Pershing Square Activist Presentation Deck

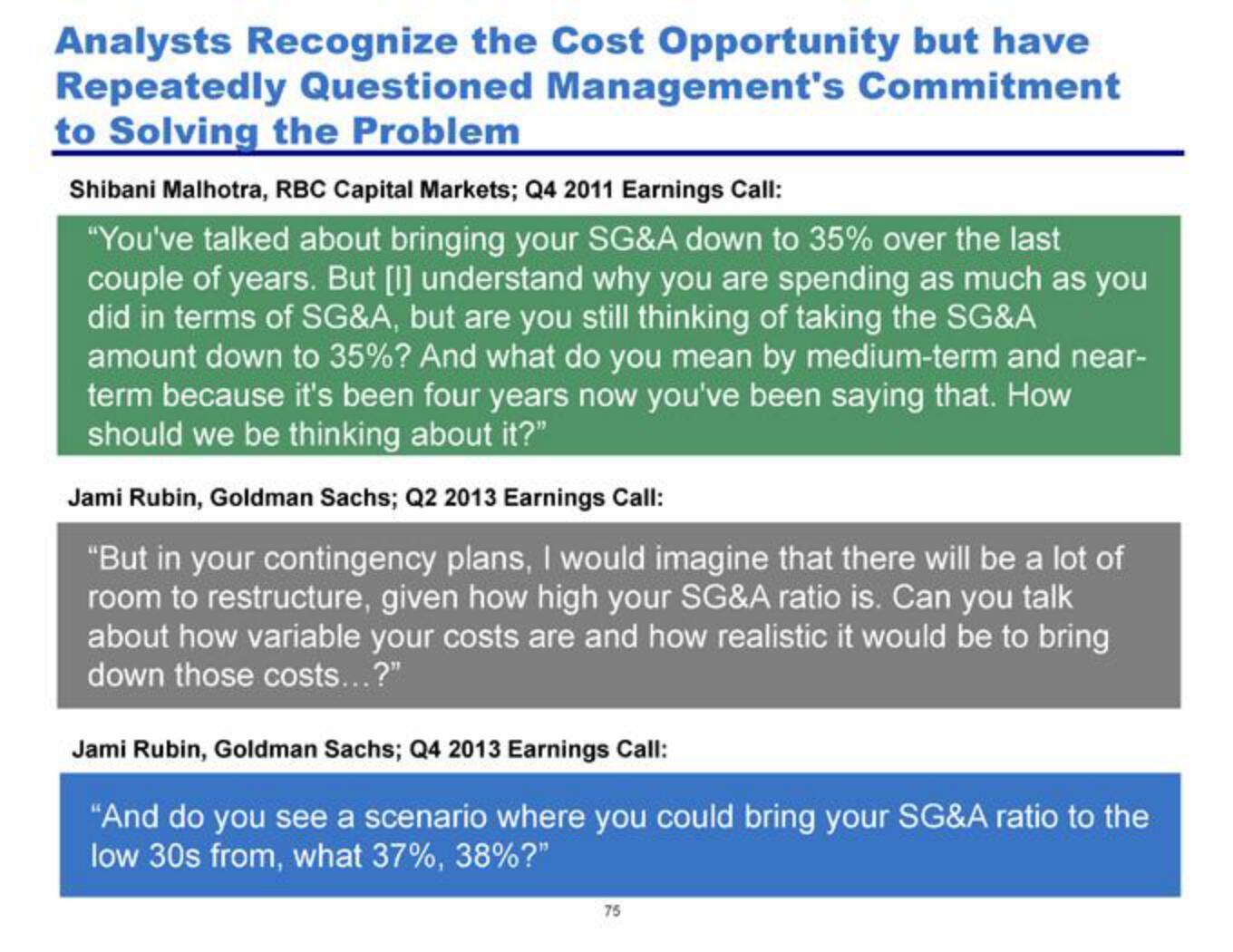

Analysts Recognize the Cost Opportunity but have

Repeatedly Questioned Management's Commitment

to Solving the Problem

Shibani Malhotra, RBC Capital Markets; Q4 2011 Earnings Call:

"You've talked about bringing your SG&A down to 35% over the last

couple of years. But [I] understand why you are spending as much as you

did in terms of SG&A, but are you still thinking of taking the SG&A

amount down to 35%? And what do you mean by medium-term and near-

term because it's been four years now you've been saying that. How

should we be thinking about it?"

Jami Rubin, Goldman Sachs; Q2 2013 Earnings Call:

"But in your contingency plans, I would imagine that there will be a lot of

room to restructure, given how high your SG&A ratio is. Can you talk

about how variable your costs are and how realistic it would be to bring

down those costs...?"

Jami Rubin, Goldman Sachs; Q4 2013 Earnings Call:

"And do you see a scenario where you could bring your SG&A ratio to the

low 30s from, what 37%, 38%?"

75View entire presentation