Nuvei Results Presentation Deck

19

Financial Outlook

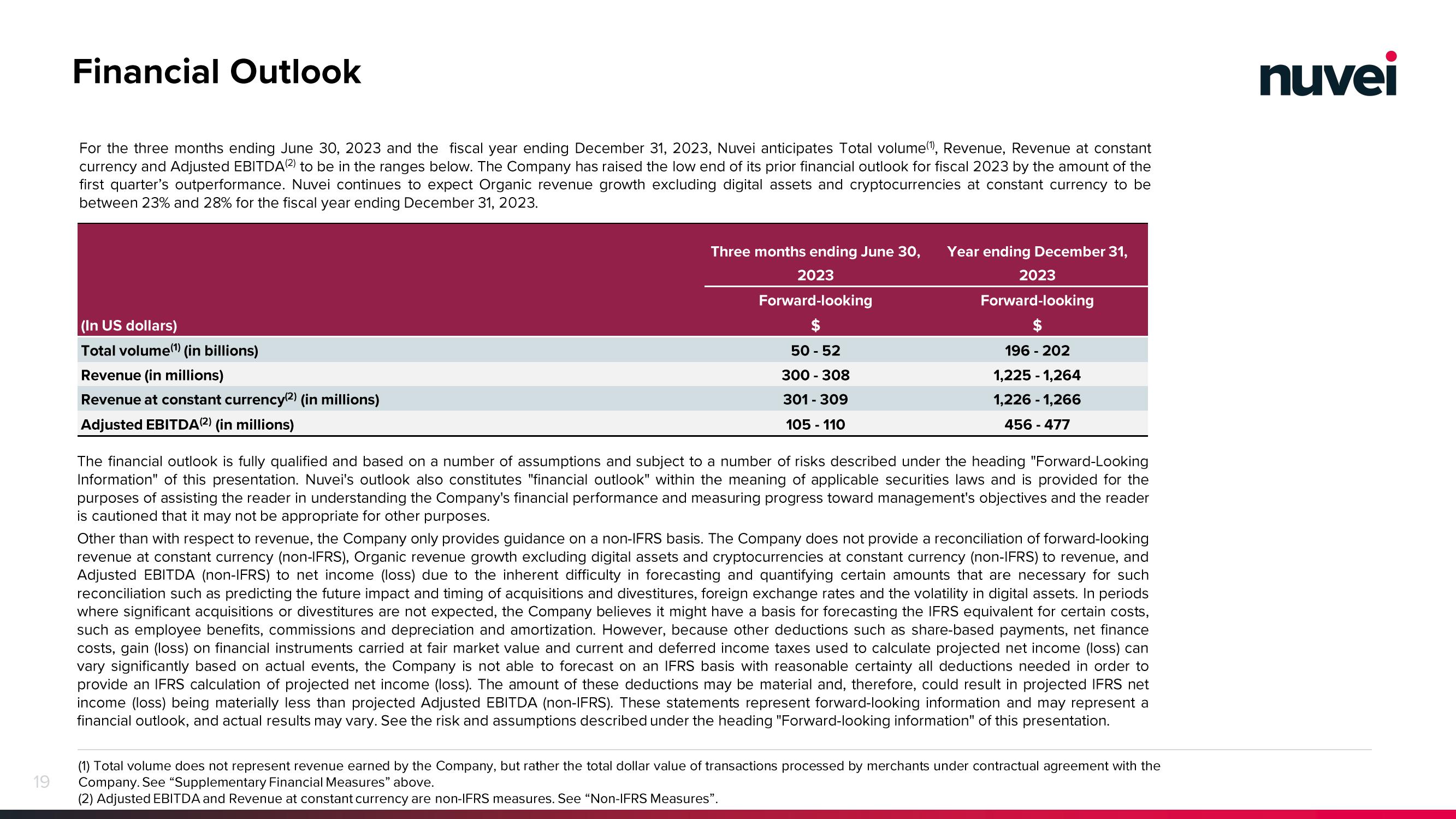

For the three months ending June 30, 2023 and the fiscal year ending December 31, 2023, Nuvei anticipates Total volume(¹), Revenue, Revenue at constant

currency and Adjusted EBITDA (2) to be in the ranges below. The Company has raised the low end of its prior financial outlook for fiscal 2023 by the amount of the

first quarter's outperformance. Nuvei continues to expect Organic revenue growth excluding digital assets and cryptocurrencies at constant currency to be

between 23% and 28% for the fiscal year ending December 31, 2023.

(In US dollars)

Total volume(¹) (in billions)

Revenue (in millions)

Revenue at constant currency(2) (in millions)

Adjusted EBITDA(2) (in millions)

Three months endi

2023

Forward-looking

50 - 52

300-308

301 - 309

105-110

June 30,

Year

December 31,

2023

Forward-looking

196 - 202

1,225 - 1,264

1,226 - 1,266

456-477

The financial outlook is fully qualified and based on a number of assumptions and subject to a number of risks described under the heading "Forward-Looking

Information" of this presentation. Nuvei's outlook also constitutes "financial outlook" within the meaning of applicable securities laws and is provided for the

purposes of assisting the reader in understanding the Company's financial performance and measuring progress toward management's objectives and the reader

is cautioned that it may not be appropriate for other purposes.

Other than with respect to revenue, the Company only provides guidance on a non-IFRS basis. The Company does not provide a reconciliation of forward-looking

revenue at constant currency (non-IFRS), Organic revenue growth excluding digital assets and cryptocurrencies at constant currency (non-IFRS) to revenue, and

Adjusted EBITDA (non-IFRS) to net income (loss) due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such

reconciliation such as predicting the future impact and timing of acquisitions and divestitures, foreign exchange rates and the volatility in digital assets. In periods

where significant acquisitions or divestitures are not expected, the Company believes it might have a basis for forecasting the IFRS equivalent for certain costs,

such as employee benefits, commissions and depreciation and amortization. However, because other deductions such as share-based payments, net finance

costs, gain (loss) on financial instruments carried at fair market value and current and deferred income taxes used to calculate projected net income (loss) can

vary significantly based on actual events, the Company is not able to forecast on an IFRS basis with reasonable certainty all deductions needed in order to

provide an IFRS calculation of projected net income (loss). The amount of these deductions may be material and, therefore, could result in projected IFRS net

income (loss) being materially less than projected Adjusted EBITDA (non-IFRS). These statements represent forward-looking information and may represent a

financial outlook, and actual results may vary. See the risk and assumptions described under the heading "Forward-looking information" of this presentation.

(1) Total volume does not represent revenue earned by the Company, but rather the total dollar value of transactions processed by merchants under contractual agreement with the

Company. See "Supplementary Financial Measures" above.

(2) Adjusted EBITDA and Revenue at constant currency are non-IFRS measures. See "Non-IFRS Measures".

nuveiView entire presentation