Hilltop Holdings Results Presentation Deck

Hilltop Holdings – Q4 2023 Liquidity Update

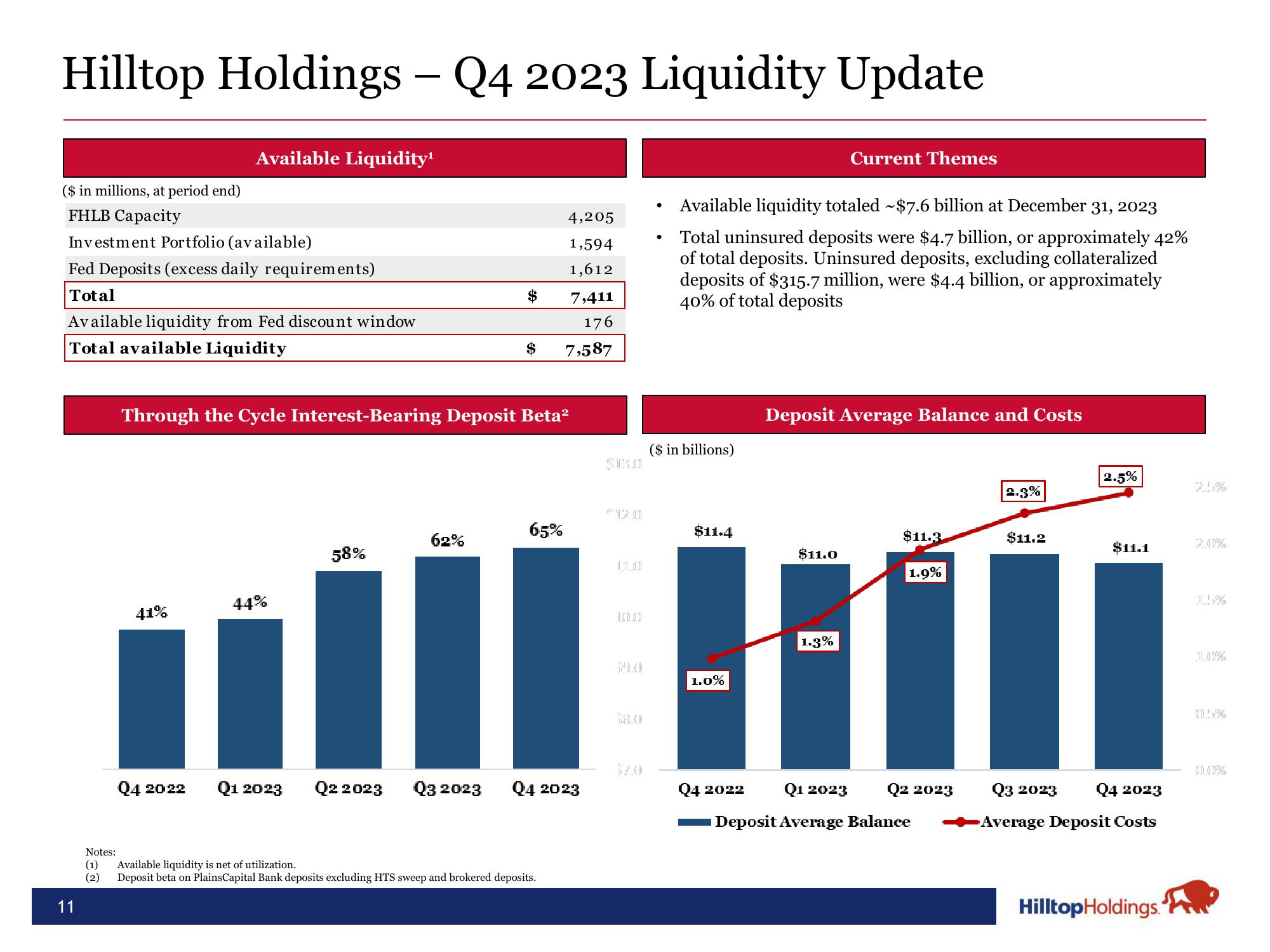

($ in millions, at period end)

FHLB Capacity

Investment Portfolio (available)

Fed Deposits (excess daily requirements)

Total

Available liquidity from Fed discount window

Total available Liquidity

11

Available Liquidity¹

41%

Through the Cycle Interest-Bearing Deposit Beta²

44%

Q4 2022 Q1 2023

58%

4,205

1,594

1,612

7,411

176

$ 7,587

62%

$

65%

Q2 2023 Q3 2023 Q4 2023

Notes:

(1) Available liquidity is net of utilization.

(2)

Deposit beta on PlainsCapital Bank deposits excluding HTS sweep and brokered deposits.

100.00

58.0

●

●

Available liquidity totaled -$7.6 billion at December 31, 2023

Total uninsured deposits were $4.7 billion, or approximately 42%

of total deposits. Uninsured deposits, excluding collateralized

deposits of $315.7 million, were $4.4 billion, or approximately

40% of total deposits

($ in billions)

$11.4

1.0%

Current Themes

Deposit Average Balance and Costs

$11.0

1.3%

$11.3

1.9%

Q4 2022 Q1 2023 Q2 2023

Deposit Average Balance

2.3%

$11.2

2.5%

$11.1

Q3 2023 Q4 2023

Average Deposit Costs

Hilltop Holdings.

11.00%

0 0.00%View entire presentation