11.8x

21.7%

48.2%

24.1%

6.0%

100.0%

Forbes

9View entire presentation