Vale Investor Conference Presentation Deck

2022 BofA Securities Global Metals, Mining & Steel Conference

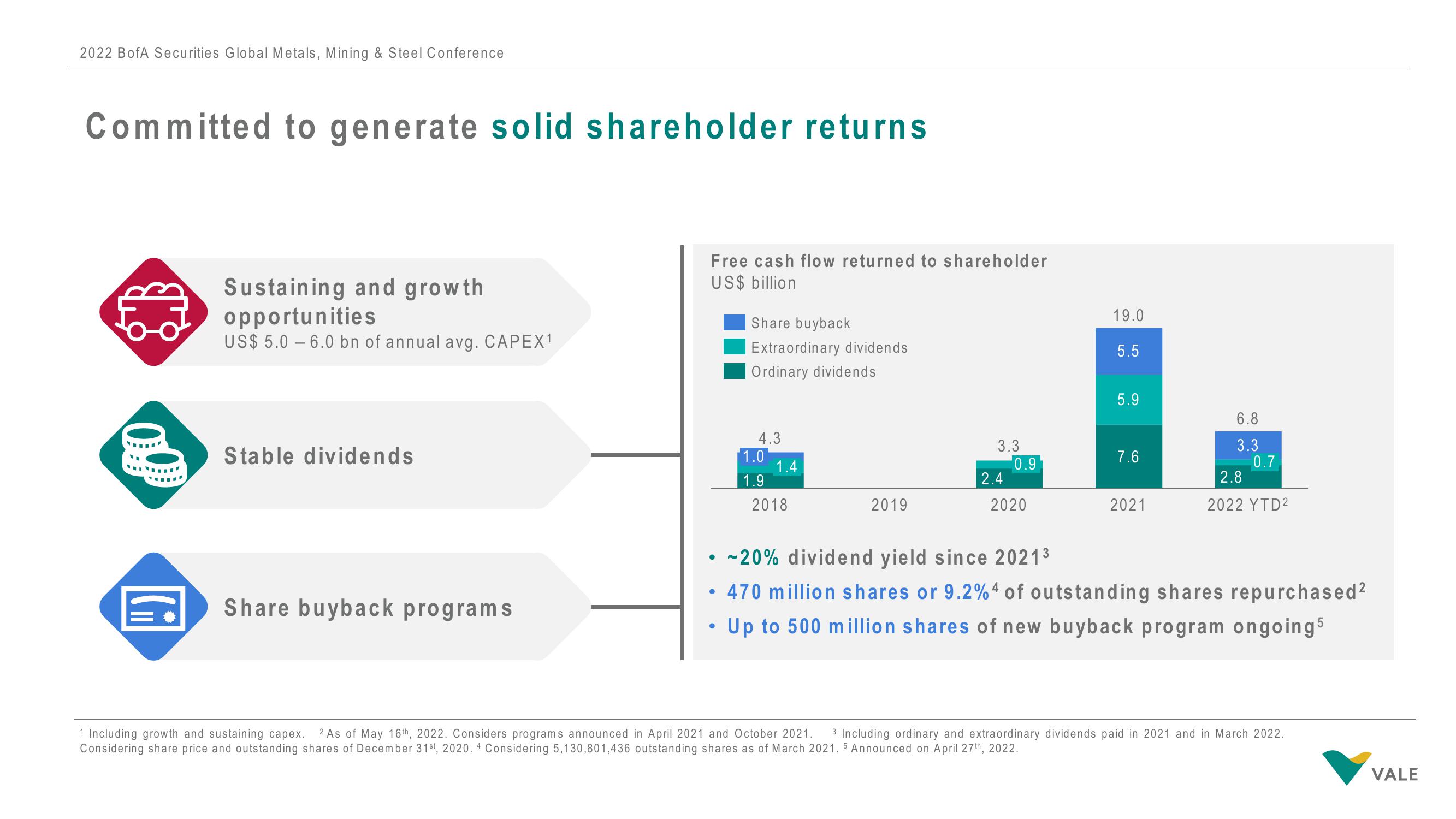

Committed to generate solid shareholder returns

|

Sustaining and growth

opportunities

US$ 5.0-6.0 bn of annual avg. CAPEX¹

Stable dividends

Share buyback programs

Free cash flow returned to shareholder

US$ billion

●

Share buyback

Extraordinary dividends

Ordinary dividends

●

4.3

1.0

1.9

1.4

2018

2019

3.3

30

2.4

0.9

2020

19.0

5.5

5.9

7.6

2021

6.8

3.3

0.7

~20% dividend yield since 2021³

• 470 million shares or 9.2% 4 of outstanding shares repurchased²

Up to 500 million shares of new buyback program ongoing5

2.8

2022 YTD²

1 Including growth and sustaining capex. 2 As of May 16th, 2022. Considers programs announced in April 2021 and October 2021. 3 Including ordinary and extraordinary dividends paid in 2021 and in March 2022.

Considering share price and outstanding shares of December 31st, 2020.4 Considering 5,130,801,436 outstanding shares as of March 2021. 5 Announced on April 27th, 2022.

VALEView entire presentation