Energy Vault SPAC Presentation Deck

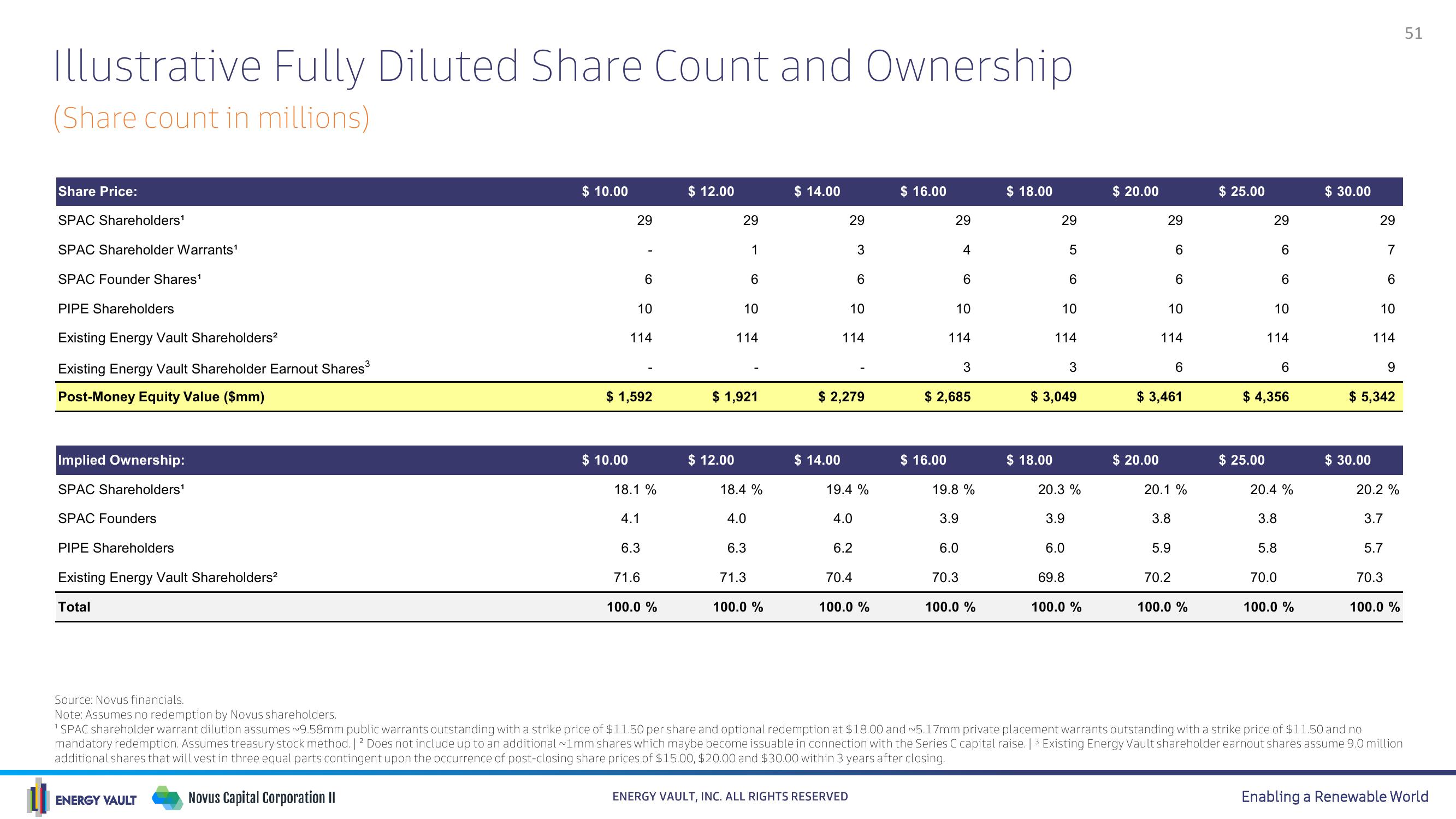

Illustrative Fully Diluted Share Count and Ownership

(Share count in millions)

Share Price:

SPAC Shareholders¹

SPAC Shareholder Warrants¹

SPAC Founder Shares¹

PIPE Shareholders

Existing Energy Vault Shareholders²

Existing Energy Vault Shareholder Earnout Shares³

Post-Money Equity Value ($mm)

Implied Ownership:

SPAC Shareholders¹

SPAC Founders

PIPE Shareholders

Existing Energy Vault Shareholders²

Total

$ 10.00

ENERGY VAULT

29

$ 10.00

10

114

$ 1,592

6

18.1 %

4.1

6.3

71.6

100.0 %

$ 12.00

29

1

6

$ 12.00

10

114

$ 1,921

18.4%

4.0

6.3

71.3

100.0 %

$ 14.00

$ 14.00

29

3

6

10

114

$ 2,279

6.2

19.4%

4.0

ENERGY VAULT, INC. ALL RIGHTS RESERVED

70.4

100.0 %

$ 16.00

29

$ 16.00

10

114

4

$ 2,685

3.9

6

6.0

19.8 %

70.3

3

100.0 %

$ 18.00

29

5

$18.00

10

114

$ 3,049

6

3.9

20.3 %

6.0

3

69.8

100.0 %

$ 20.00

29

$ 20.00

6

10

6

114

$ 3,461

5.9

70.2

6

20.1%

3.8

100.0 %

$ 25.00

29

$ 25.00

6

6

10

114

$ 4,356

3.8

5.8

6

20.4 %

70.0

100.0 %

$ 30.00

29

$ 30.00

6

10

7

114

$ 5,342

5.7

9

20.2%

3.7

70.3

Source: Novus financials.

Note: Assumes no redemption by Novus shareholders.

¹ SPAC shareholder warrant dilution assumes ~9.58mm public warrants outstanding with a strike price of $11.50 per share and optional redemption at $18.00 and ~5.17mm private placement warrants outstanding with a strike price of $11.50 and no

mandatory redemption. Assumes treasury stock method. | 2 Does not include up to an additional ~1mm shares which maybe become issuable in connection with the Series C capital raise. | 3 Existing Energy Vault shareholder earnout shares assume 9.0 million

additional shares that will vest in three equal parts contingent upon the occurrence of post-closing share prices of $15.00, $20.00 and $30.00 within 3 years after closing.

Novus Capital Corporation II

100.0 %

51

Enabling a Renewable WorldView entire presentation