Hipgnosis Songs Fund Results Presentation Deck

Made public by

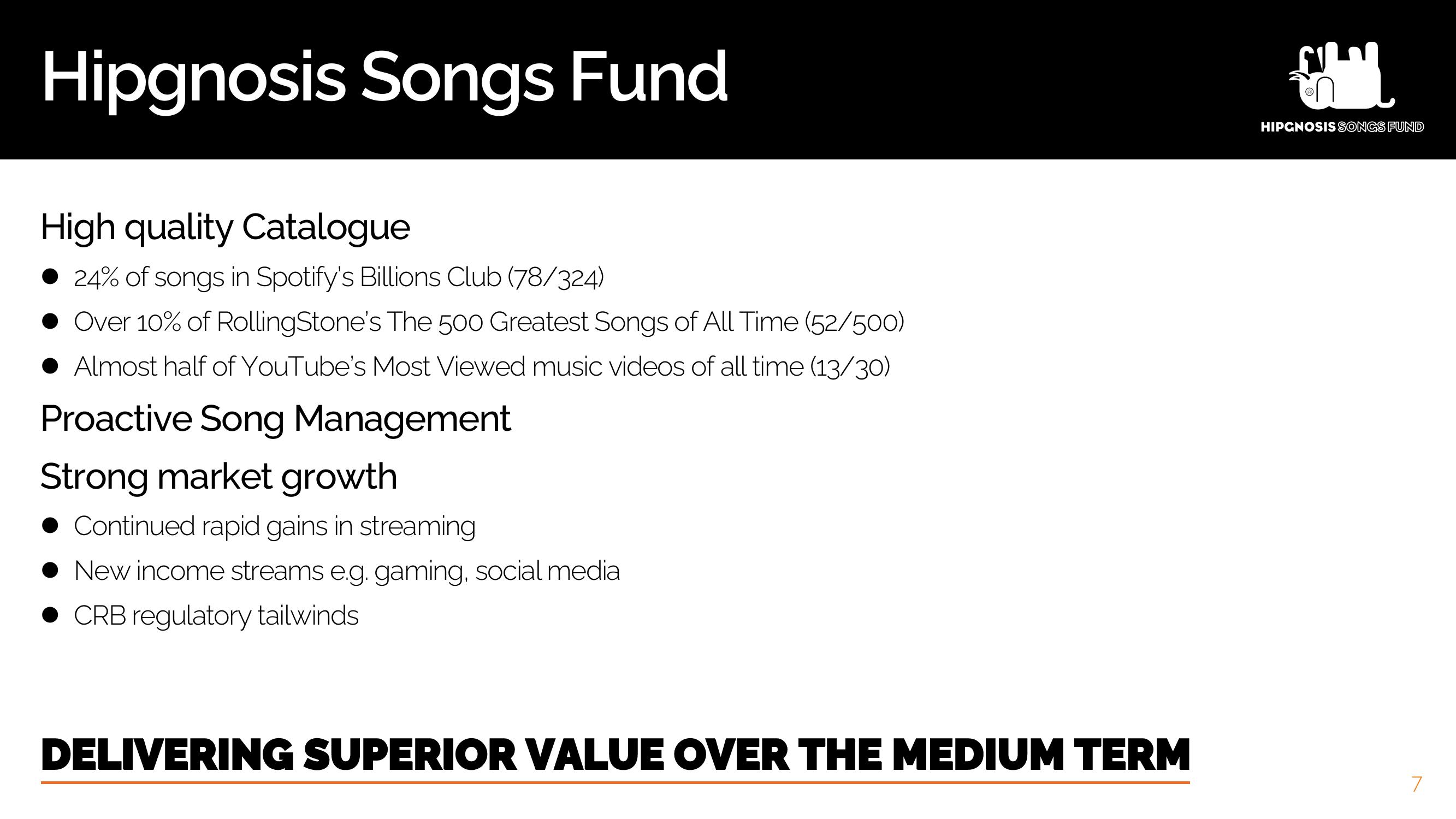

