Investor Insights: Q1 MCR Corp

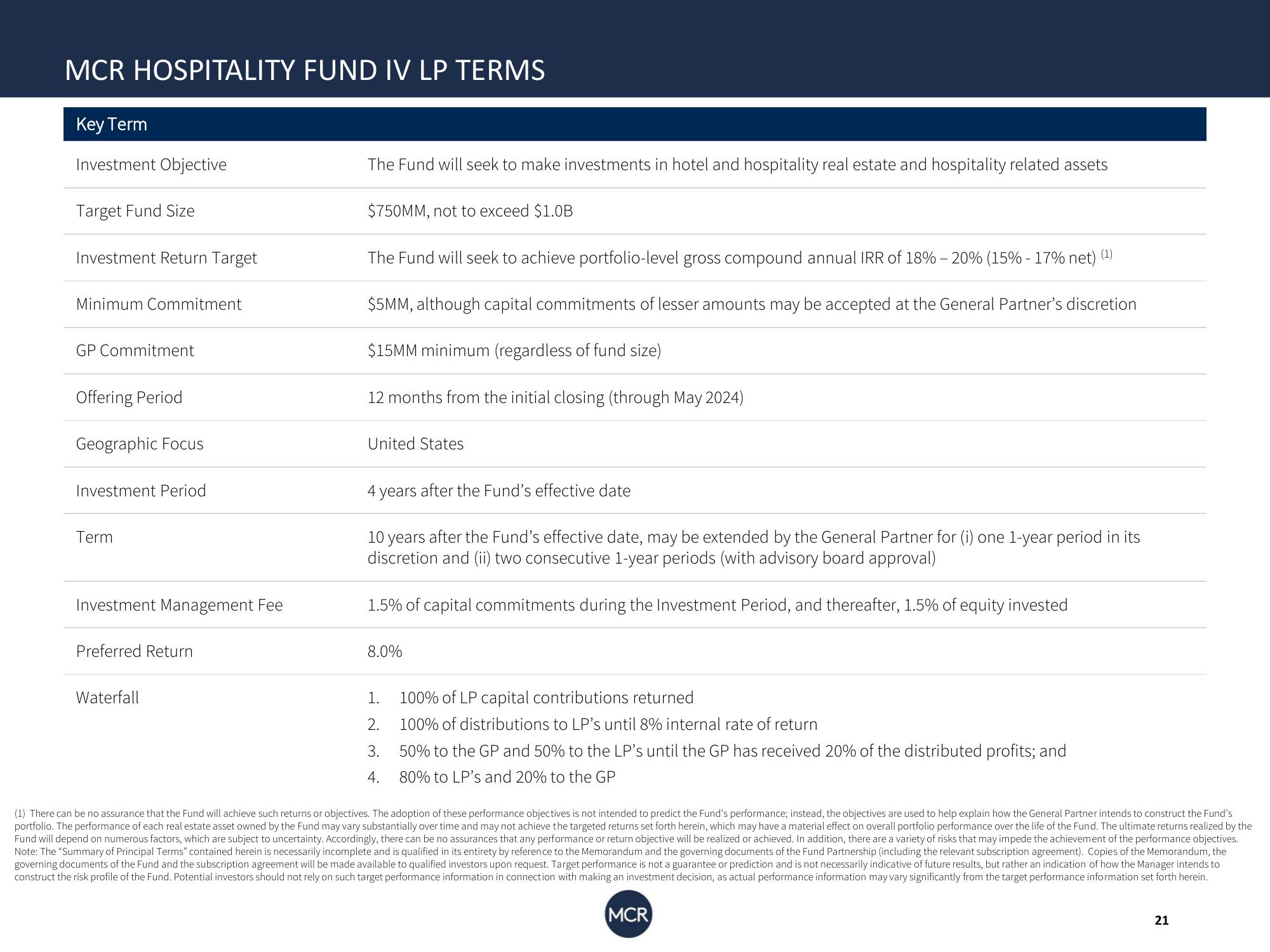

MCR HOSPITALITY FUND IV LP TERMS

Key Term

Investment Objective

Target Fund Size

Investment Return Target

Minimum Commitment

GP Commitment

Offering Period

Geographic Focus

Investment Period

Term

Investment Management Fee

Preferred Return

Waterfall

The Fund will seek to make investments in hotel and hospitality real estate and hospitality related assets

$750MM, not to exceed $1.0B

The Fund will seek to achieve portfolio-level gross compound annual IRR of 18% - 20% (15% -17% net) (¹)

$5MM, although capital commitments of lesser amounts may be accepted at the General Partner's discretion

$15MM minimum (regardless of fund size)

12 months from the initial closing (through May 2024)

United States

4 years after the Fund's effective date

10 years after the Fund's effective date, may be extended by the General Partner for (i) one 1-year period in its

discretion and (ii) two consecutive 1-year periods (with advisory board approval)

1.5% of capital commitments during the Investment Period, and thereafter, 1.5% of equity invested

8.0%

1.

2.

3.

4.

100% of LP capital contributions returned

100% of distributions to LP's until 8% internal rate of return

50% to the GP and 50% to the LP's until the GP has received 20% of the distributed profits; and

80% to LP's and 20% to the GP

(1) There can be no assurance that the Fund will achieve such returns or objectives. The adoption of these performance objectives is not intended to predict the Fund's performance; instead, the objectives are used to help explain how the General Partner intends to construct the Fund's

portfolio. The performance of each real estate asset owned by the Fund may vary substantially over time and may not achieve the targeted returns set forth herein, which may have a material effect on overall portfolio performance over the life of the Fund. The ultimate returns realized by the

Fund will depend on numerous factors, which are subject to uncertainty. Accordingly, there can be no assurances that any performance or return objective will be realized or achieved. In addition, there are a variety of risks that may impede the achievement of the performance objectives.

Note: The "Summary of Principal Terms" contained herein is necessarily incomplete and is qualified in its entirety by reference to the Memorandum and the governing documents of the Fund Partnership (including the relevant subscription agreement). Copies of the Memorandum, the

governing documents of the Fund and the subscription agreement will be made available to qualified investors upon request. Target performance is not a guarantee or prediction and is not necessarily indicative of future results, but rather an indication of how the Manager intends to

construct the risk profile of the Fund. Potential investors should not rely on such target performance information in connection with making an investment decision, as actual performance information may vary significantly from the target performance information set forth herein.

MCR

21View entire presentation