Nauticus SPAC Presentation Deck

TRANSACTION SUMMARY

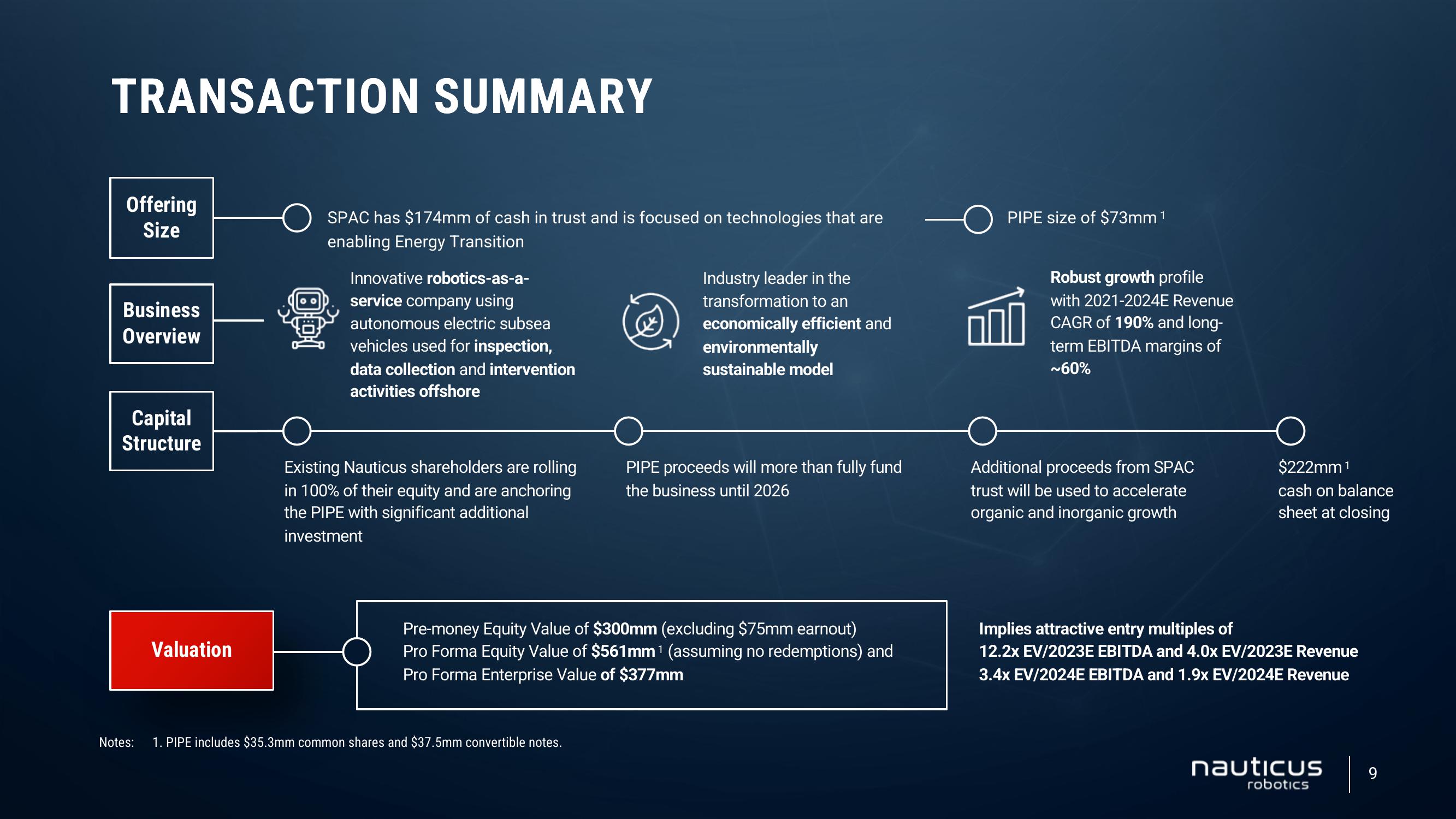

Offering

Size

Business

Overview

Capital

Structure

Notes:

Valuation

OO!

SPAC has $174mm of cash in trust and is focused on technologies that are

enabling Energy Transition

Innovative robotics-as-a-

service company using

autonomous electric subsea

vehicles used for inspection,

data collection and intervention

activities offshore

Existing Nauticus shareholders are rolling

in 100% of their equity and are anchoring

the PIPE with significant additional

investment

Industry leader in the

transformation to an

economically efficient and

environmentally

sustainable model

1. PIPE includes $35.3mm common shares and $37.5mm convertible notes.

PIPE proceeds will more than fully fund

the business until 2026

Pre-money Equity Value of $300mm (excluding $75mm earnout)

Pro Forma Equity Value of $561mm ¹ (assuming no redemptions) and

Pro Forma Enterprise Value of $377mm

PIPE size of $73mm ¹

Robust growth profile

with 2021-2024E Revenue

CAGR of 190% and long-

term EBITDA margins of

~60%

Additional proceeds from SPAC

trust will be used to accelerate

organic and inorganic growth

$222mm ¹

cash on balance

sheet at closing

Implies attractive entry multiples of

12.2x EV/2023E EBITDA and 4.0x EV/2023E Revenue

3.4x EV/2024E EBITDA and 1.9x EV/2024E Revenue

nauticus

robotics

9View entire presentation