Morgan Stanley Investment Banking Pitch Book

.

Project Roosevelt

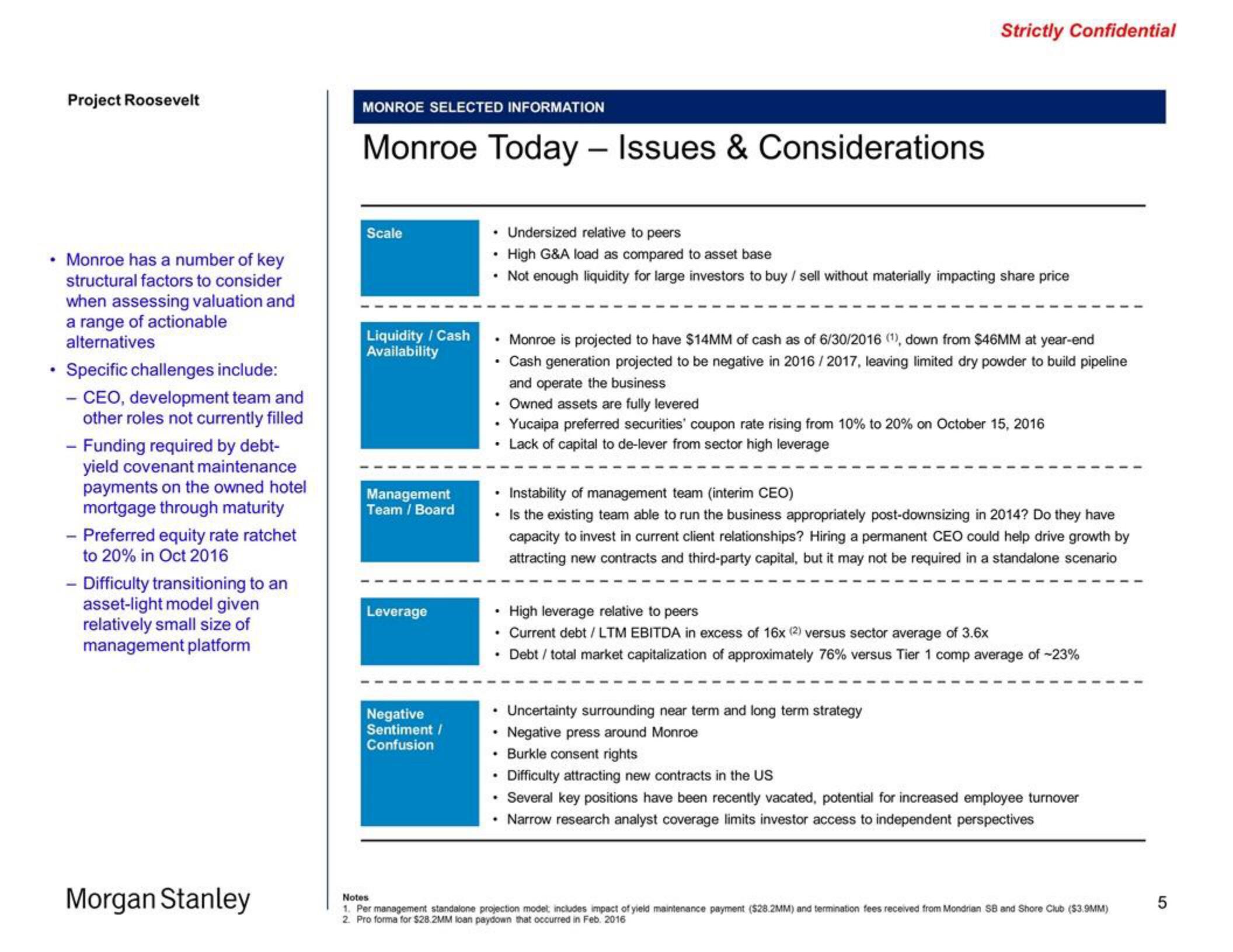

Monroe has a number of key

structural factors to consider

when assessing valuation and

a range of actionable

alternatives

• Specific challenges include:

- CEO, development team and

other roles not currently filled

- Funding required by debt-

yield covenant maintenance

payments on the owned hotel

mortgage through maturity

- Preferred equity rate ratchet

to 20% in Oct 2016

- Difficulty transitioning to an

asset-light model given

relatively small size of

management platform

Morgan Stanley

MONROE SELECTED INFORMATION

Monroe Today - Issues & Considerations

Scale

Liquidity / Cash

Availability

Management

Team / Board

Leverage

Negative

Sentiment /

Confusion

Strictly Confidential

Undersized relative to peers

High G&A load as compared to asset base

• Not enough liquidity for large investors to buy / sell without materially impacting share price

• Monroe is projected to have $14MM of cash as of 6/30/2016 (1), down from $46MM at year-end

• Cash generation projected to be negative in 2016/2017, leaving limited dry powder to build pipeline

and operate the business

Owned assets are fully levered

• Yucaipa preferred securities' coupon rate rising from 10% to 20% on October 15, 2016

• Lack of capital to de-lever from sector high leverage

Instability of management team (interim CEO)

• Is the existing team able to run the business appropriately post-downsizing in 2014? Do they have

capacity to invest in current client relationships? Hiring a permanent CEO could help drive growth by

attracting new contracts and third-party capital, but it may not be required in a standalone scenario

High leverage relative to peers

• Current debt / LTM EBITDA in excess of 16x (2) versus sector average of 3.6x

• Debt / total market capitalization of approximately 76% versus Tier 1 comp average of -23%

Uncertainty surrounding near term and long term strategy

Negative press around Monroe

· Burkle consent rights

Difficulty attracting new contracts in the US

• Several key positions have been recently vacated, potential for increased employee turnover

• Narrow research analyst coverage limits investor access to independent perspectives

.

Notes

1. Per management standalone projection model; includes impact of yield maintenance payment ($28.2MM) and termination fees received from Mondrian SB and Shore Club ($3.9MM)

2. Pro forma for $28.2MM loan paydown that occurred in Feb. 2016

5View entire presentation