SoftBank Results Presentation Deck

=SoftBank

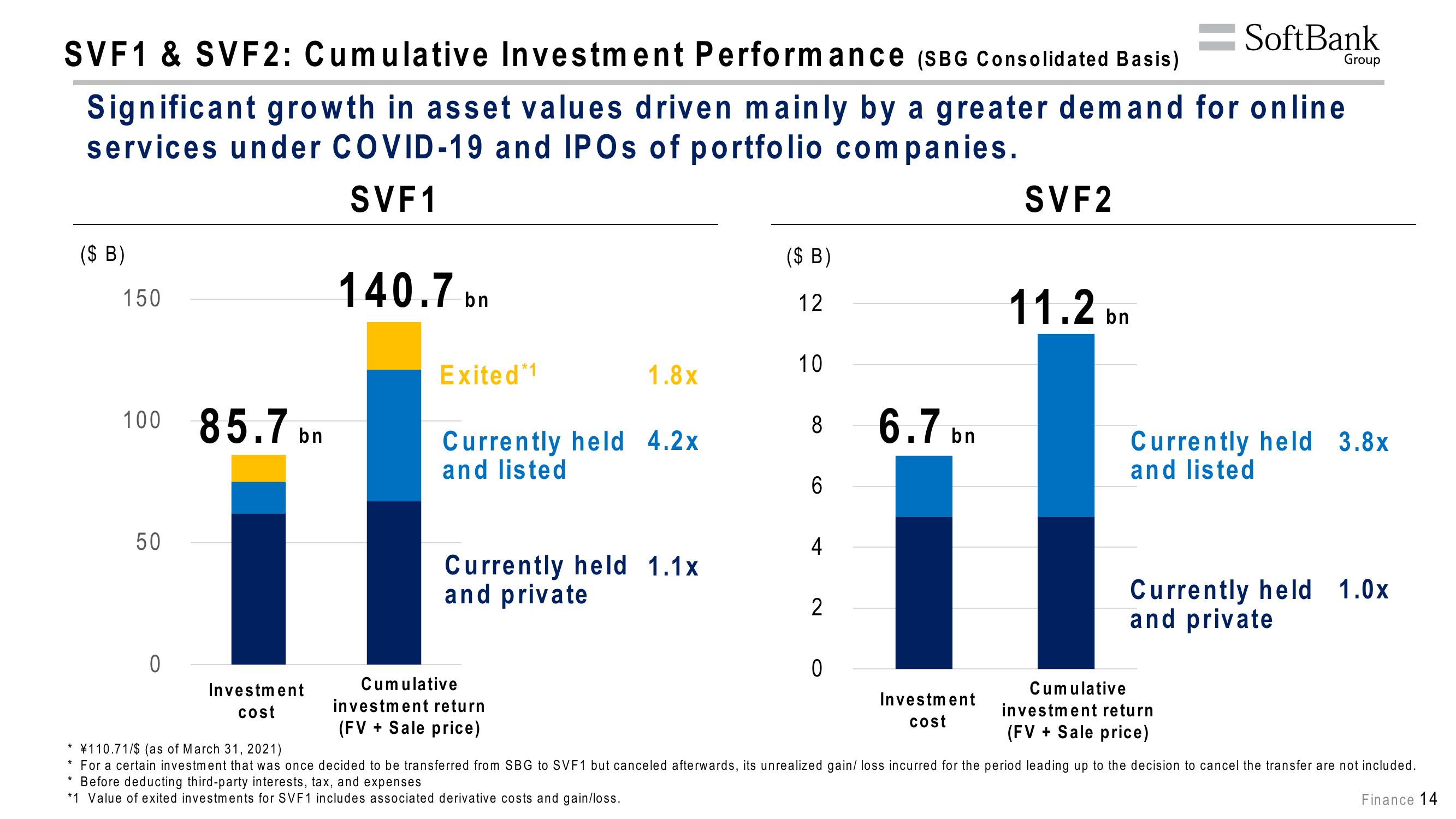

SVF1 & SVF2: Cumulative Investment Performance (SBG Consolidated Basis)

Significant growth in asset values driven mainly by a greater demand for online

services under COVID-19 and IPOs of portfolio companies.

SVF1

($ B)

150

100 85.7 bn

50

0

Investment

cost

140.7 bn

Exited*1

1.8x

Currently held 4.2x

and listed

Currently held 1.1x

and private

Cumulative

investment return

(FV + Sale price)

($ B)

12

10

8

6

4

2

0

6.7 bm

bn

Investment

cost

SVF2

11.2 bn

Group

Currently held 3.8x

and listed

Currently held 1.0x

and private

Cumulative

investment return

(FV + Sale price)

¥110.71/$ (as of March 31, 2021)

For a certain investment that was once decided to be transferred from SBG to SVF1 but canceled afterwards, its unrealized gain/ loss incurred for the period leading up to the decision to cancel the transfer are not included.

Before deducting third-party interests, tax, and expenses

*1 Value of exited investments for SVF1 includes associated derivative costs and gain/loss.

Finance 14View entire presentation