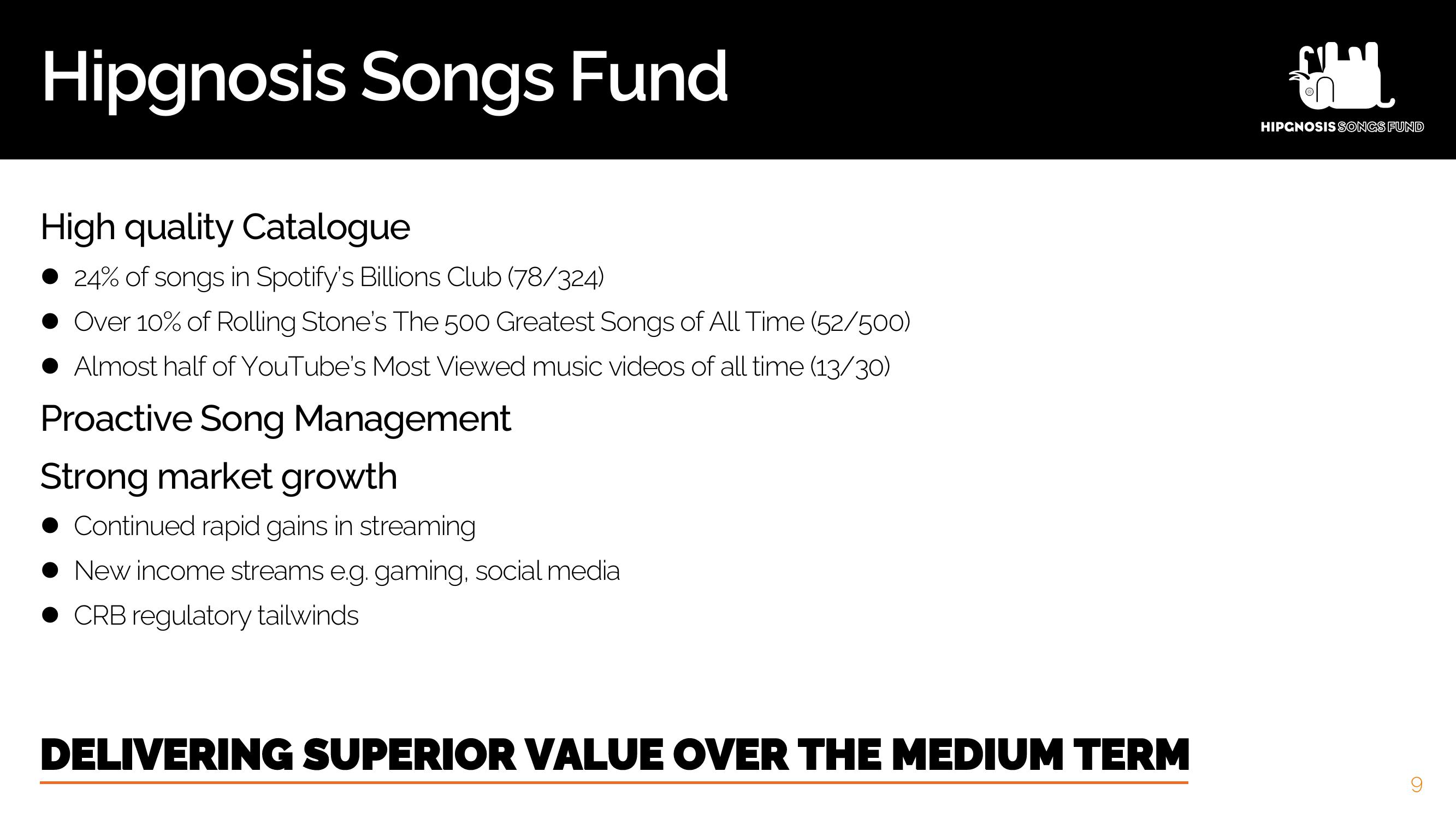

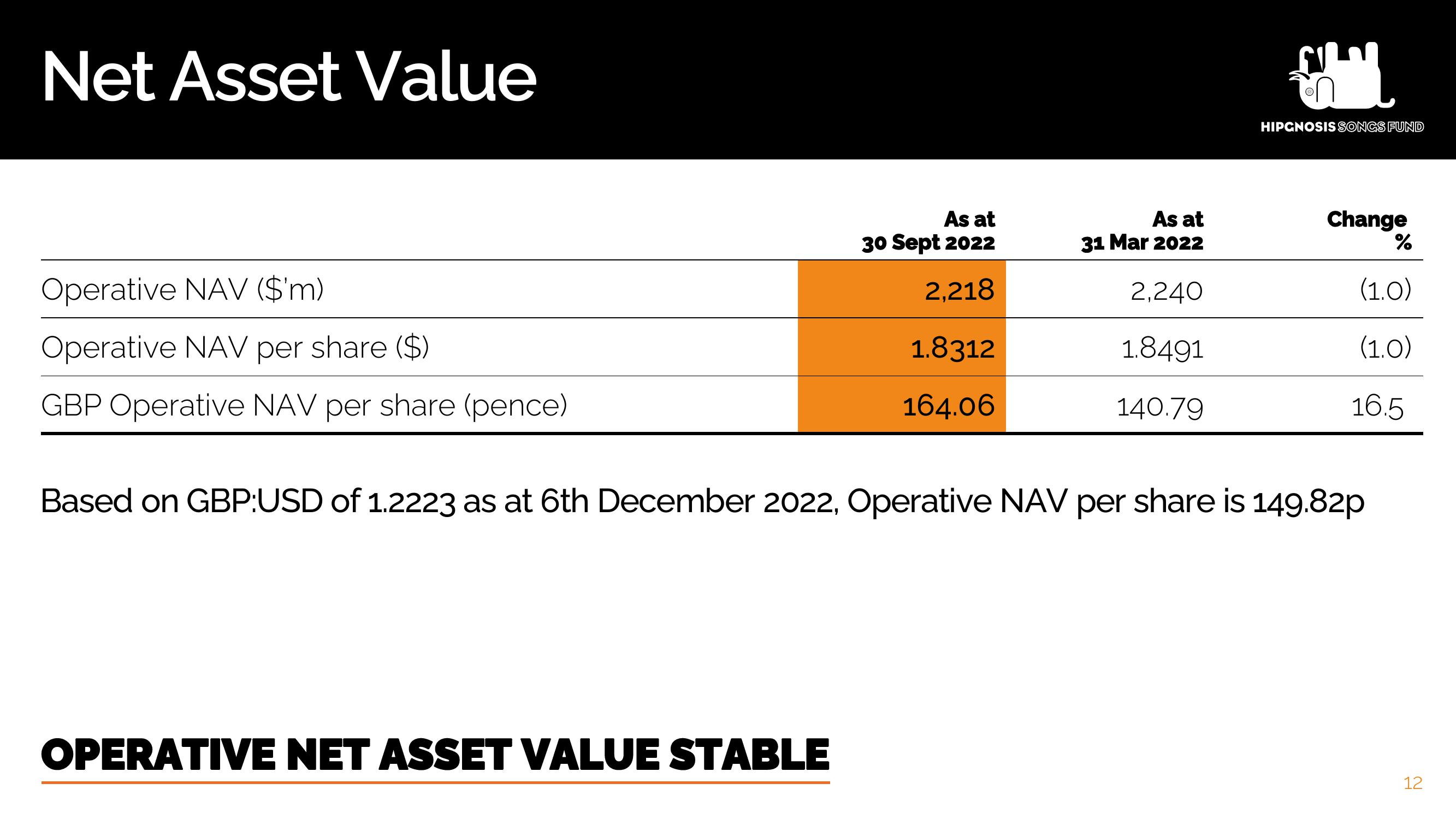

Hipgnosis Songs Fund

sourced by PitchSend

Creator

hipgnosis-songs-fund

Category

Communication

Published

December 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related