BenevolentAI Investor Presentation Deck

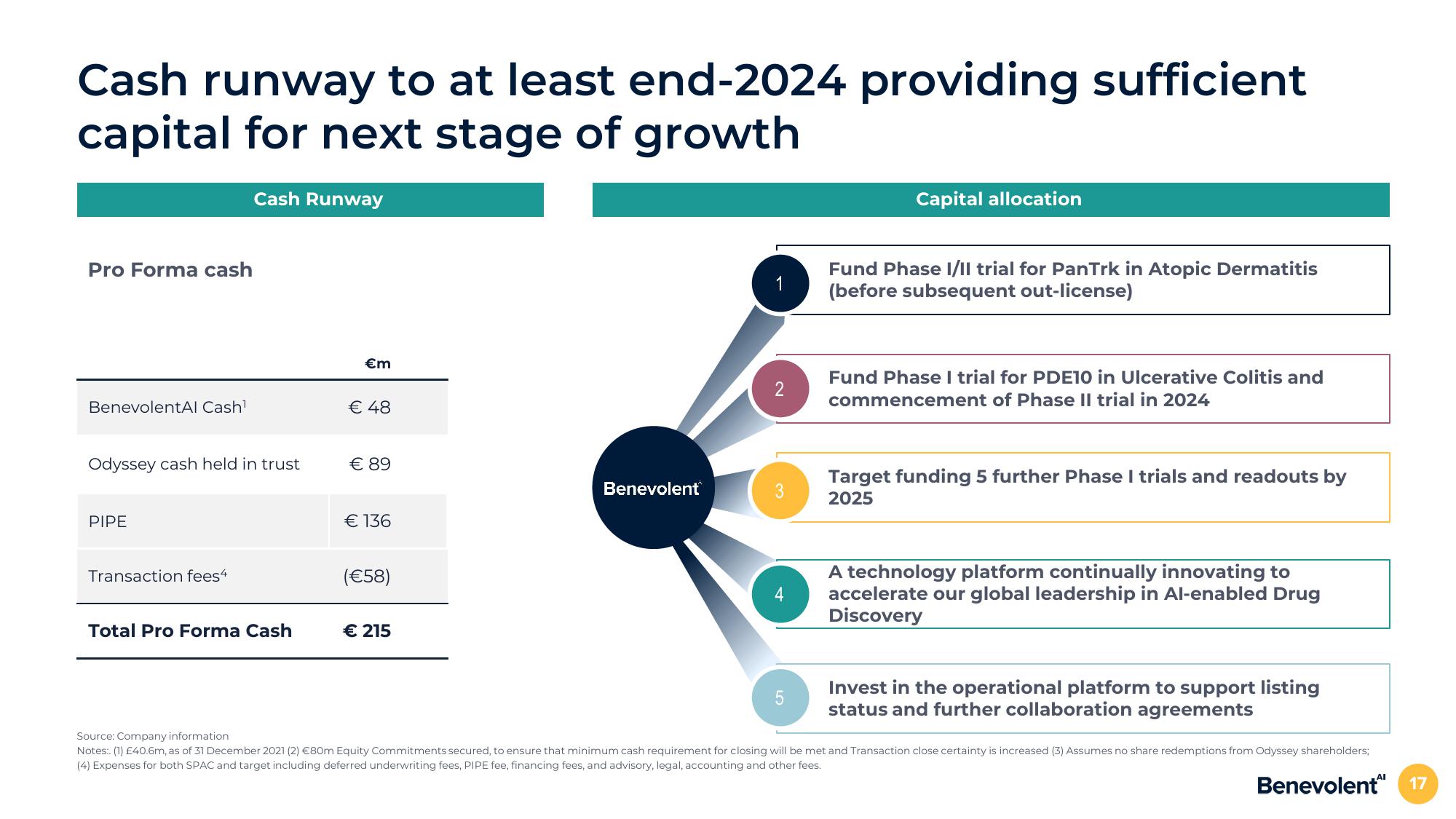

Cash runway to at least end-2024 providing sufficient

capital for next stage of growth

Pro Forma cash

BenevolentAl Cash¹

Odyssey cash held in trust

PIPE

Cash Runway

Transaction fees4

Total Pro Forma Cash

€m

€ 48

€ 89

€ 136

(€58)

€ 215

Benevolent

5

Capital allocation

Fund Phase I/II trial for PanTrk in Atopic Dermatitis

(before subsequent out-license)

Fund Phase I trial for PDE10 in Ulcerative Colitis and

commencement of Phase II trial in 2024

Target funding 5 further Phase I trials and readouts by

2025

A technology platform continually innovating to

accelerate our global leadership in Al-enabled Drug

Discovery

Invest in the operational platform to support listing

status and further collaboration agreements

Source: Company information

Notes:. (1) £40.6m, as of 31 December 2021 (2) €80m Equity Commitments secured, to ensure that minimum cash requirement for closing will be met and Transaction close certainty is increased (3) Assumes no share redemptions from Odyssey shareholders;

(4) Expenses for both SPAC and target including deferred underwriting fees, PIPE fee, financing fees, and advisory, legal, accounting and other fees.

Benevolent 17View entire presentation