Evercore Investment Banking Pitch Book

SIRE Situation Analysis

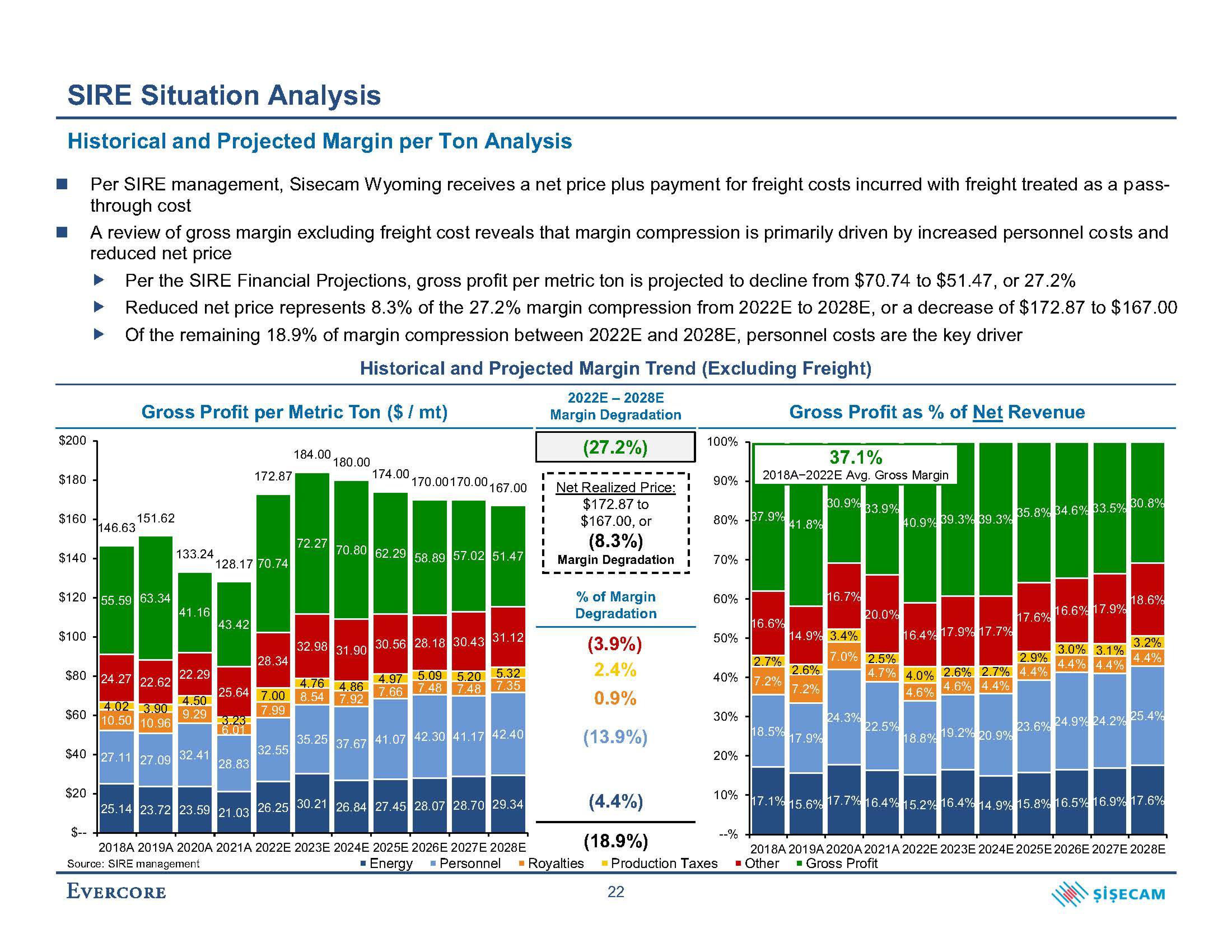

Historical and Projected Margin per Ton Analysis

Per SIRE management, Sisecam Wyoming receives a net price plus payment for freight costs incurred with freight treated as a pass-

through cost

$200

$180

$160

$140

$100

$80

A review of gross margin excluding freight cost reveals that margin compression is primarily driven by increased personnel costs and

reduced net price

Per the SIRE Financial Projections, gross profit per metric ton is projected to decline from $70.74 to $51.47, or 27.2%

Reduced net price represents 8.3% of the 27.2% margin compression from 2022E to 2028E, or a decrease of $172.87 to $167.00

Of the remaining 18.9% of margin compression between 2022E and 2028E, personnel costs are the key driver

Historical and Projected Margin Trend (Excluding Freight)

2022E-2028E

Margin Degradation

(27.2%)

146.63

$12055.59 63.34

$60

Gross Profit per Metric Ton ($ / mt)

151.62

$20-

133.24

24.27 22.62

4.02 3.90

10.50 10.96

$40 27.11 27.09 32.41

41.16

22.29

4.50

9.29

128.17 70.74

43.42

25.64

3.23

6.01

28.83

172.87

25.14 23.72 23.59 21.03

28.34

184.00

32.55

72.27

180.00

32.98 31.90

4.76 4.86

7.00 8.54 7.92

7.99

35.25

174.00

70.80 62.29 58.89 57.02 51.47

37.67

170.00 170.00.

167.00

30.56 28.18 30.43 31.12

5.09 5.20 5.32

4.97

7.66

7.48 7.48 7.35

41.07 42.30 41.17 42.40

26.25 30.21 26.84 27.45 28.07 28.70 29.34

2018A 2019A 2020A 2021A 2022E 2023E 2024E 2025E 2026E 2027E 2028E

Source: SIRE management

EVERCORE

I

Net Realized Price:

$172.87 to

$167.00, or

(8.3%)

Margin Degradation

% of Margin

Degradation

(3.9%)

2.4%

0.9%

(13.9%)

(4.4%)

(18.9%)

▪ Energy ■ Personnel ■ Royalties

I

22

100%

90%

80% -37.9%

70%-

60% -

50% -

30%

2.7%

40% 17.2%

20%

10%

Production Taxes

37.1%

2018A-2022E Avg. Gross Margin

--%

16.6%

Gross Profit as % of Net Revenue

141.8%

18.5%

2.6%

7.2%

14.9% 3.4%

17.9%

30.9%

17.1% 15.6%

16.7%

33.9%

24.3%

20.0%

40.9% 39.3% 39.3%

22.5%

16.4% 17.9% 17.7%

7.0% 2.5%

4.7% 4.0% 2.6% 2.7% 4.4%

4.6%

4.6% 4.4%

18.8%

35.8% 34.6% 33.5% 30.8%

19.2% 20.9%

17.6% 16.6% 17.9%

3.0% 3.1%

2.9% 4.4% 4.4%

18.6%

3.2%

4.4%

23.6% 24.9% 24.2% 25.4%

17.7% 16.4% 15.2 % 16.4% 14.9% 15.8% 16.5% 16.9% 17.6%

2018A 2019A 2020A 2021A 2022E 2023E 2024E 2025E 2026E 2027E 2028E

■ Other ■ Gross Profit

ŞİŞECAMView entire presentation