Marti SPAC Presentation Deck

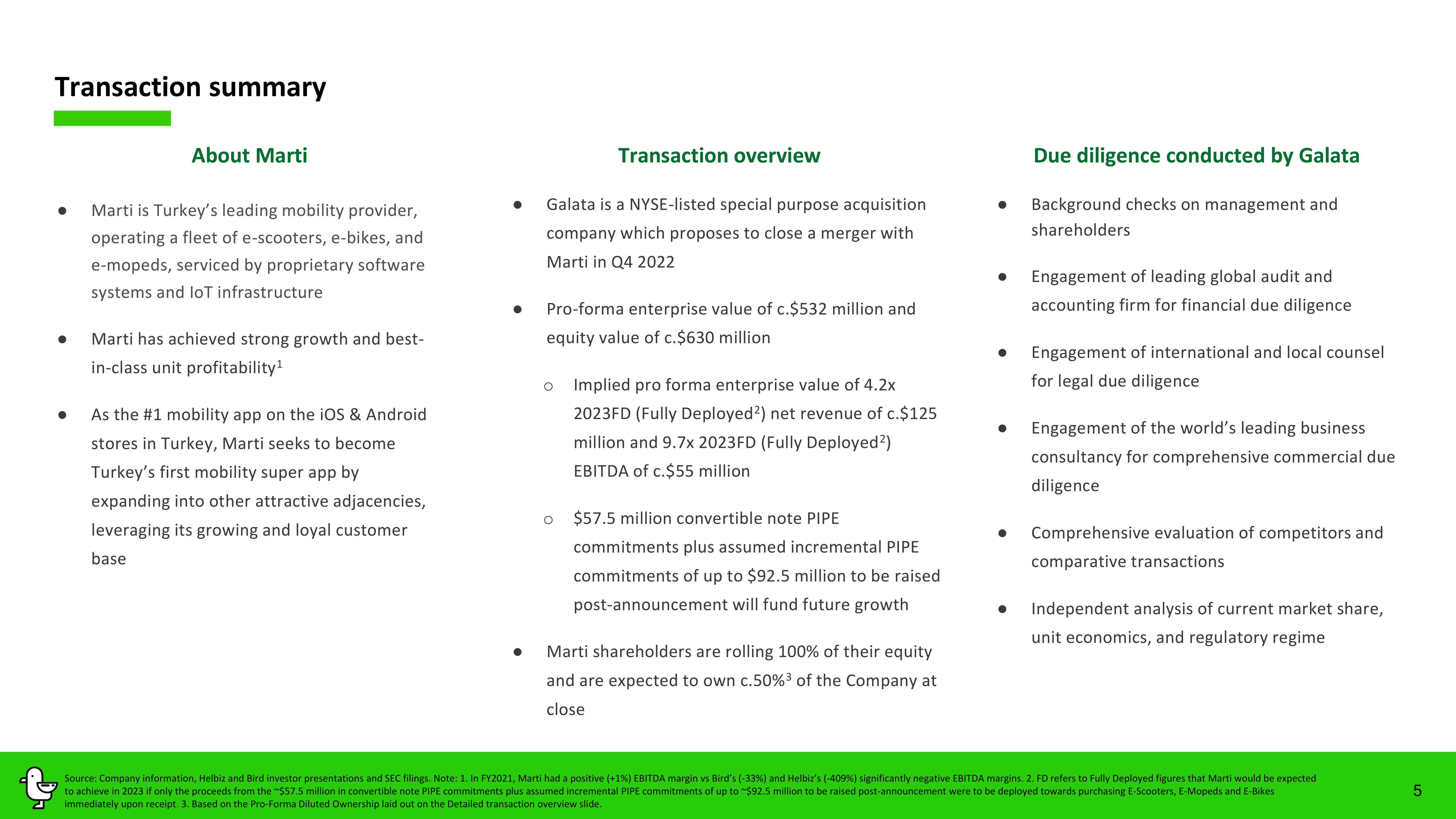

Transaction summary

●

About Marti

Marti is Turkey's leading mobility provider,

operating a fleet of e-scooters, e-bikes, and

e-mopeds, serviced by proprietary software

systems and loT infrastructure

Marti has achieved strong growth and best-

in-class unit profitability¹

As the #1 mobility app on the iOS & Android

stores in Turkey, Marti seeks to become

Turkey's first mobility super app by

expanding into other attractive adjacencies,

leveraging its growing and loyal customer

base

Transaction overview

Galata is a NYSE-listed special purpose acquisition

company which proposes to close a merger with

Marti in Q4 2022

Pro-forma enterprise value of c.$532 million and

equity value of c.$630 million

O Implied pro forma enterprise value of 4.2x

2023FD (Fully Deployed2) net revenue of c.$125

million and 9.7x 2023FD (Fully Deployed²)

EBITDA of c.$55 million

O

$57.5 million convertible note PIPE

commitments plus assumed incremental PIPE

commitments of up to $92.5 million to be raised

post-announcement will fund future growth

Marti shareholders are rolling 100% of their equity

and are expected to own c.50% ³ of the Company at

close

●

Due diligence conducted by Galata

Background checks on management and

shareholders

Engagement of leading global audit and

accounting firm for financial due diligence

Engagement of international and local counsel

for legal due diligence

Engagement of the world's leading business

consultancy for comprehensive commercial due

diligence

Comprehensive evaluation of competitors and

comparative transactions

Independent analysis of current market share,

unit economics, and regulatory regime

Source: Company information, Helbiz and Bird investor presentations and SEC filings. Note: 1. In FY2021, Marti had a positive (+1%) EBITDA margin vs Bird's (-33%) and Helbiz's (-409%) significantly negative EBITDA margins. 2. FD refers to Fully Deployed figures that Marti would be expected

to achieve in 2023 if only the proceeds from the ~$57.5 million in convertible note PIPE commitments plus assumed incremental PIPE commitments of up to ~$92.5 million to be raised post-announcement were to be deployed towards purchasing E-Scooters, E-Mopeds and E-Bikes

immediately upon receipt. 3. Based on the Pro-Forma Diluted Ownership laid out on the Detailed transaction overview slide.

5View entire presentation