Bed Bath & Beyond Results Presentation Deck

FINANCIAL OUTLOOK

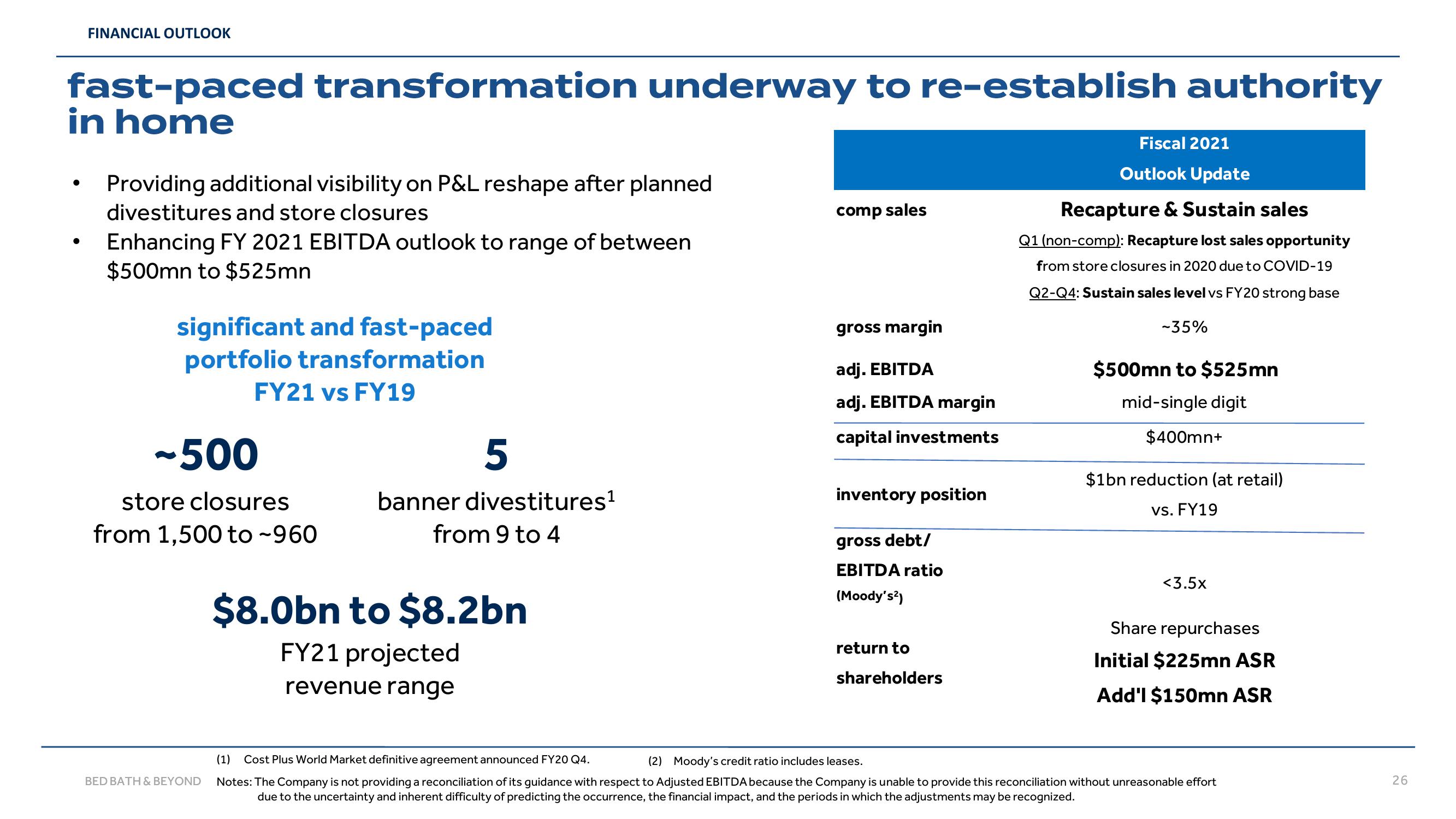

fast-paced transformation underway to re-establish authority

in home

●

Providing additional visibility on P&L reshape after planned

divestitures and store closures

Enhancing FY 2021 EBITDA outlook to range of between

$500mn to $525mn

significant and fast-paced

portfolio transformation

FY21 vs FY19

-500

store closures

from 1,500 to -960

BED BATH & BEYOND

5

banner divestitures¹

from 9 to 4

$8.0bn to $8.2bn

FY21 projected

revenue range

comp sales

gross margin

adj. EBITDA

adj. EBITDA margin

capital investments

inventory position

gross debt/

EBITDA ratio

(Moody's²)

return to

shareholders

Fiscal 2021

Outlook Update

Recapture & Sustain sales

Q1 (non-comp): Recapture lost sales opportunity

from store closures in 2020 due to COVID-19

Q2-Q4: Sustain sales level vs FY20 strong base

-35%

$500mn to $525mn

mid-single digit

$400mn+

$1bn reduction (at retail)

vs. FY19

<3.5x

Share repurchases

Initial $225mn ASR

Add'l $150mn ASR

(2) Moody's credit ratio includes leases.

(1) Cost Plus World Market definitive agreement announced FY20 Q4.

Notes: The Company is not providing a reconciliation of its guidance with respect to Adjusted EBITDA because the Company is unable to provide this reconciliation without unreasonable effort

due to the uncertainty and inherent difficulty of predicting the occurrence, the financial impact, and the periods in which the adjustments may be recognized.

26View entire presentation