Kinnevik Results Presentation Deck

WITH OUR RECENT SUCCESSES WE EXPECT OUR 2023 INVESTMENTS TO BE

MORE SKEWED TOWARDS FOLLOW-ONS IN THE WINNERS OF OUR PORTFOLIO

■

■

■

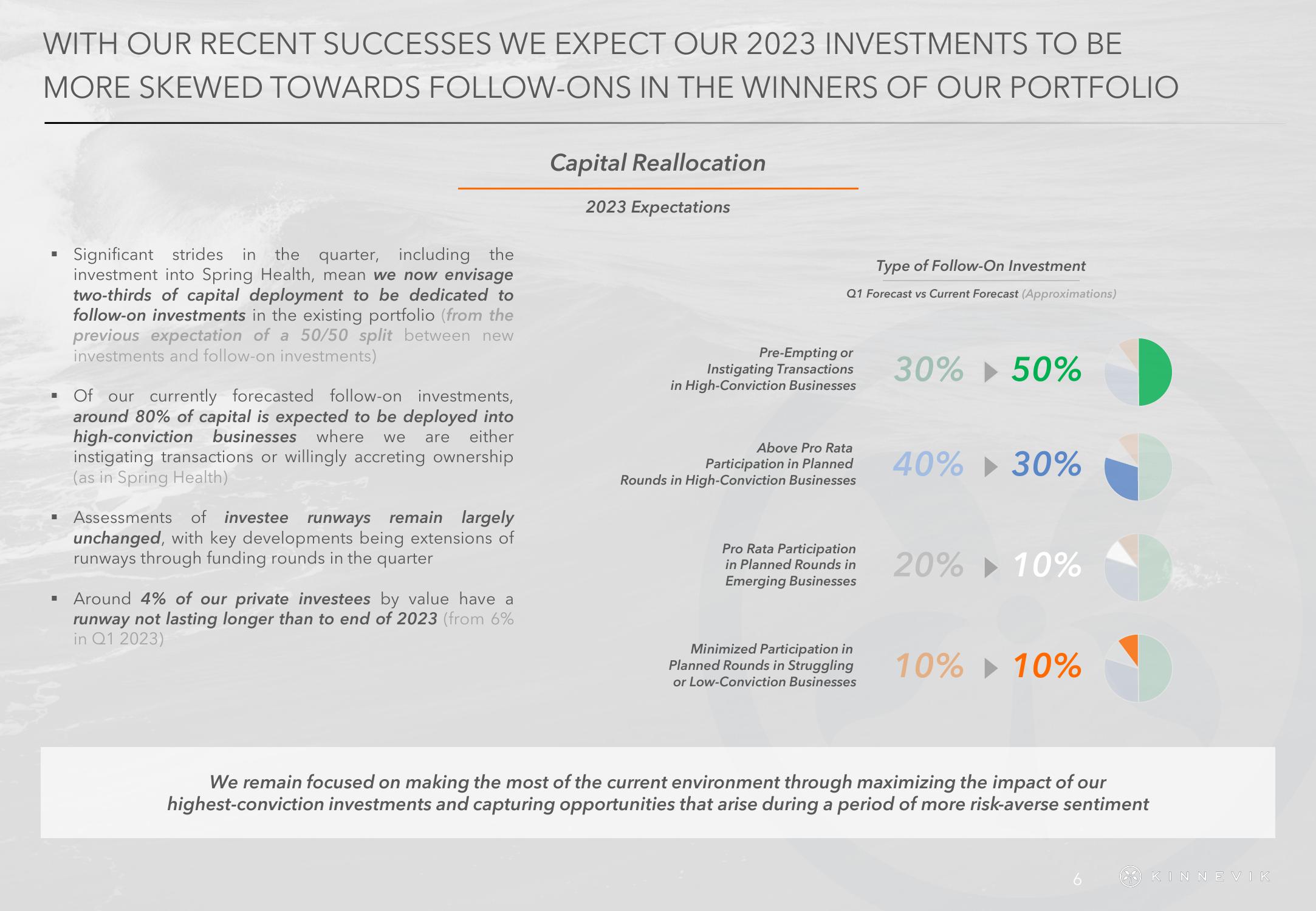

Significant strides in the quarter, including the

investment into Spring Health, mean we now envisage

two-thirds of capital deployment to be dedicated to

follow-on investments in the existing portfolio (from the

previous expectation of a 50/50 split between new

investments and follow-on investments)

Of our currently forecasted follow-on investments,

around 80% of capital is expected to be deployed into

high-conviction businesses where we are either

instigating transactions or willingly accreting ownership

(as in Spring Health)

Assessments of investee runways remain largely

unchanged, with key developments being extensions of

runways through funding rounds in the quarter

Around 4% of our private investees by value have a

runway not lasting longer than to end of 2023 (from 6%

in Q1 2023)

Capital Reallocation

2023 Expectations

Type of Follow-On Investment

Q1 Forecast vs Current Forecast (Approximations)

Pre-Empting or

Instigating Transactions

in High-Conviction Businesses

Above Pro Rata

Participation in Planned

Rounds in High-Conviction Businesses

Pro Rata Participation

in Planned Rounds in

Emerging Businesses

Minimized Participation in

Planned Rounds in Struggling

or Low-Conviction Businesses

30% 50%

40% 30%

20% 10%

10% 10%

We remain focused on making the most of the current environment through maximizing the impact of our

highest-conviction investments and capturing opportunities that arise during a period of more risk-averse sentiment

KINNEVIKView entire presentation