2nd Quarter 2021 Investor Presentation

Liquidity and Securities Portfolio

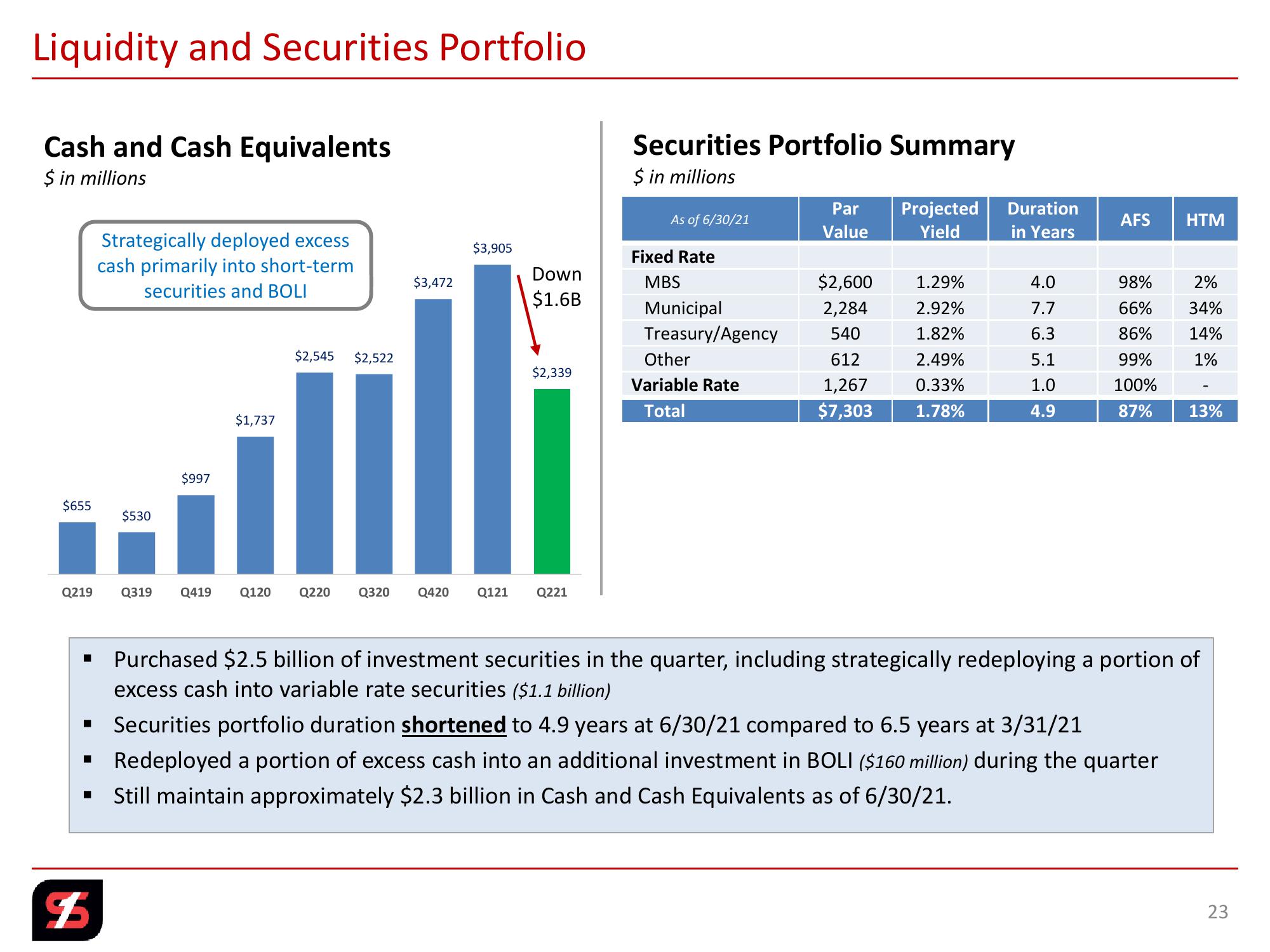

Cash and Cash Equivalents

$ in millions

Strategically deployed excess

cash primarily into short-term

securities and BOLI

$997

$655

$530

$1,737

$2,545 $2,522

Securities Portfolio Summary

$ in millions

Par

Projected

Duration

As of 6/30/21

AFS

HTM

Value

Yield

in Years

$3,905

Fixed Rate

Down

$3,472

MBS

$2,600

1.29%

4.0

98%

2%

$1.6B

Municipal

2,284

2.92%

7.7

66%

34%

Treasury/Agency

540

1.82%

6.3

86%

14%

Other

612

2.49%

5.1

99%

1%

$2,339

Variable Rate

Total

1,267

0.33%

1.0

100%

$7,303

1.78%

4.9

87%

13%

Q219

Q319 Q419 Q120 Q220 Q320 Q420 Q121

Q221

$

☐

☐

Purchased $2.5 billion of investment securities in the quarter, including strategically redeploying a portion of

excess cash into variable rate securities ($1.1 billion)

Securities portfolio duration shortened to 4.9 years at 6/30/21 compared to 6.5 years at 3/31/21

Redeployed a portion of excess cash into an additional investment in BOLI ($160 million) during the quarter

Still maintain approximately $2.3 billion in Cash and Cash Equivalents as of 6/30/21.

23View entire presentation