Moelis & Company Investment Banking Pitch Book

Weighted Average Cost of Capital Analysis

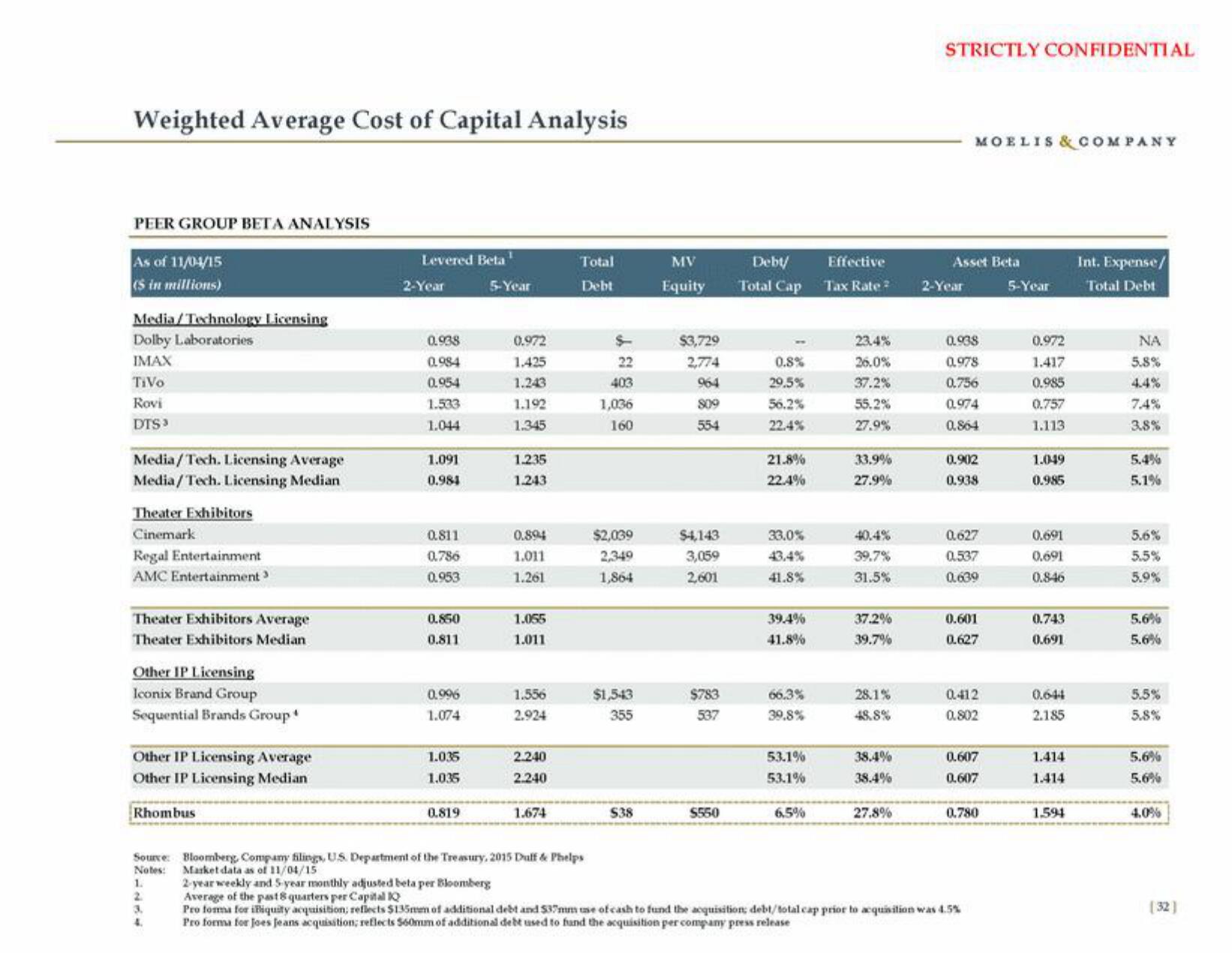

PEER GROUP BETA ANALYSIS

As of 11/04/15

(S in millions)

Media/Technology Licensing

Dolby Laboratories

IMAX

TiVo

Rovi

DTS³

Media/Tech. Licensing Average

Media/Tech. Licensing Median

Theater Exhibitors

Cinemark

Regal Entertainment

AMC Entertainment ³

Theater Exhibitors Average

Theater Exhibitors Median

Other IP Licensing

Iconix Brand Group

Sequential Brands Group

Other IP Licensing Average

Other IP Licensing Median

Rhombus

Levered Beta¹

1.

2

3.

4.

2-Year

0.938

0.984

0.954

1.533

1.044

1.091

0.984

0.811

0.786

0.953

0.850

0.811

0.996

1.074

1.035

1.035

0.819

5-Year

0.972

1.425

1.243

1.192

1.345

1.235

1.243

0.894

1.011

1.261

1.055

1.011

1.556

2.924

2.240

2.240

1.674

Total

Debt

Source: Bloomberg, Company filings, US Department of the Treasury, 2015 Duff & Phelps

Notes:

Market data as of 11/04/15

22

403

1,036

160

$2,039

2,349

1,864

$1,543

355

$38

MV

Equity

$3,729

2,774

964

809

554

$4,143

3,059

2,601

$783

537

$550

Debt/

Total Cap

0.8%

29.5%

56.2%

22.4%

21.8%

22.4%

33.0%

43,4%

41.8%

39.4%

41.8%

66.3%

39.8%

53.1%

53.1%

6,5%

Effective

Tax Rate 2

23.4%

26.0%

37.2%

55.2%

27.9%

33.9%

27.9%

40.4%

39.7%

31.5%

37.2%

39.7%

28.1%

48.8%

38.4%

38.4%

27.8%

STRICTLY CONFIDENTIAL

Asset Beta

2-Year

MOELIS & COMPANY

0.938

0,978

0.756

0.974

0.864

0.902

0.938

0.627

0.537

0.639

0.601

0.627

0.412

0.802

0.607

0.607

0.780

2-year weekly and 5-year monthly adjusted beta per Bloomberg

Average of the past 8 quarters per Capital Q

Pro forma for iBiquity acquisition; reflects $135mm of additional debt and $37mm use of cash to fund the acquisition; debt/total cap prior to acquisition was 4.5%

Pro forma for Joes Jeans acquisition; reflects 560mm of additional debt used to fund the acquisition per company press release

5-Year

0.972

1.417

0.985

0.757

1.113

1.049

0.985

0.691

0.691

0.846

0.743

0.691

0.644

2.185

1.414

1.414

1.594

Int. Expense/

Total Debt

ΝΑ

5.8%

4.4%

7.4%

3.8%

5.4%

5.1%

5.6%

5.5%

5.9%

5.6%

5.6%

5.5%

5.8%

5.6%

5.6%

4.0%

[32]View entire presentation