KKR Real Estate Finance Trust Results Presentation Deck

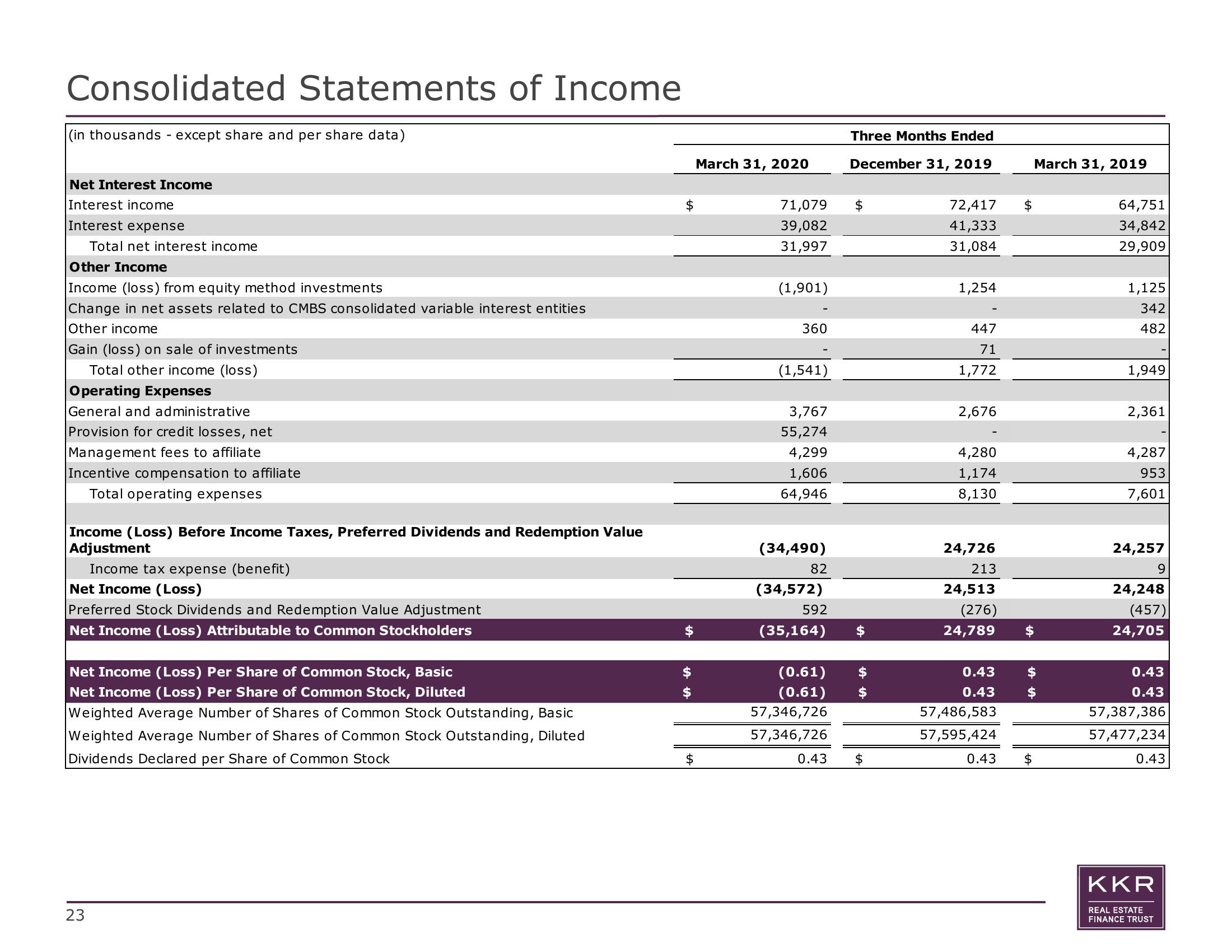

Consolidated Statements of Income

(in thousands - except share and per share data)

Net Interest Income

Interest income

Interest expense

Total net interest income

Other Income

Income (loss) from equity method investments

Change in net assets related to CMBS consolidated variable interest entities

Other income

Gain (loss) on sale of investments

Total other income (loss)

Operating Expenses

General and administrative

Provision for credit losses, net

Management fees to affiliate

Incentive compensation to affiliate

Total operating expenses

Income (Loss) Before Income Taxes, Preferred Dividends and Redemption Value

Adjustment

Income tax expense (benefit)

Net Income (Loss)

Preferred Stock Dividends and Redemption Value Adjustment

Net Income (Loss) Attributable to Common Stockholders

Net Income (Loss) Per Share of Common Stock, Basic

Net Income (Loss) Per Share of Common Stock, Diluted

Weighted Average Number of Shares of Common Stock Outstanding, Basic

Weighted Average Number of Shares of Common Stock Outstanding, Diluted

Dividends Declared per Share of Common Stock

23

SASA

March 31, 2020

71,079

39,082

31,997

(1,901)

360

(1,541)

3,767

55,274

4,299

1,606

64,946

(34,490)

82

(34,572)

592

(35,164)

(0.61)

(0.61)

57,346,726

57,346,726

0.43

Three Months Ended

December 31, 2019

$

SASA

$

72,417

41,333

31,084

1,254

447

71

1,772

2,676

4,280

1,174

8,130

24,726

213

24,513

(276)

24,789

0.43

0.43

57,486,583

57,595,424

$

0.43 $

March 31, 2019

64,751

34,842

29,909

1,125

342

482

1,949

2,361

4,287

953

7,601

24,257

9

24,248

(457)

24,705

0.43

0.43

57,387,386

57,477,234

0.43

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation