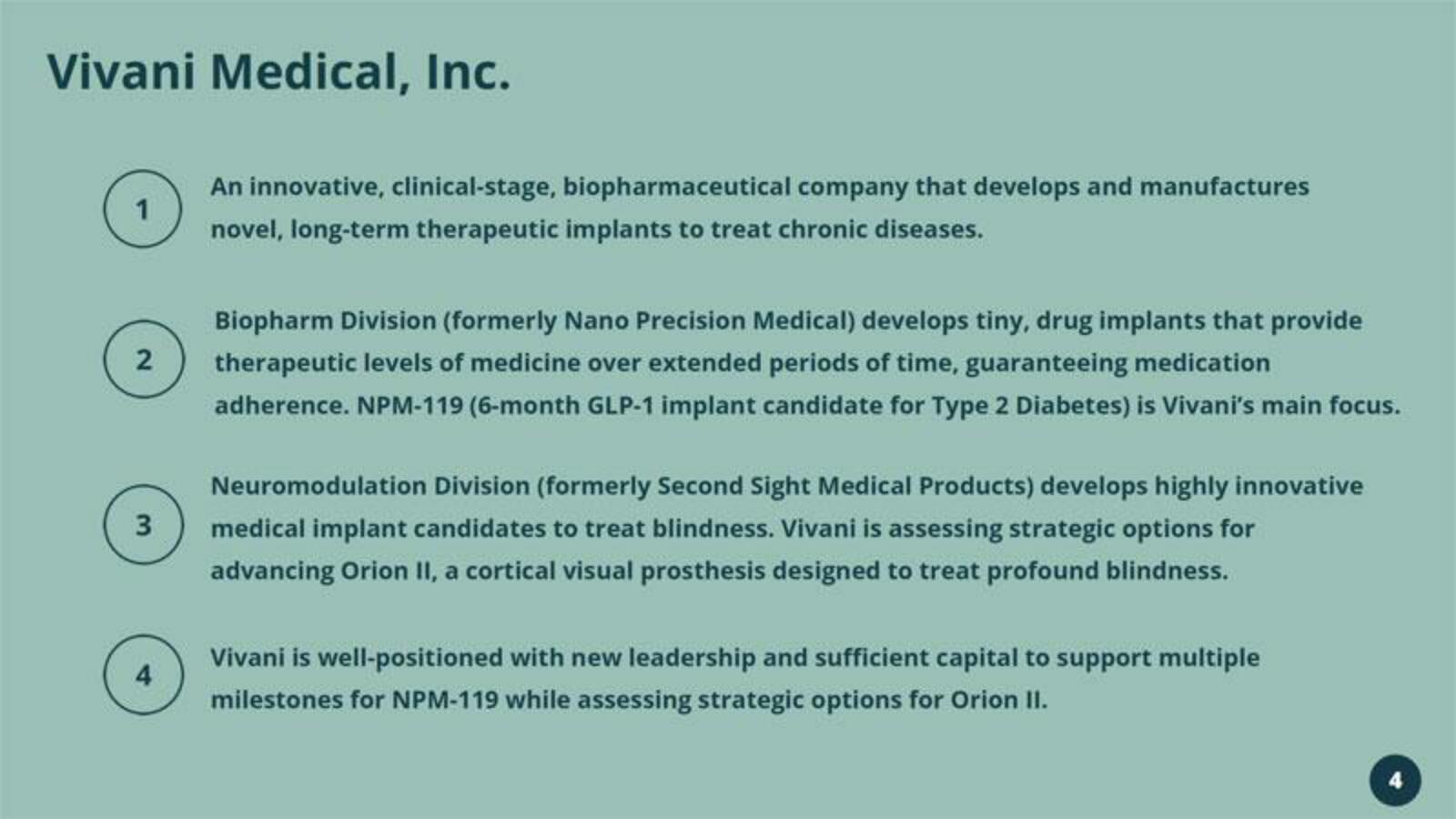

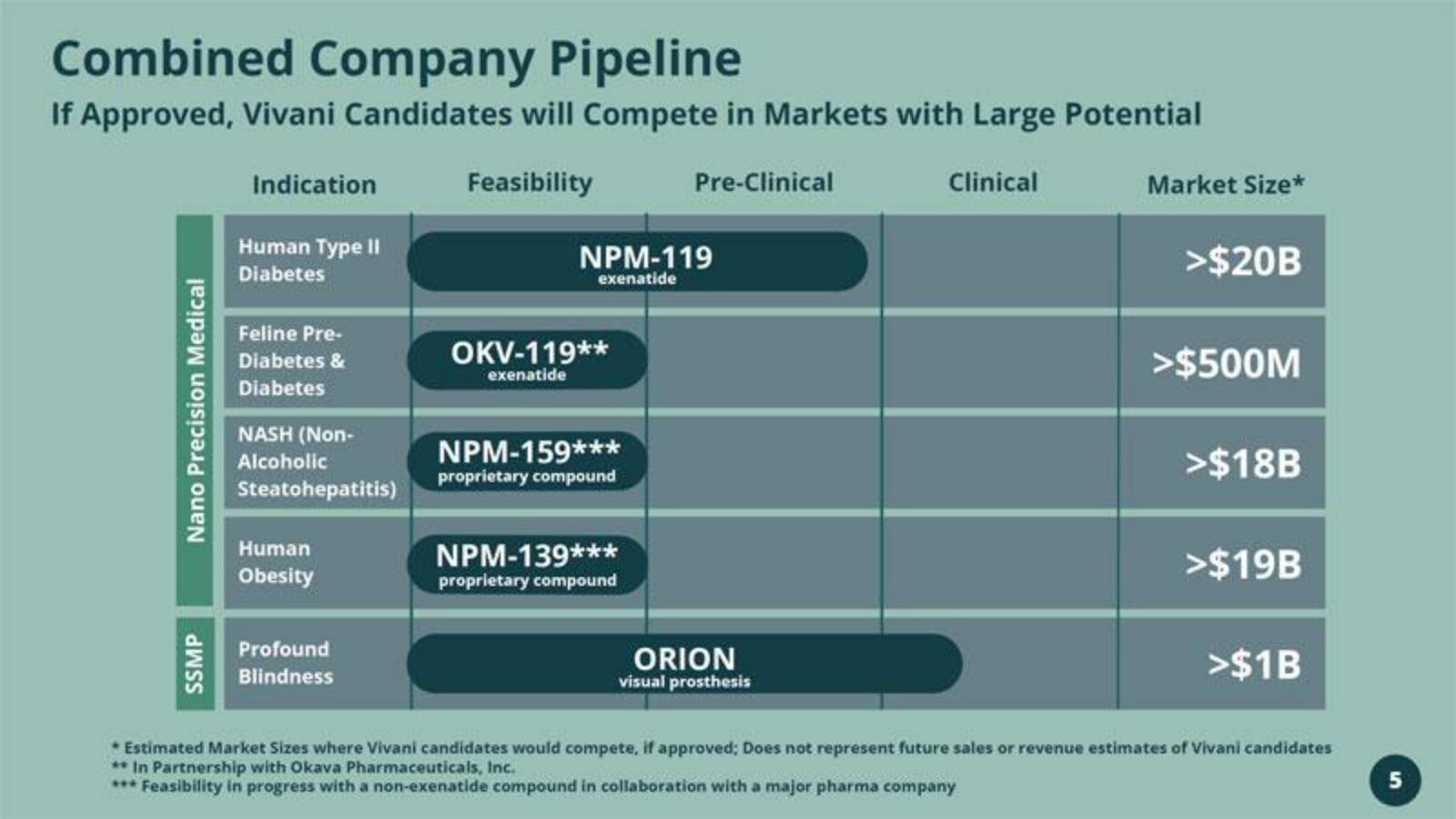

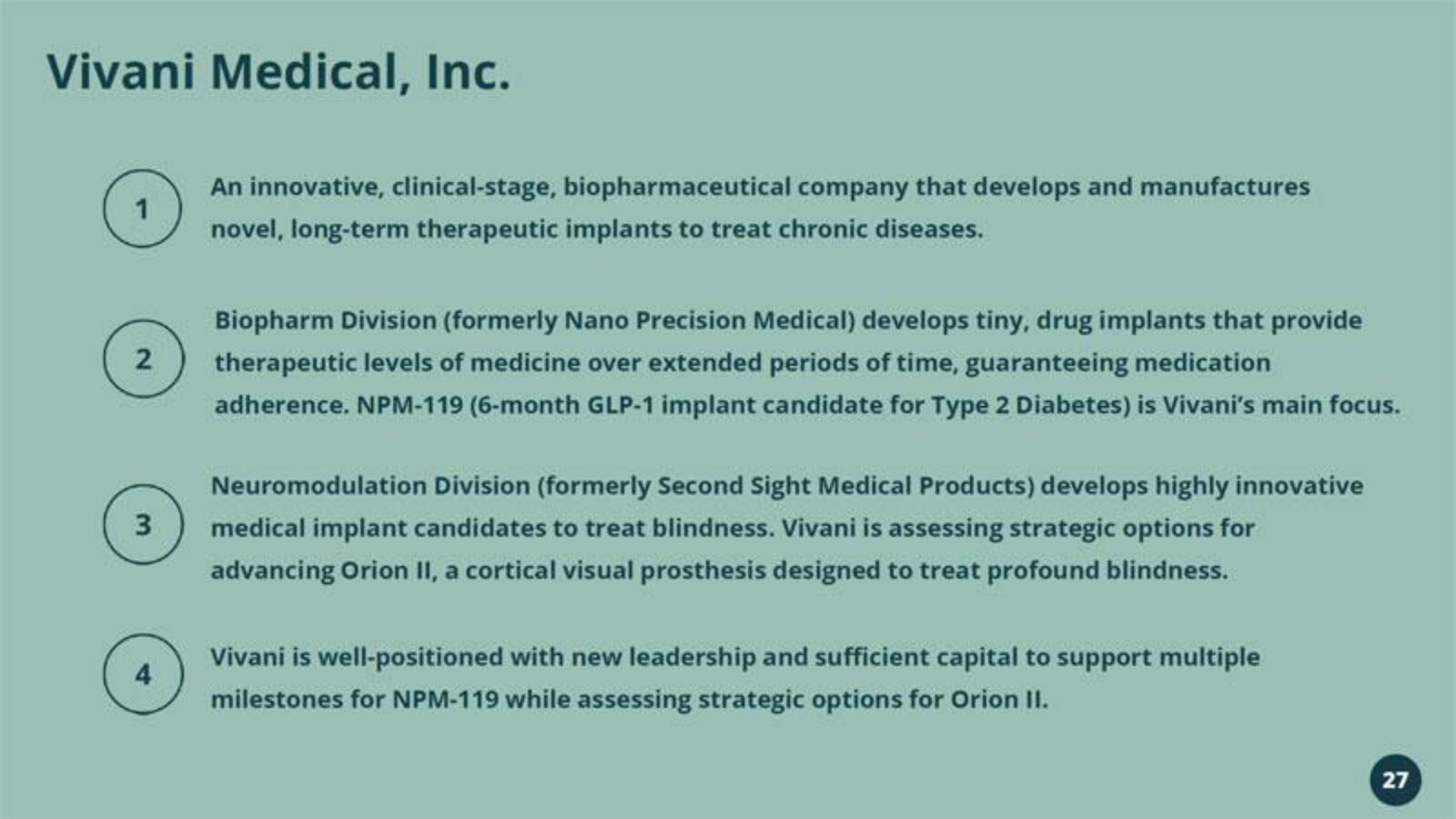

Vivani Medical Mergers and Acquisitions Presentation Deck

Made public by

Vivani Medical

sourced by PitchSend

Creator

vivani-medical

Category

Healthcare

Published

October 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related