First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

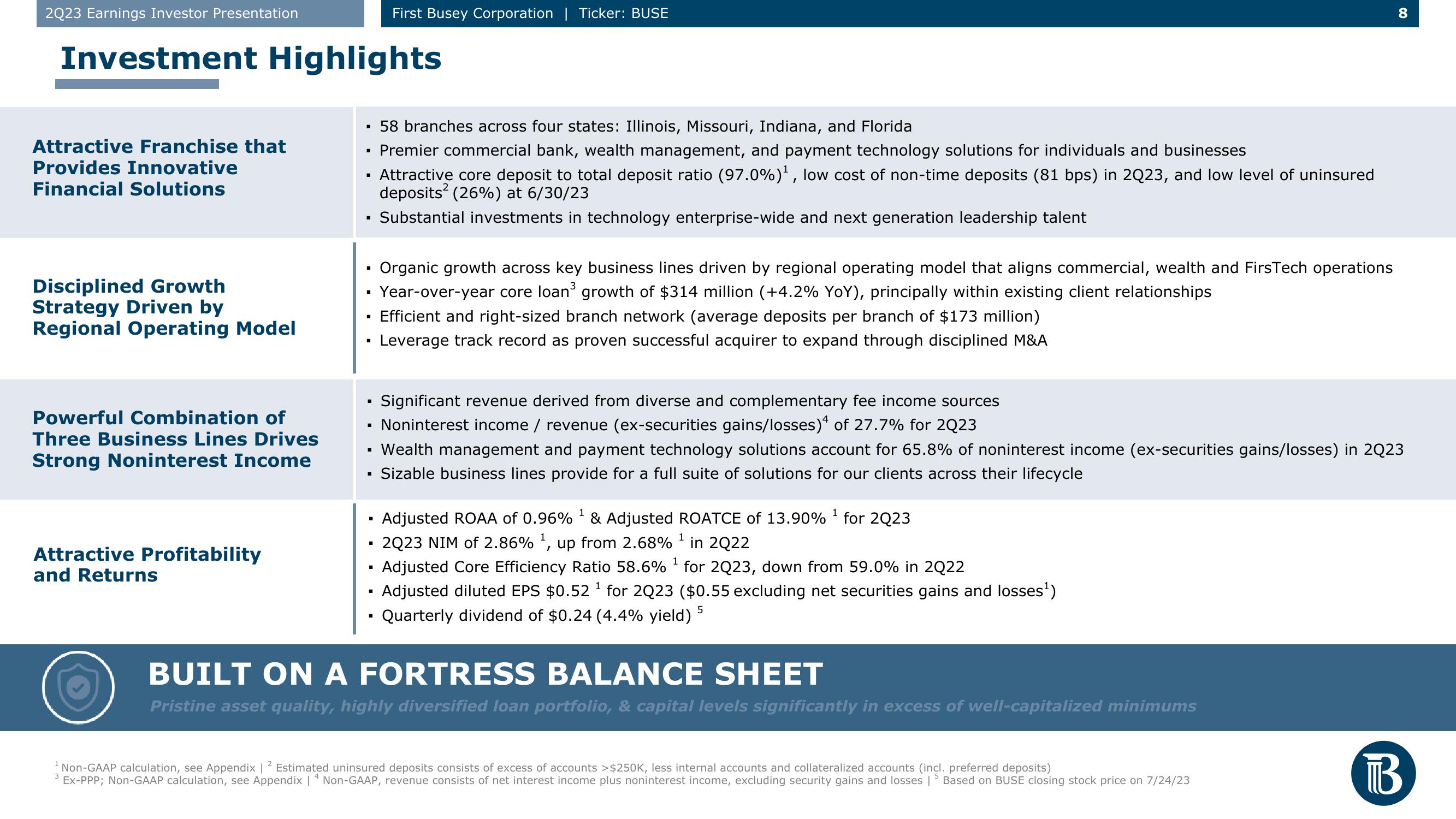

Investment Highlights

Attractive Franchise that

Provides Innovative

Financial Solutions

Disciplined Growth

Strategy Driven by

Regional Operating Model

Powerful Combination of

Three Business Lines Drives

Strong Noninterest Income

Attractive Profitability

and Returns

1

■

I

■

■

■

Organic growth across key business lines driven by regional operating model that aligns commercial, wealth and FirsTech operations

▪ Year-over-year core loan³ growth of $314 million (+4.2% YoY), principally within existing client relationships

Efficient and right-sized branch network (average deposits per branch of $173 million)

Leverage track record as proven successful acquirer to expand through disciplined M&A

I

I

Significant revenue derived from diverse and complementary fee income sources

Noninterest income / revenue (ex-securities gains/losses) of 27.7% for 2Q23

▪ Wealth management and payment technology solutions account for 65.8% of noninterest income (ex-securities gains/losses) in 2Q23

▪ Sizable business lines provide for a full suite of solutions for our clients across their lifecycle

■

First Busey Corporation | Ticker: BUSE

1

1

Adjusted ROAA of 0.96% ¹ & Adjusted ROATCE of 13.90% ¹ for 2Q23

▪ 2Q23 NIM of 2.86% 1, up from 2.68% ¹ in 2Q22

1

Adjusted Core Efficiency Ratio 58.6% ¹ for 2023, down from 59.0% in 2Q22

Adjusted diluted EPS $0.52¹ for 2Q23 ($0.55 excluding net securities gains and losses¹)

Quarterly dividend of $0.24 (4.4% yield) 5

■

58 branches across four states: Illinois, Missouri, Indiana, and Florida

Premier commercial bank, wealth management, and payment technology solutions for individuals and businesses

Attractive core deposit to total deposit ratio (97.0%) ¹, low cost of non-time deposits (81 bps) in 2Q23, and low level of uninsured

deposits² (26%) at 6/30/23

Substantial investments in technology enterprise-wide and next generation leadership talent

■

■

BUILT ON A FORTRESS BALANCE SHEET

Pristine asset quality, highly diversified loan portfolio, & capital levels significantly in excess of well-capitalized minimums

8

Non-GAAP calculation, see Appendix | ² Estimated uninsured deposits consists of excess of accounts >$250K, less internal accounts and collateralized accounts (incl. preferred deposits)

Ex-PPP; Non-GAAP calculation, see Appendix | 4 Non-GAAP, revenue consists of net interest income plus noninterest income, excluding security gains and losses | 5 Based on BUSE closing stock price on 7/24/23

BView entire presentation