Melrose Results Presentation Deck

Nortek Air Management: highlights

Melrose

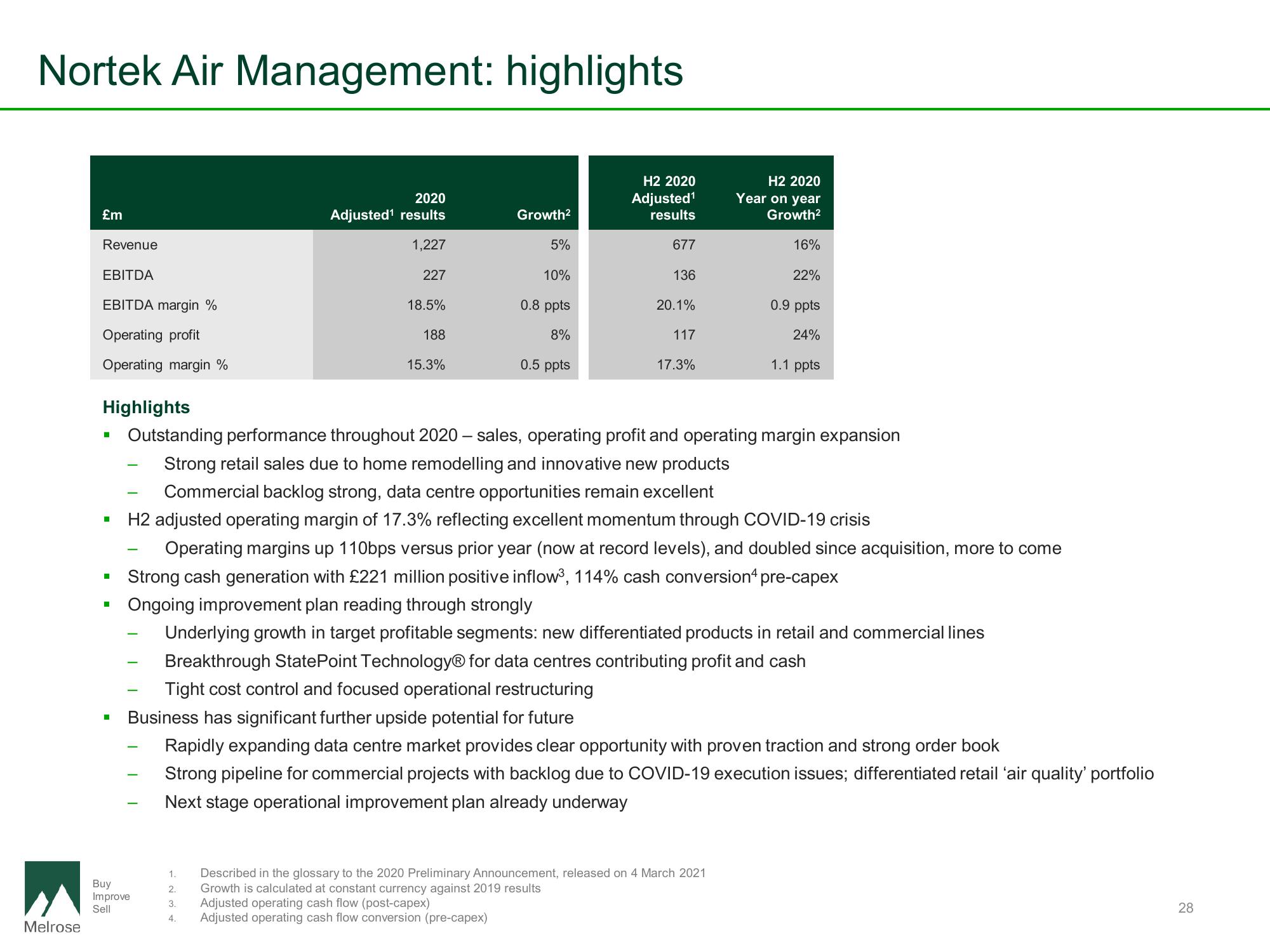

£m

Revenue

EBITDA

EBITDA margin %

Operating profit

Operating margin %

■

■

■

2020

Adjusted¹ results

1,227

227

Buy

Improve

Sell

18.5%

1.

2.

3.

4.

188

15.3%

Growth²

5%

10%

0.8 ppts

8%

0.5 ppts

H2 2020

Adjusted¹

results

677

136

20.1%

Highlights

Outstanding performance throughout 2020-sales, operating profit and operating margin expansion

Strong retail sales due to home remodelling and innovative new products

Commercial backlog strong, data centre opportunities remain excellent

H2 adjusted operating margin of 17.3% reflecting excellent momentum through COVID-19 crisis

Operating margins up 110bps versus prior year (now at record levels), and doubled since acquisition, more to come

Strong cash generation with £221 million positive inflow³, 114% cash conversion4 pre-capex

117

17.3%

H2 2020

Year on year

Growth²

Ongoing improvement plan reading through strongly

Underlying growth in target profitable segments: new differentiated products in retail and commercial lines

Breakthrough StatePoint Technology® for data centres contributing profit and cash

Tight cost control and focused operational restructuring

Business has significant further upside potential for future

Rapidly expanding data centre market provides clear opportunity with proven traction and strong order book

Strong pipeline for commercial projects with backlog due to COVID-19 execution issues; differentiated retail 'air quality' portfolio

Next stage operational improvement plan already underway

16%

22%

0.9 ppts

24%

1.1 ppts

Described in the glossary to the 2020 Preliminary Announcement, released on 4 March 2021

Growth is calculated at constant currency against 2019 results

Adjusted operating cash flow (post-capex)

Adjusted operating cash flow conversion (pre-capex)

28View entire presentation