Credit Suisse Investment Banking Pitch Book

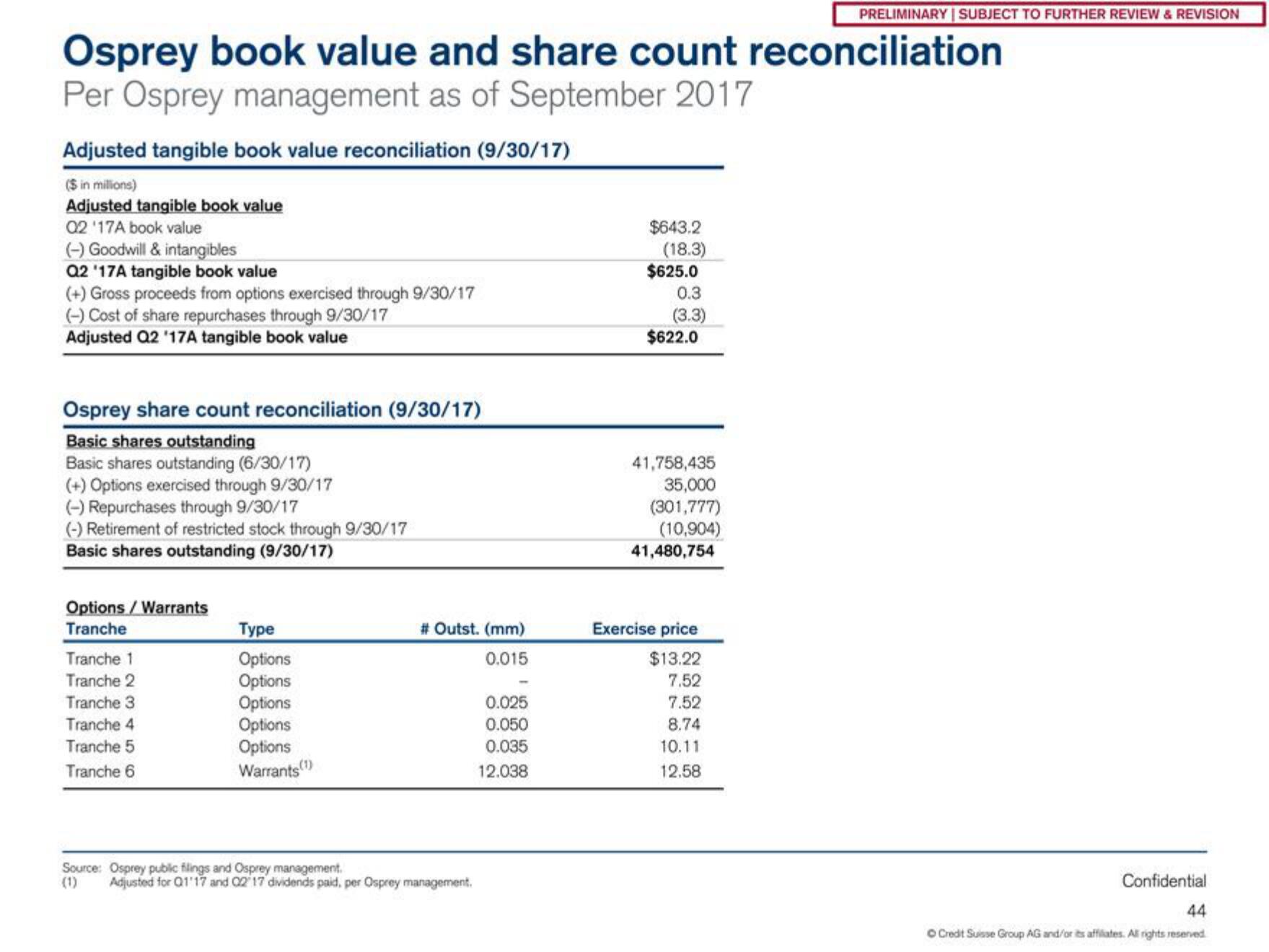

Osprey book value and share count reconciliation

Per Osprey management as of September 2017

Adjusted tangible book value reconciliation (9/30/17)

($ in millions)

Adjusted tangible book value

Q2 '17A book value

(-) Goodwill & intangibles

Q2 '17A tangible book value

(+) Gross proceeds from options exercised through 9/30/17

(-) Cost of share repurchases through 9/30/17

Adjusted Q2 '17A tangible book value

Osprey share count reconciliation (9/30/17)

Basic shares outstanding

Basic shares outstanding (6/30/17)

(+) Options exercised through 9/30/17

(-) Repurchases through 9/30/17

(-) Retirement of restricted stock through 9/30/17

Basic shares outstanding (9/30/17)

Options / Warrants

Tranche

Tranche 1

Tranche 2

Tranche 3

Tranche 4

Tranche 5

Tranche 6

Type

Options

Options

Options

Options

Options

Warrants (¹)

Source: Osprey public filings and Osprey management.

# Outst. (mm)

0.015

Adjusted for Q1'17 and 02 17 dividends paid, per Osprey management.

0.025

0.050

0.035

12.038

$643.2

(18.3)

$625.0

0.3

(3.3)

$622.0

41,758,435

35,000

(301,777)

(10,904)

41,480,754

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Exercise price

$13.22

7.52

7.52

8.74

10.11

12.58

Confidential

44

Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation