KLA Investor Day Presentation Deck

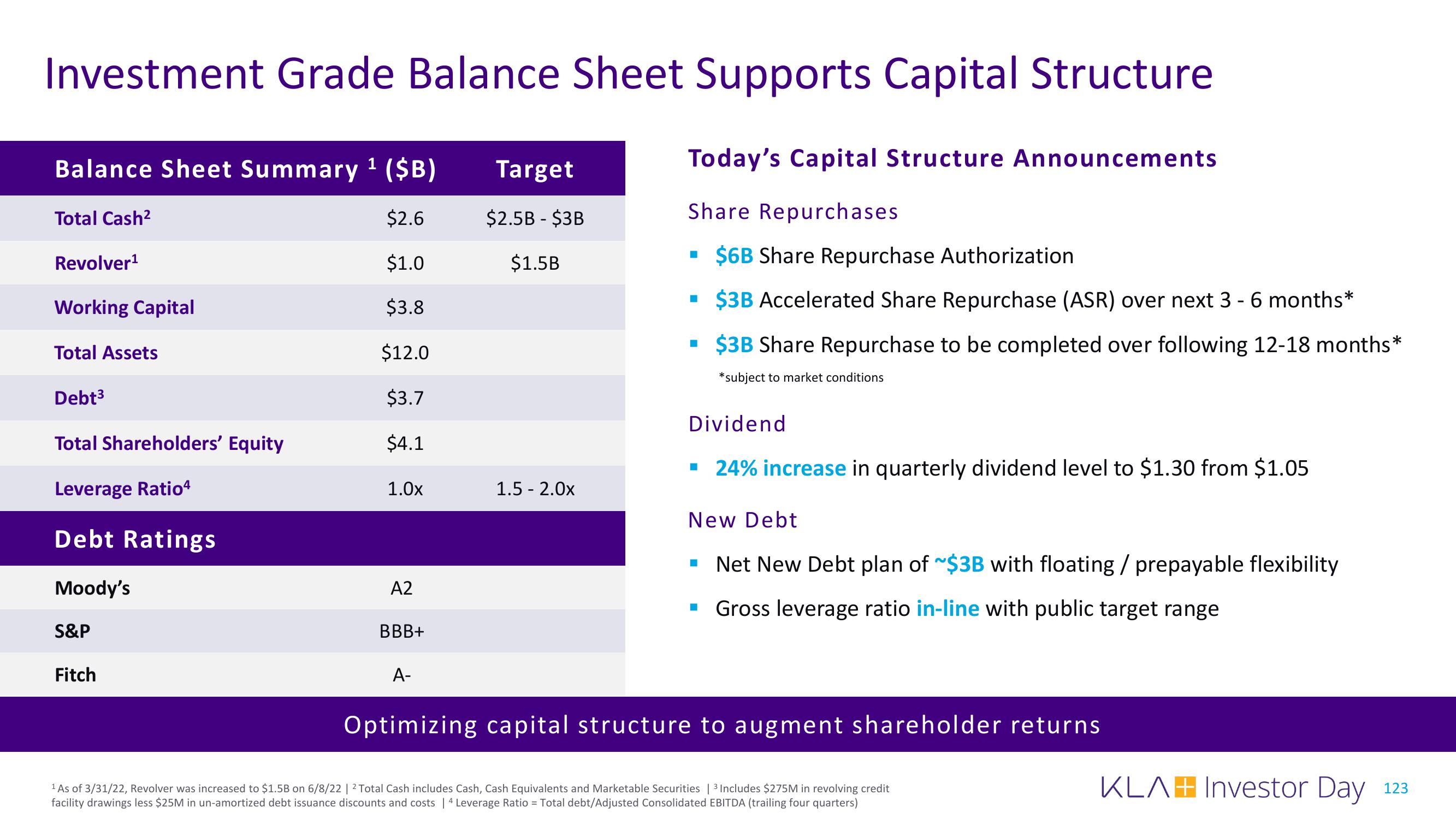

Investment Grade Balance Sheet Supports Capital Structure

Balance Sheet Summary ¹ ($B)

$2.6

$1.0

$3.8

$12.0

$3.7

$4.1

Total Cash²

Revolver¹

Working Capital

Total Assets

Debt³

Total Shareholders' Equity

Leverage Ratio4

Debt Ratings

Moody's

S&P

Fitch

1.0x

A2

BBB+

A-

Target

$2.5B - $3B

$1.5B

1.5 - 2.0x

Today's Capital Structure Announcements

Share Repurchases

▪ $6B Share Repurchase Authorization

$3B Accelerated Share Repurchase (ASR) over next 3 - 6 months*

▪ $3B Share Repurchase to be completed over following 12-18 months*

*subject to market conditions

■

Dividend

▪ 24% increase in quarterly dividend level to $1.30 from $1.05

New Debt

Net New Debt plan of ~$3B with floating / prepayable flexibility

■ Gross leverage ratio in-line with public target range

Optimizing capital structure to augment shareholder returns

1 As of 3/31/22, Revolver was increased to $1.5B on 6/8/22 | 2 Total Cash includes Cash, Cash Equivalents and Marketable Securities | ³ Includes $275M in revolving credit

facility drawings less $25M in un-amortized debt issuance discounts and costs | 4 Leverage Ratio = Total debt/Adjusted Consolidated EBITDA (trailing four quarters)

KLAH Investor Day 123View entire presentation