Second Quarter 2022 Conference Call

Commercial Performance

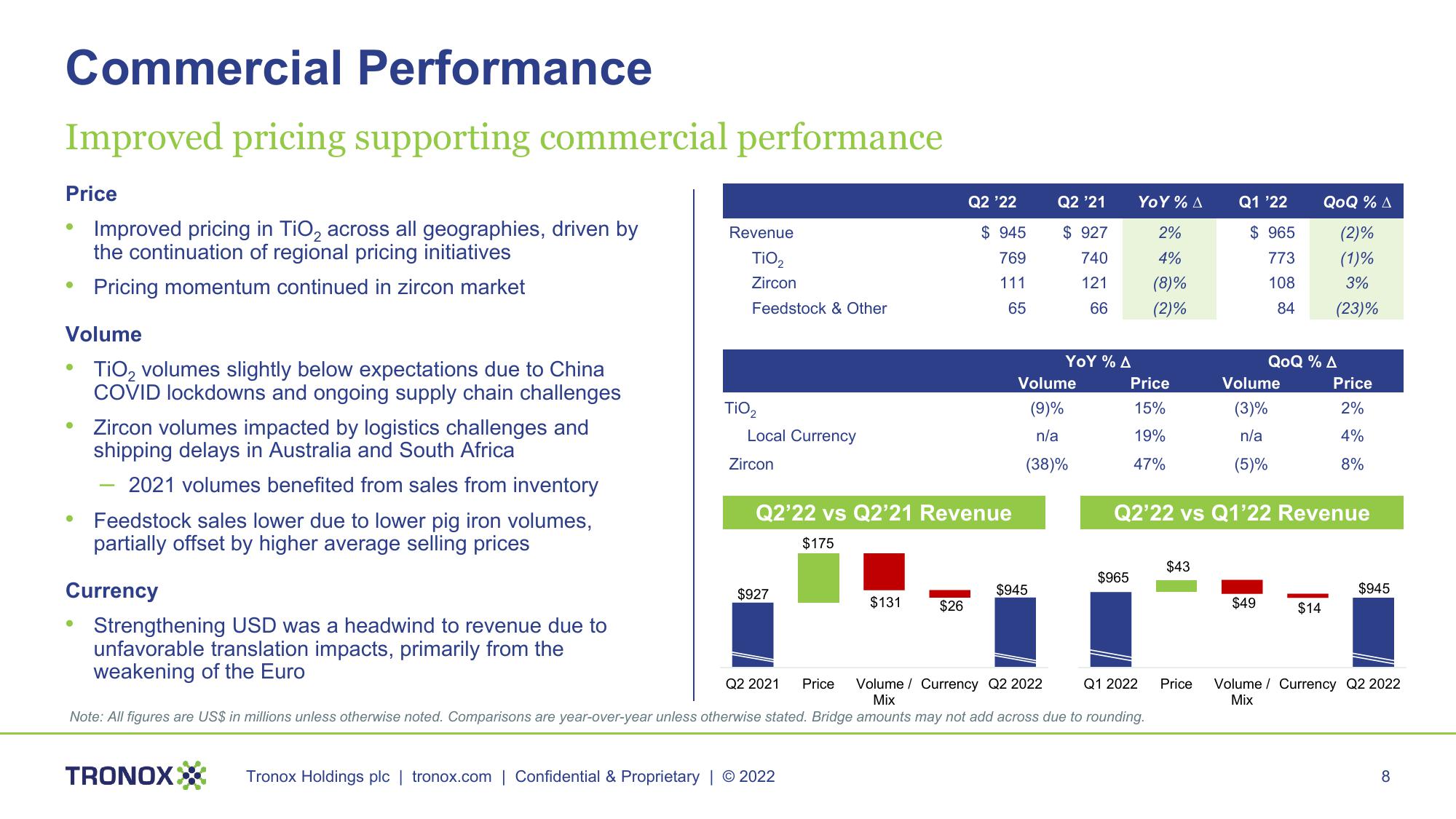

Improved pricing supporting commercial performance

Price

●

Volume

TiO₂ volumes slightly below expectations due to China

COVID lockdowns and ongoing supply chain challenges

●

Improved pricing in TiO₂ across all geographies, driven by

the continuation of regional pricing initiatives

Pricing momentum continued in zircon market

• Zircon volumes impacted by logistics challenges and

shipping delays in Australia and South Africa

2021 volumes benefited from sales from inventory

●

Feedstock sales lower due to lower pig iron volumes,

partially offset by higher average selling prices

Currency

●

Strengthening USD was a headwind to revenue due to

unfavorable translation impacts, primarily from the

weakening of the Euro

Revenue

TiO₂

Zircon

Feedstock & Other

TRONOX

TiO₂

Local Currency

Zircon

Q2'22 vs Q2'21 Revenue

$175

$927

Q2 2021 Price

$131

Tronox Holdings plc | tronox.com | Confidential & Proprietary | © 2022

Q2 '22

$ 945

769

111

65

$26

Q2 '21

$945

$ 927

740

121

66

YOY % A

Volume

(9)%

n/a

(38)%

YOY % A

2%

4%

(8)%

(2)%

$965

Volume / Currency Q2 2022

Mix

Note: All figures are US$ in millions unless otherwise noted. Comparisons are year-over-year unless otherwise stated. Bridge amounts may not add across due to rounding.

Price

15%

19%

47%

Q1 2022

$43

Q1 '22

Price

$ 965

773

108

84

Q2'22 vs Q1'22 Revenue

Volume

(3)%

n/a

(5)%

QoQ % A

(2)%

(1)%

3%

(23)%

QoQ % A

$49

Price

2%

4%

8%

$14

$945

Volume / Currency Q2 2022

Mix

8View entire presentation