DraftKings Investor Day Presentation Deck

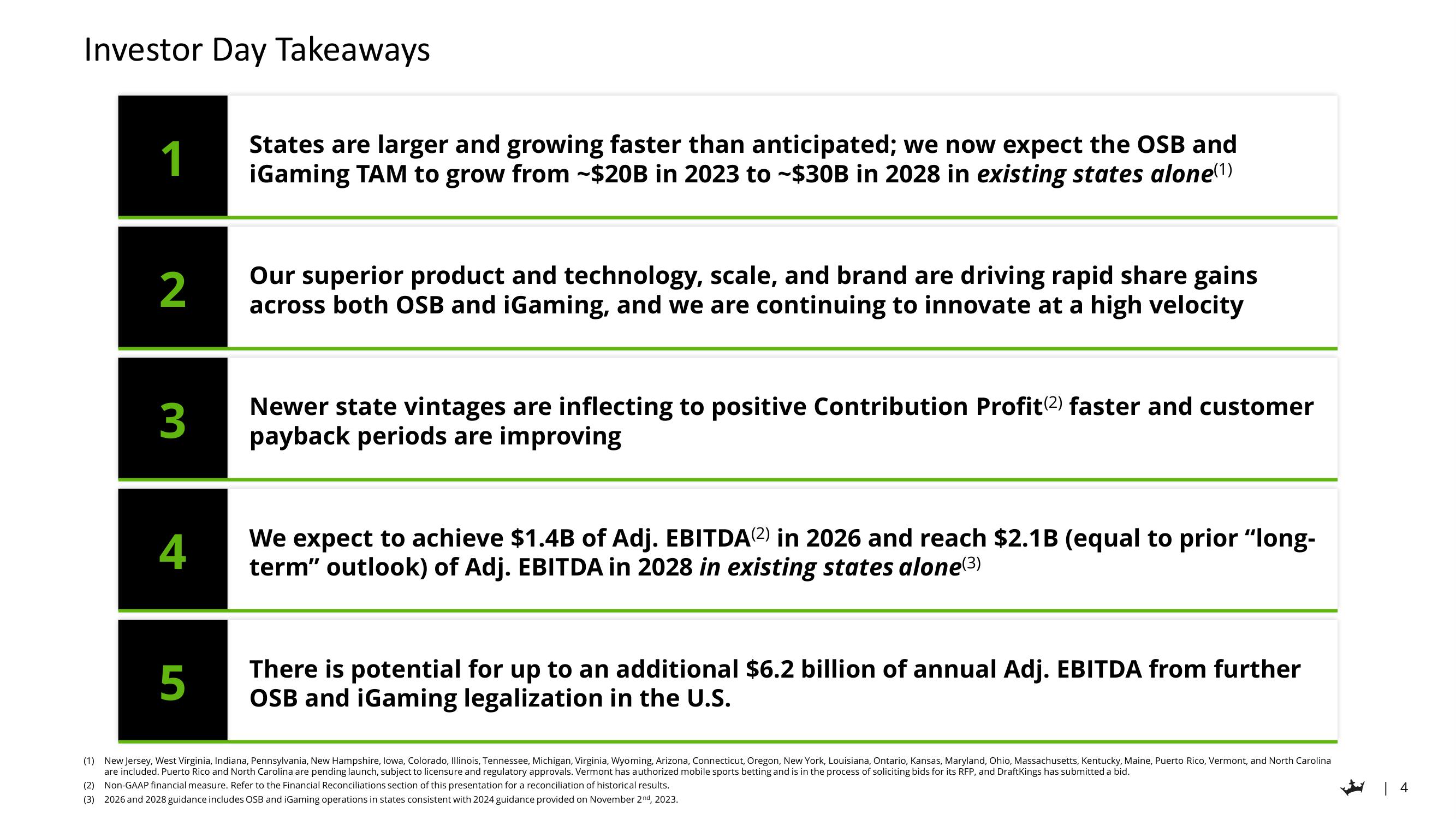

Investor Day Takeaways

1

2

3

States are larger and growing faster than anticipated; we now expect the OSB and

iGaming TAM to grow from ~$20B in 2023 to ~$30B in 2028 in existing states alone(¹)

5

Our superior product and technology, scale, and brand are driving rapid share gains

across both OSB and iGaming, and we are continuing to innovate at a high velocity

Newer state vintages are inflecting to positive Contribution Profit (2) faster and customer

payback periods are improving

4

We expect to achieve $1.4B of Adj. EBITDA(2) in 2026 and reach $2.1B (equal to prior "long-

term" outlook) of Adj. EBITDA in 2028 in existing states alone (3)

There is potential for up to an additional $6.2 billion of annual Adj. EBITDA from further

OSB and iGaming legalization in the U.S.

(1) New Jersey, West Virginia, Indiana, Pennsylvania, New Hampshire, lowa, Colorado, Illinois, Tennessee, Michigan, Virginia, Wyoming, Arizona, Connecticut, Oregon, New York, Louisiana, Ontario, Kansas, Maryland, Ohio, Massachusetts, Kentucky, Maine, Puerto Rico, Vermont, and North Carolina

are included. Puerto Rico and North Carolina are pending launch, subject to licensure and regulatory approvals. Vermont has authorized mobile sports betting and is in the process of soliciting bids for its RFP, and DraftKings has submitted a bid.

(2) Non-GAAP financial measure. Refer to the Financial Reconciliations section of this presentation for a reconciliation of historical results.

(3) 2026 and 2028 guidance includes OSB and iGaming operations in states consistent with 2024 guidance provided on November 2nd, 2023.

| 4View entire presentation