A Leading Provider of Cannabis Capital

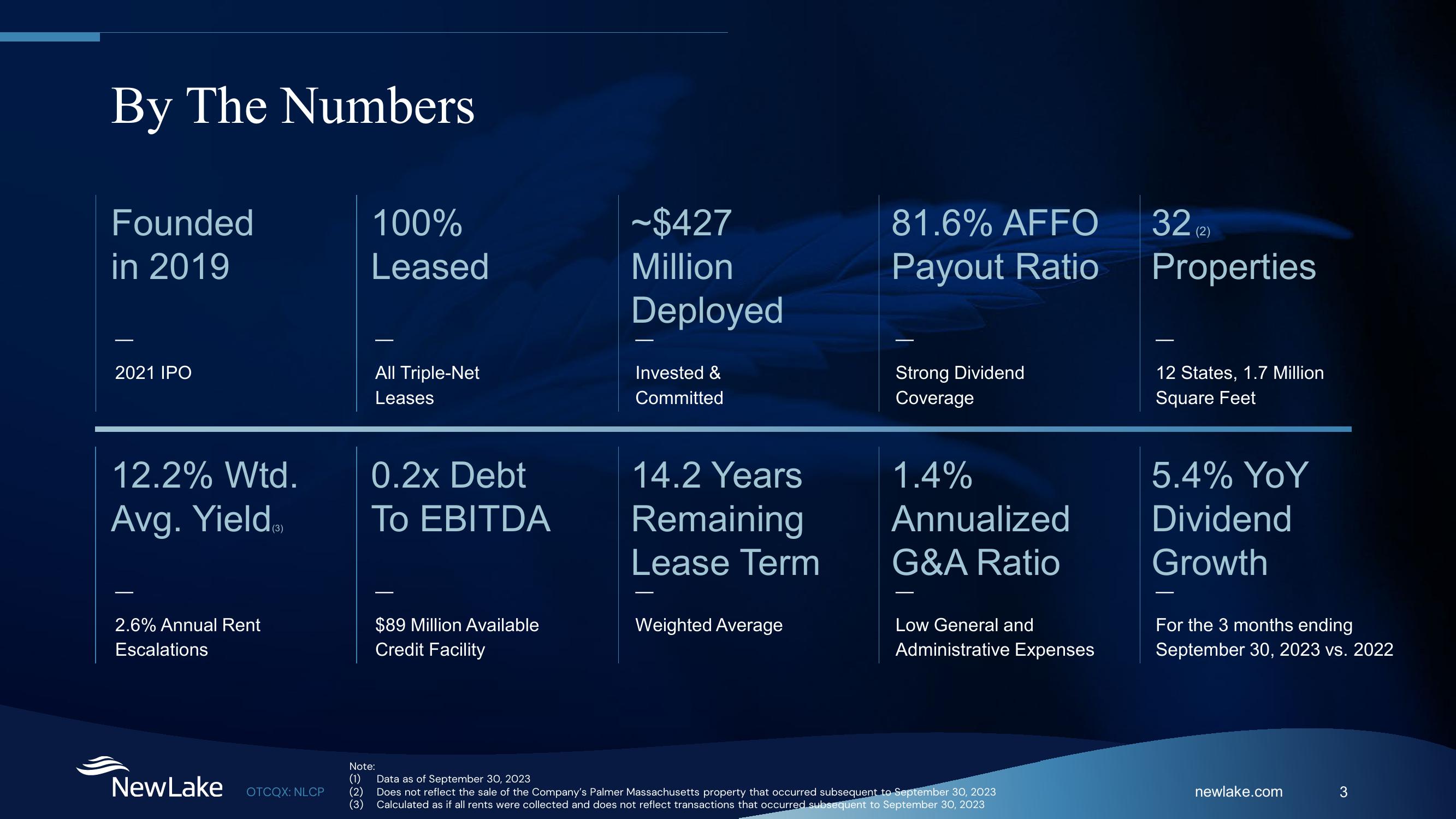

By The Numbers

Founded

in 2019

2021 IPO

12.2% Wtd.

Avg. Yield

2.6% Annual Rent

Escalations

NewLake

OTCQX: NLCP

100%

Leased

All Triple-Net

Leases

0.2x Debt

To EBITDA

$89 Million Available

Credit Facility

Note:

(1)

(2)

(3)

~$427

Million

Deployed

Invested &

Committed

14.2 Years

Remaining

Lease Term

Weighted Average

81.6% AFFO

Payout Ratio

Strong Dividend

Coverage

1.4%

Annualized

G&A Ratio

Low General and

Administrative Expenses

Data as of September 30, 2023

Does not reflect the sale of the Company's Palmer Massachusetts property that occurred subsequent to September 30, 2023

Calculated as if all rents were collected and does not reflect transactions that occurred subsequent to September 30, 2023

32 (2)

Properties

12 States, 1.7 Million

Square Feet

5.4% YoY

Dividend

Growth

For the 3 months ending

September 30, 2023 vs. 2022

newlake.com

3View entire presentation