Evercore Investment Banking Pitch Book

Appendix

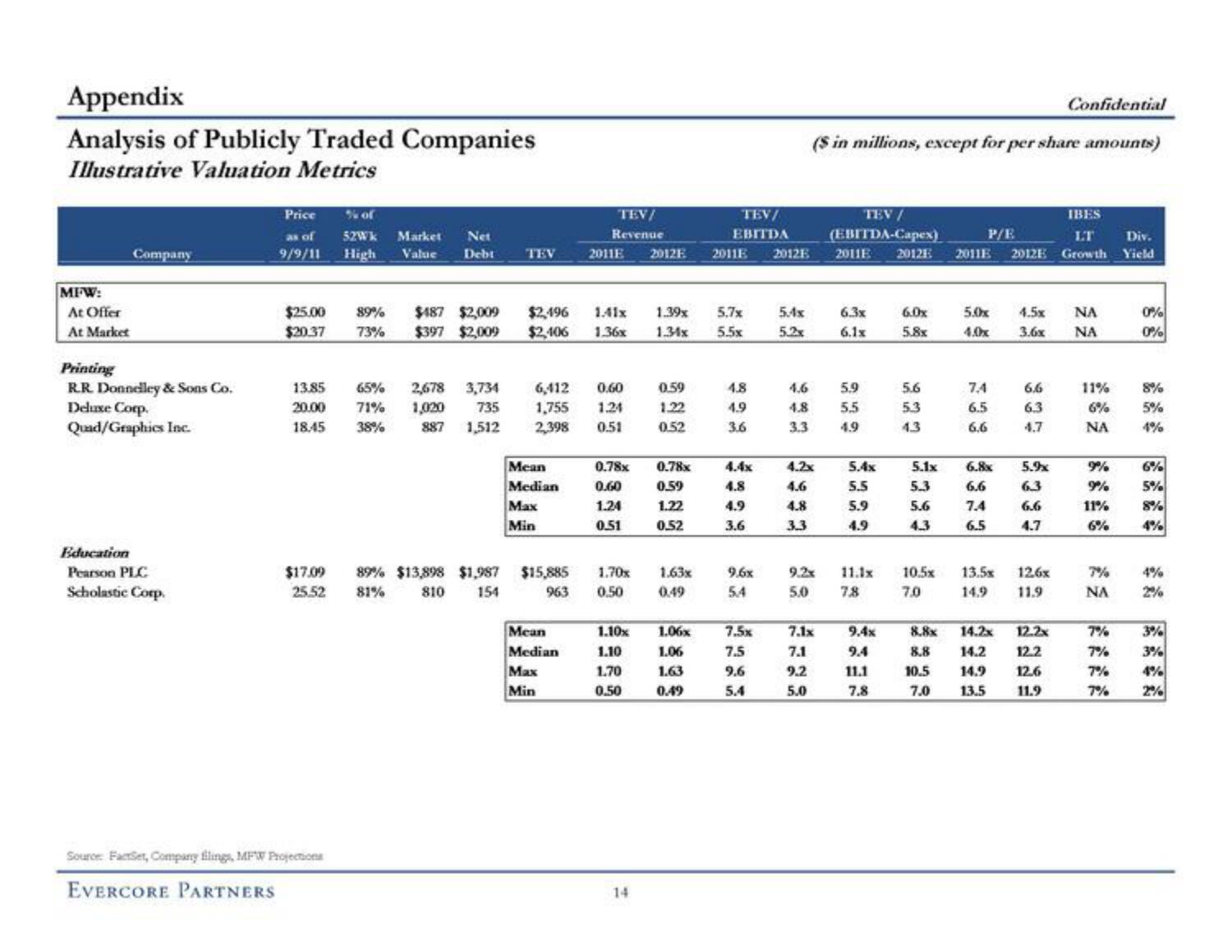

Analysis of Publicly Traded Companies

Illustrative Valuation Metrics

MFW:

At Offer

At Market

Company

Printing

R.R. Donnelley & Sons Co.

Deluxe Corp.

Quad/Graphics Inc.

Education

Pearson PLC

Scholastic Corp.

Price

% of

as of 52Wk Market Net

9/9/11 High

Value Debt

$25.00

$20.37

13.85

20.00

18.45

$17.09

25.52

Source FactSet, Company filings, MFW Projections

EVERCORE PARTNERS

89% $487 $2,009

73% $397 $2,009

65% 2,678 3,734

71% 1,020

735

887 1,512

38%

TEV

$2,496 1.41x

$2,406 1.36x

Mean

Median

Max

Min

TEV/

Revenue

6,412 0.60

1,755 1.24

2,398 0.51

89% $13,898 $1,987 $15,885

81%

810

154

963

Mean

Median

Max

Min

2011E 2012E 2011E 2012E

0.78x

0.60

1.24

0.51

1.70x

0.50

14

1.39x 5.7x

1.34x 5.5x

0.59

1.22

0.52

0.78x

0.59

1.22

0.52

TEV/

EBITDA

1.63x

0.49

1.10x 1.06x

1.10

1.06

1.70

1.63

0.50

0.49

4.8

4.9

3.6

4.4x

4.8

4.9

3.6

9.6x

5.4

7.5x

7.5

9.6

5.4

5.4x

5.2x

4.6

4.8

3.3

Confidential

($ in millions, except for per share amounts)

4.2x

4.6

4.8

3.3

9.2x

5.0

7.1x

7.1

9.2

5.0

TEV /

(EBITDA-Capex)

2011E 2012E

6.3x

6.1x

5.9

5.5

4.9

5.4x

5.5

5.9

4.9

11.1x

7.8

9.4x

9.4

11.1

7.8

6.0x

5.8x

5.6

5.3

4.3

5.1x

5.3

5.6

4.3

195.

7.0

IBES

LT Div.

2011E 2012E Growth Yield

P/E

5.0x 4.5x NA

4.0x 3.6x ΝΑ

7.4

6.5

6.6

6.8x

6.6

7.4

6.5

6.6

6.3

4.7

8.8x

14.2x

8.8

14.2

10.5

14.9

7.0 13.5

5.9x

6.3

6.6

4.7

135

126x

14.9 11.9

12.2x

12.2

12.6

11.9

11%

6%

ΝΑ

9%

9%

11%

6%

7%

NA

7%

7%

7%

7%

0%

0%

8%

5%

4%

6%

5%

8%

4%

3%

3%

4%

2%View entire presentation