J.P.Morgan Investment Banking Pitch Book

VALUATION ANALYSIS

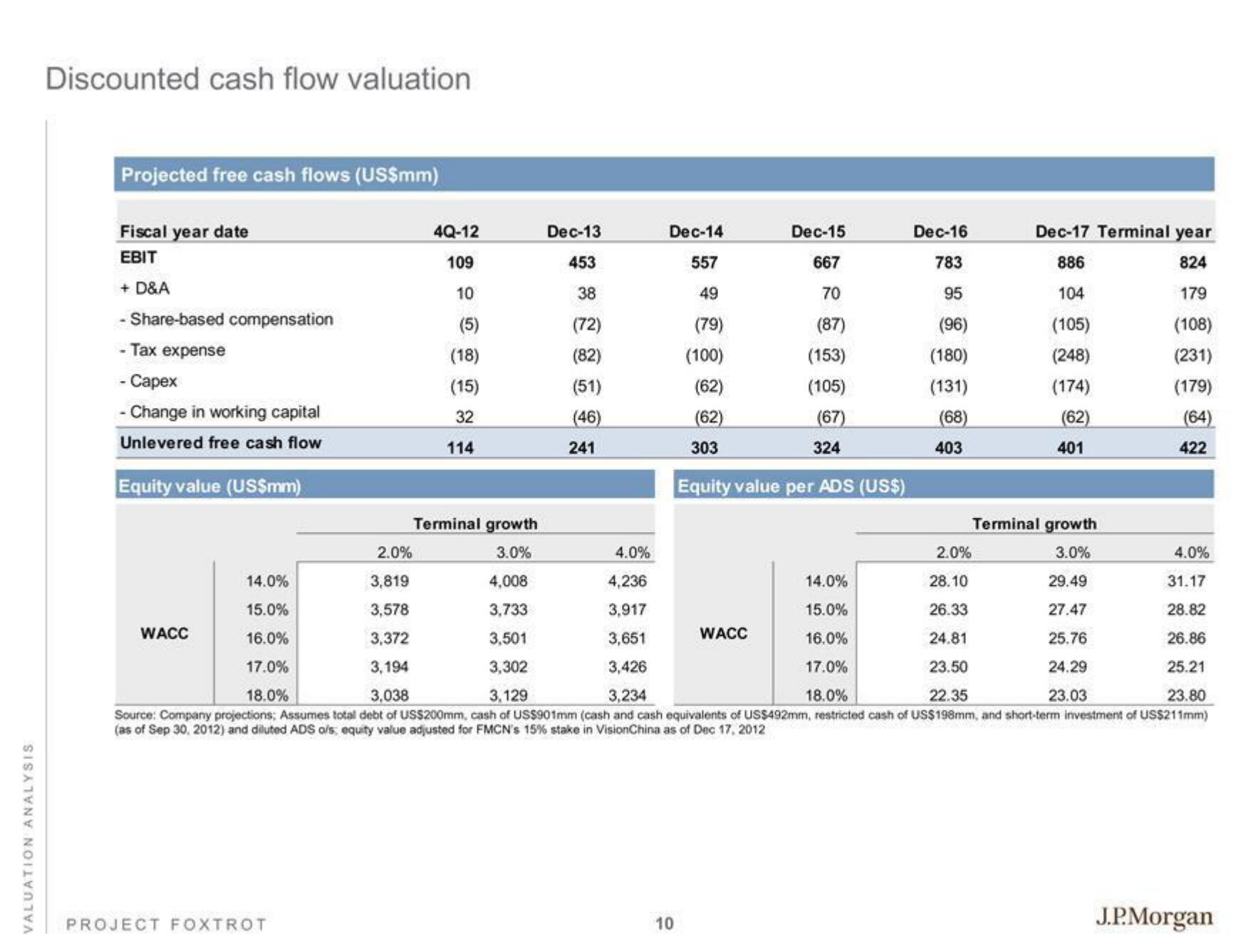

Discounted cash flow valuation

Projected free cash flows (US$mm)

Fiscal year date

EBIT

+ D&A

Share-based compensation

- Tax expense

- Capex

- Change in working capital

Unlevered free cash flow

Equity value (US$mm)

-

WACC

4Q-12

109

10

(5)

(18)

(15)

32

114

PROJECT FOXTROT

Terminal growth

3.0%

Dec-13

453

38

(72)

(82)

(51)

(46)

241

Dec-14

Dec-15

557

667

49

70

(79)

(87)

(100)

(153)

(62)

(105)

(62)

(67)

303

324

Equity value per ADS (US$)

10

Dec-16

783

95

(96)

(180)

(131)

(68)

403

2.0%

4.0%

4.0%

14.0%

3,819

4,008

4,236

14.0%

28.10

31.17

15.0%

3,578

3,733

3,917

15.0%

26.33

28.82

16.0%

3,372

3,501

3,651

16.0%

24.81

26.86

17.0%

3,194

3,302

3,426

17.0%

23.50

25.21

18.0%

3,038

3,129

3,234

18.0%

22.35

23.80

Source: Company projections; Assumes total debt of US$200mm, cash of US$901mm (cash and cash equivalents of US$492mm, restricted cash of US$198mm, and short-term investment of US$211mm)

(as of Sep 30, 2012) and diluted ADS o/s; equity value adjusted for FMCN's 15% stake in VisionChina as of Dec 17, 2012

WACC

Dec-17 Terminal year

886

824

104

179

(105)

(108)

(248)

(231)

(174)

(179)

(62)

(64)

401

Terminal growth

3.0%

29.49

27.47

25.76

24.29

23.03

2.0%

422

J.P.MorganView entire presentation