KLA Investor Day Presentation Deck

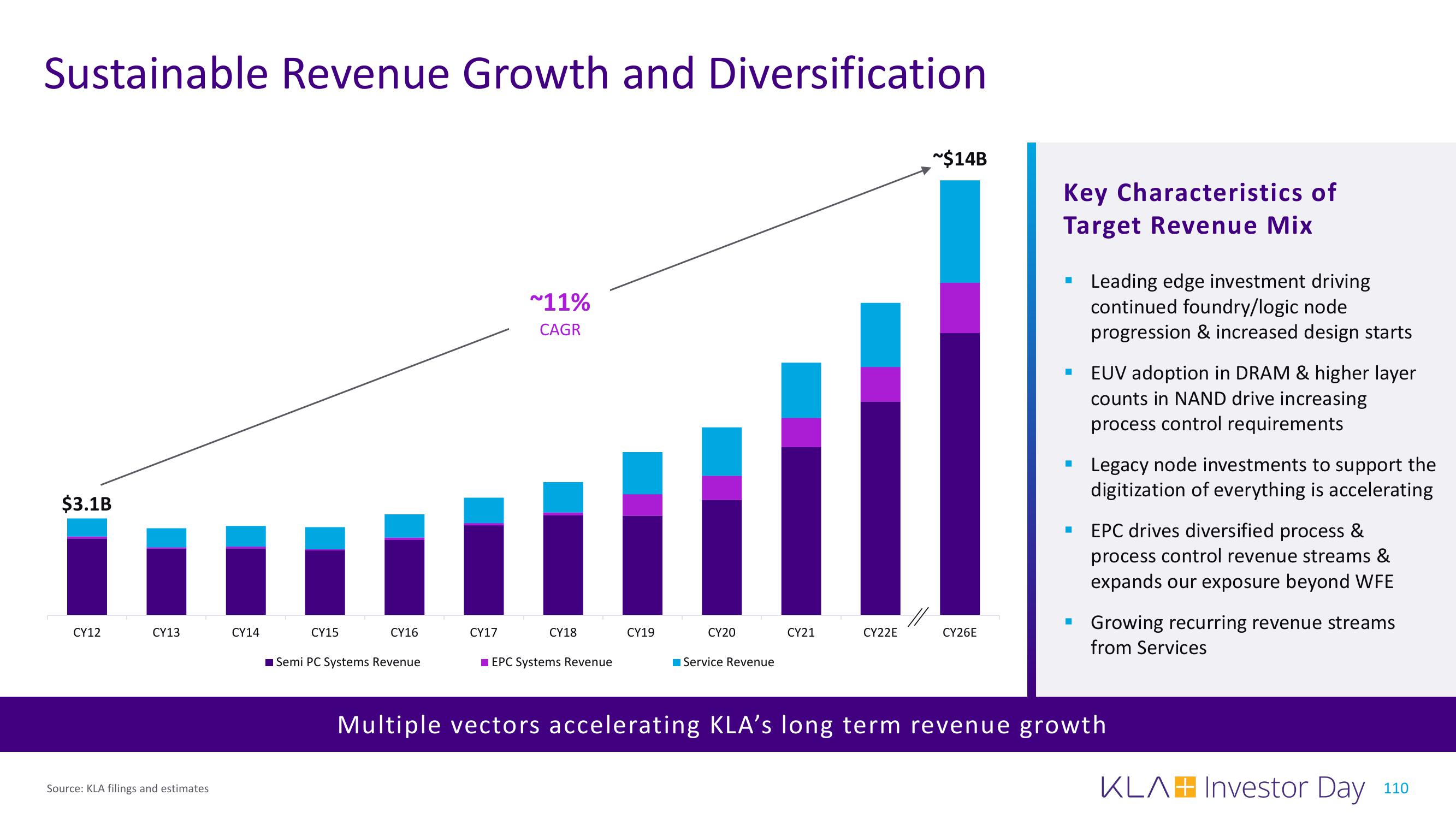

Sustainable Revenue Growth and Diversification

$3.1B

CY12

CY13

Source: KLA filings and estimates

CY14

CY15

CY16

■Semi PC Systems Revenue

CY17

~11%

CAGR

CY18

EPC Systems Revenue

CY19

CY20

Service Revenue

CY21

CY22E

~$14B

CY26E

Key Characteristics of

Target Revenue Mix

■

■

■

■

■

Leading edge investment driving

continued foundry/logic node

progression & increased design starts

EUV adoption in DRAM & higher layer

counts in NAND drive increasing

process control requirements

Legacy node investments to support the

digitization of everything is accelerating

EPC drives diversified process &

process control revenue streams &

expands our exposure beyond WFE

Growing recurring revenue streams

from Services

Multiple vectors accelerating KLA's long term revenue growth

KLAH Investor Day 110View entire presentation