Tudor, Pickering, Holt & Co Investment Banking

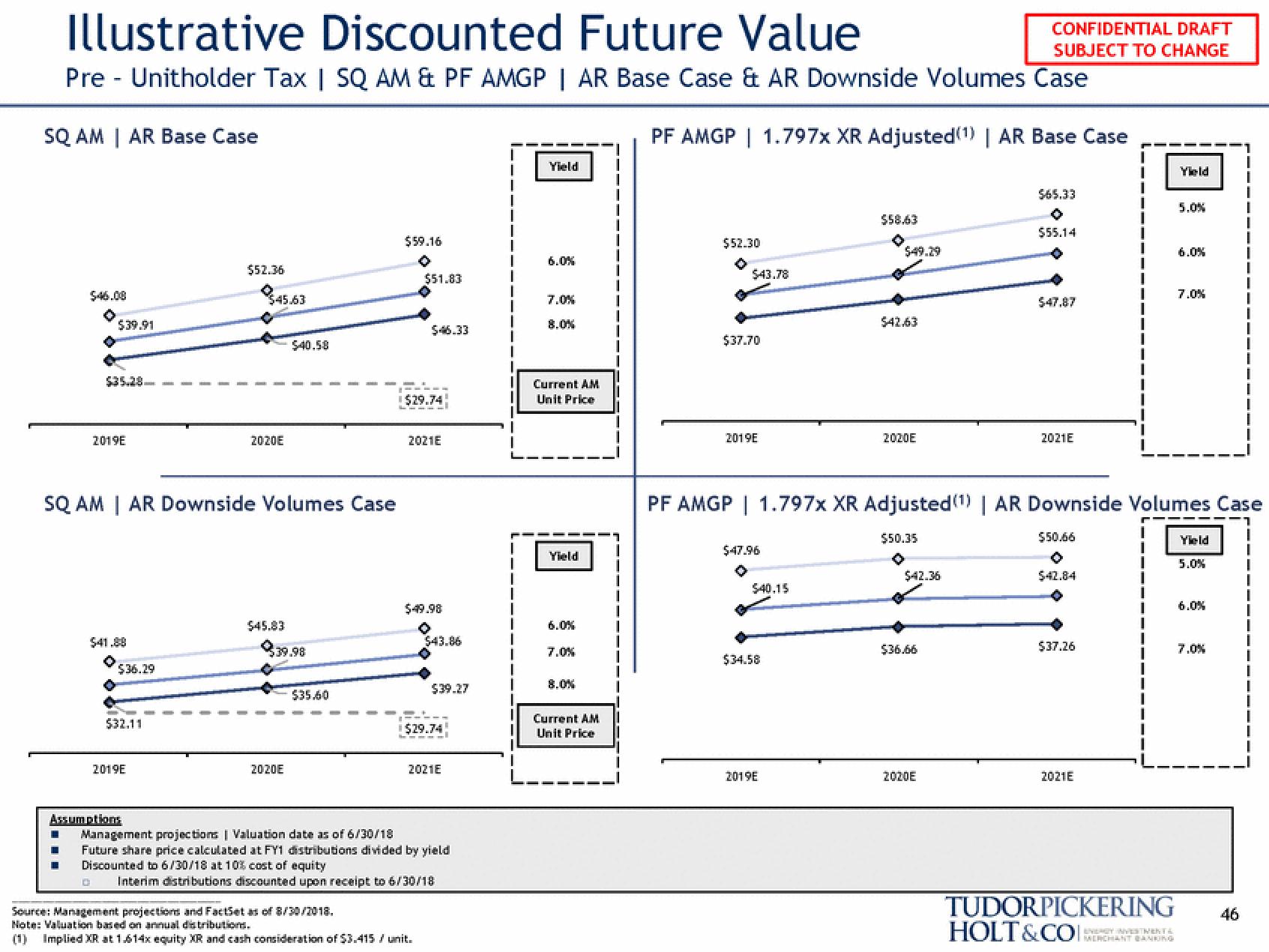

Illustrative Discounted Future Value

Pre Unitholder Tax | SQ AM & PF AMGP | AR Base Case & AR Downside Volumes Case

SQ AM | AR Base Case

PF AMGP | 1.797x XR Adjusted (1) | AR Base Case

$39.91

2019E

$41.88

$36.29

$32.11

SQ AM | AR Downside Volumes Case

2019E

$52.36

Assumptions

$45.63

2020E

$45.83

$40.58

$39.98

2020E

$35.60

$59.16

$51.83

$46.33

$29.74

2021E

$-49.98

$43.86

Source: Management projections and FactSet as of 8/30/2018.

Note: Valuation based on annual distributions.

(1) Implied XR at 1.614x equity XR and cash consideration of $3.415 / unit.

$39.27

$29.74

2021E

Management projections | Valuation date as of 6/30/18

Future share price calculated at FY1 distributions divided by yield

Discounted to 6/30/18 at 10% cost of equity

0 Interim distributions discounted upon receipt to 6/30/18

1

1

I

1

I

1

Yield

6.0%

7.0%

Current AM

Unit Price

Yield

7.0%

8.0%

Current AM

Unit Price

|

|

$52.30

$43.78

$37.70

2019E

$47.96

$40.15

$34.58

$58.63

2019E

$49.29

$42.63

2020E

$42.36

$36.66

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

2020E

$65.33

O

$55.14

$47.87

2021E

PF AMGP | 1.797x XR Adjusted (1) | AR Downside Volumes Case

1

I

$50.35

T

$50.66

O

$42.84

$37.26

2021E

TUDORPICKERING

HOLT&COI:

Yield

ENERGY INVESTMENTS

5.0%

6.0%

7.0%

Yield

5.0%

6.0%

7.0%

I

46

1

1View entire presentation