OpenText Mergers and Acquisitions Presentation Deck

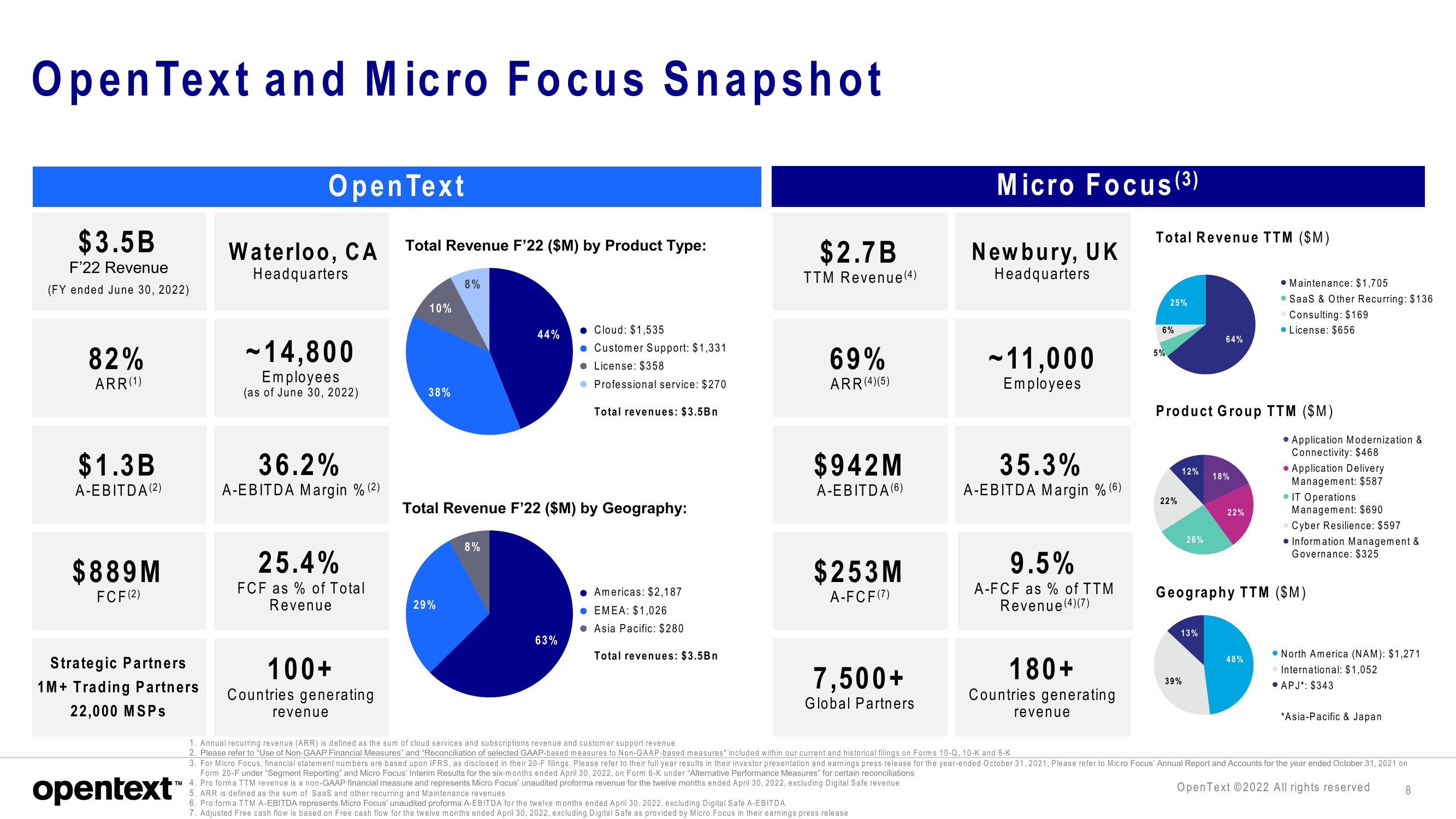

Open Text and Micro Focus Snapshot

$3.5B

F'22 Revenue

(FY ended June 30, 2022)

82%

ARR (1)

$1.3B

A-EBITDA (2)

$889 M

FCF (2)

Strategic Partners

1M+ Trading Partners

22,000 MSPs

opentext

Open Text

Waterloo, CA

Headquarters

~14,800

Employees

(as of June 30, 2022)

36.2%

A-EBITDA Margin % (2)

25.4%

FCF as % of Total

Revenue

100+

Countries generating

revenue

Total Revenue F'22 ($M) by Product Type:

10%

38%

8%

29%

44%

8%

Total Revenue F'22 ($M) by Geography:

Cloud: $1,535

. Customer Support: $1,331

License: $358

Professional service: $270

63%

Total revenues: $3.5Bn

Americas: $2,187

EMEA: $1,026

Asia Pacific: $280

Total revenues: $3.5Bn

$2.7B

TTM Revenue (4)

69%

ARR (4)(5)

$942M

A-EBITDA (6)

$253M

A-FCF (7)

7,500+

Global Partners

Micro Focus (³)

Newbury, UK

Headquarters

~11,000

Employees

35.3%

A-EBITDA Margin % (6)

9.5%

A-FCF as % of TTM

Revenue (4)(7)

180+

Countries generating

revenue

Total Revenue TTM ($M)

25%

6%

5%

22%

Product Group TTM ($M)

12%

26%

64%

13%

39%

18%

22%

• Maintenance: $1,705

SaaS & Other Recurring: $136

Consulting: $169

License: $656

Geography TTM ($M)

48%

Application Modernization &

Connectivity: $468

. Application Delivery

Management: $587

IT Operations

Management: $690

Cyber Resilience: $597

Information Management &

Governance: $325

North America (NAM): $1,271

International: $1,052

APJ*: $343

*Asia-Pacific & Japan

1. Annual recurring revenue (ARR) is defined as the sum of cloud services and subscriptions revenue and customer support revenue

2. Please refer to "Use of Non-GAAP Financial Measures" and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and historical filings on Forms 10-Q, 10-K and 8-K

3. For Micro Focus, financial statement numbers are based upon IFRS, as disclosed in their 20-F filings. Please refer to their full year results in their investor presentation and earnings press release for the year-ended October 31, 2021, Please refer to Micro Focus' Annual Report and Accounts for the year ended October 31, 2021 on

Form 20-F under "Segment Reporting" and Micro Focus' Interim Results for the six-months ended April 30, 2022, on Form 6-K under "Alternative Performance Measures" for certain reconciliations

TM 4. Pro forma TTM revenue is a non-GAAP financial measure and represents Micro Focus' unaudited proforma revenue for the twelve months ended April 30, 2022, excluding Digital Safe revenue

OpenText ©2022 All rights reserved

5. ARR is defined as the sum of SaaS and other recurring and Maintenance revenues

6. Pro forma TTM A-EBITDA represents Micro Focus' unaudited proforma A-EBITDA for the twelve months ended April 30, 2022, excluding Digital Safe A-EBITDA

7. Adjusted Free cash flow is based on Free cash flow for the twelve months ended April 30, 2022, excluding Digital Safe as provided by Micro Focus in their earnings press release

8View entire presentation