Embracer Group Results Presentation Deck

FINANCIAL PERFORMANCE Q4

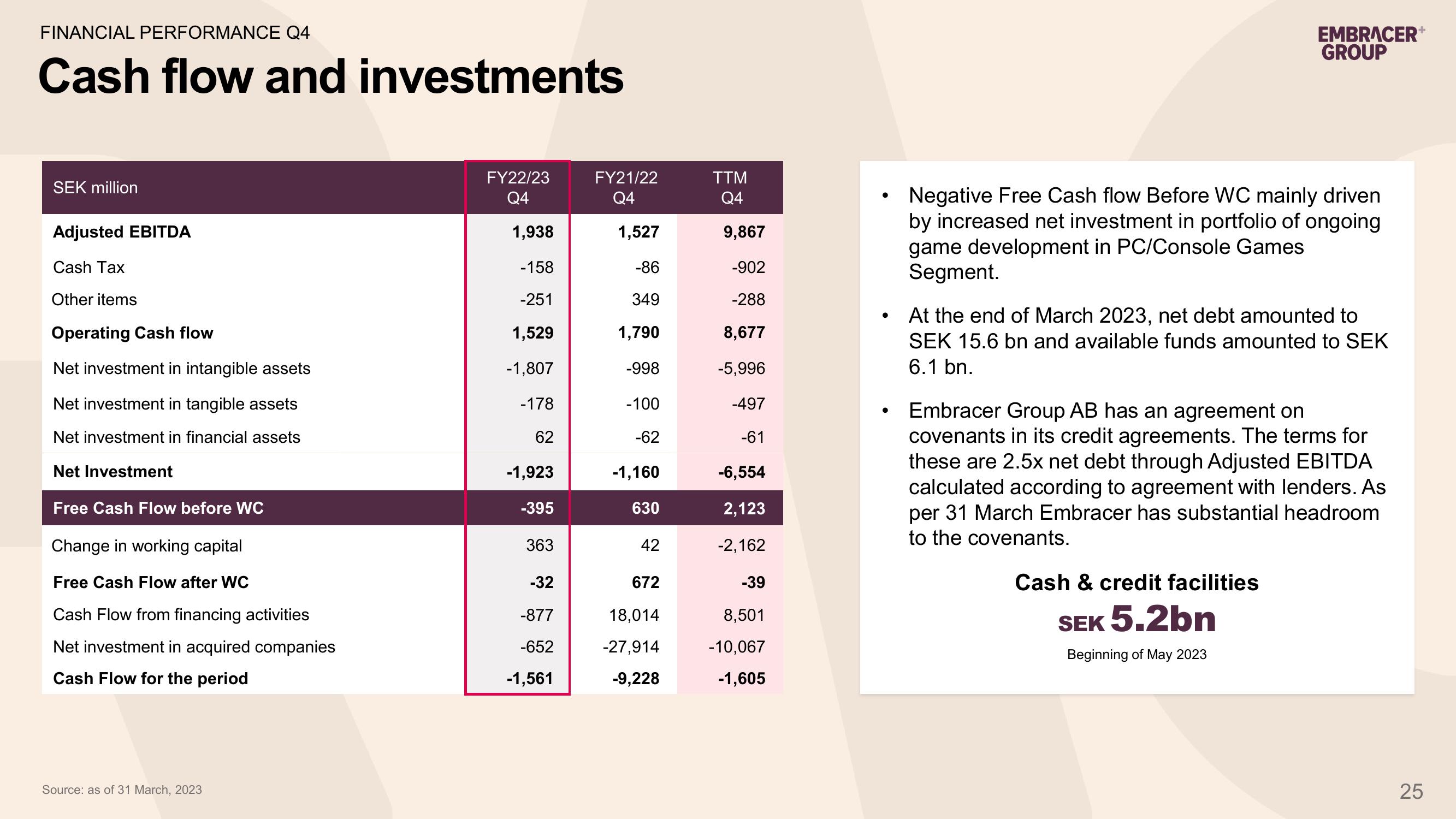

Cash flow and investments

SEK million

Adjusted EBITDA

Cash Tax

Other items

Operating Cash flow

Net investment in intangible assets

Net investment in tangible assets

Net investment in financial assets

Net Investment

Free Cash Flow before WC

Change in working capital

Free Cash Flow after WC

Cash Flow from financing activities

Net investment in acquired companies

Cash Flow for the period

Source: as of 31 March, 2023

FY22/23

Q4

1,938

-158

-251

1,529

-1,807

-178

62

-1,923

-395

363

-32

-877

-652

-1,561

FY21/22

Q4

1,527

-86

349

1,790

-998

-100

-62

-1,160

630

42

672

18,014

-27,914

-9,228

TTM

Q4

9,867

-902

-288

8,677

-5,996

-497

-61

-6,554

2,123

-2,162

-39

8,501

-10,067

-1,605

EMBRACER+

GROUP

Negative Free Cash flow Before WC mainly driven

by increased net investment in portfolio of ongoing

game development in PC/Console Games

Segment.

At the end of March 2023, net debt amounted to

SEK 15.6 bn and available funds amounted to SEK

6.1 bn.

Embracer Group AB has an agreement on

covenants in its credit agreements. The terms for

these are 2.5x net debt through Adjusted EBITDA

calculated according to agreement with lenders. As

per 31 March Embracer has substantial headroom

to the covenants.

Cash & credit facilities

SEK 5.2bn

Beginning of May 2023

25View entire presentation