KLA Investor Day Presentation Deck

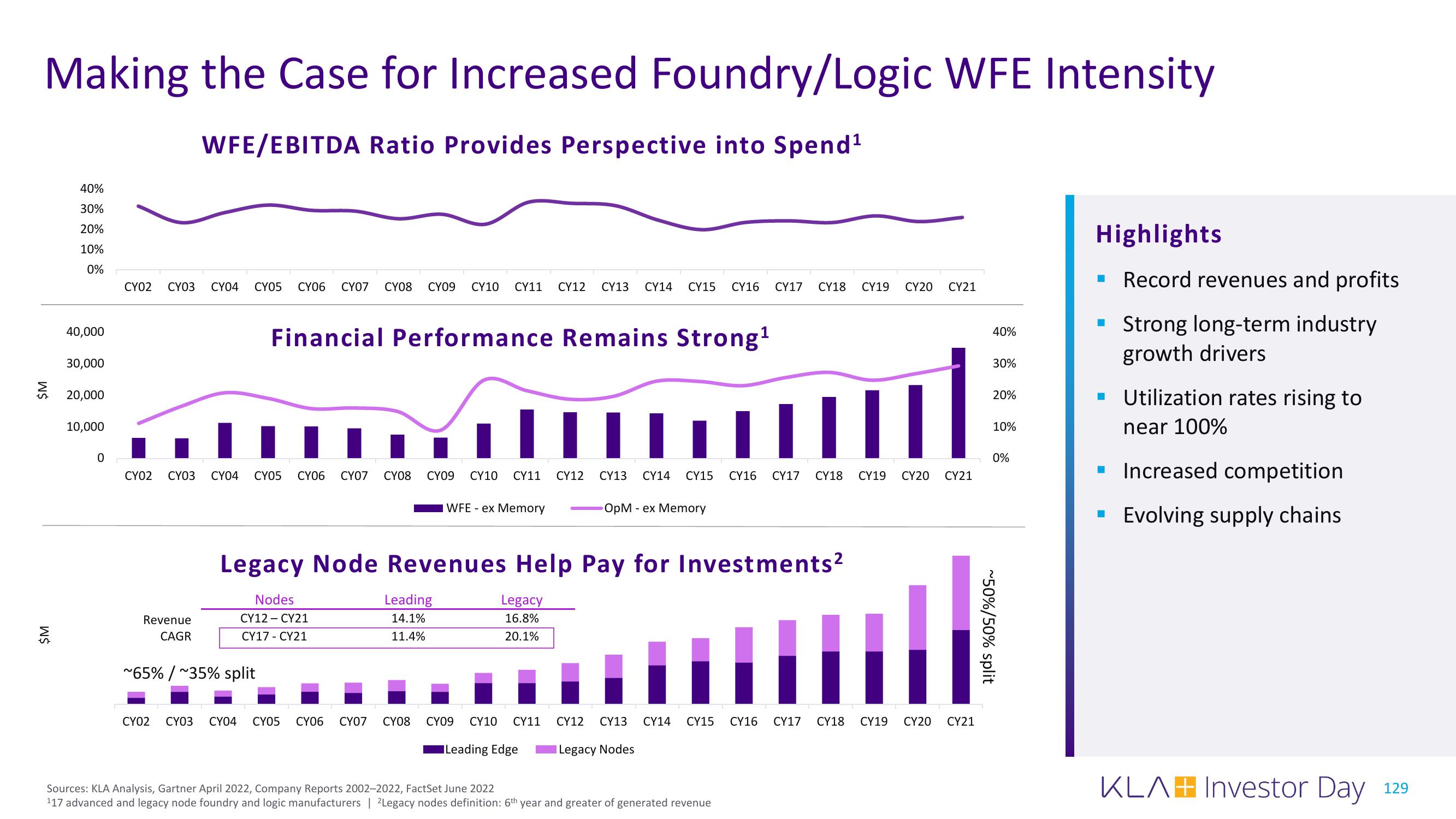

Making the Case for Increased Foundry/Logic WFE Intensity

WFE/EBITDA Ratio Provides Perspective into Spend¹

ŞM

$M

40%

30%

20%

10%

0%

40,000

30,000

20,000

10,000

0

CY02 CY03 CY04 CY05 CY06 CY07 CY08 CY09 CY10 CY11 CY12 CY13 CY14 CY15 CY16 CY17 CY18 CY19 CY20 CY21

Financial Performance Remains Strong¹

..…………….…………….……………

CY02 CY03 CY04 CY05

Revenue

CAGR

||||

CY06 CY07 CY08 CY09 CY10 CY11 CY12 CY13 CY14 CY15 CY16 CY17 CY18 CY19 CY20 CY21

~65% /~35% split

Nodes

CY12 - CY21

CY17- CY21

Legacy Node Revenues Help Pay for Investments²

Leading

14.1%

11.4%

WFE - ex Memory

CY02 CY03 CY04 CY05 CY06 CY07 CY08

Legacy

16.8%

20.1%

CY09 CY10 CY11

OpM - ex Memory

Leading Edge

CY12 CY13 CY14 CY15

Legacy Nodes

Sources: KLA Analysis, Gartner April 2022, Company Reports 2002-2022, FactSet June 2022

117 advanced and legacy node foundry and logic manufacturers | 2Legacy nodes definition: 6th year and greater of generated revenue

CY16 CY17 CY18 CY19 CY20 CY21

40%

30%

20%

10%

0%

~50%/50% split

Highlights

Record revenues and profits

Strong long-term industry

growth drivers

■

Utilization rates rising to

near 100%

▪ Increased competition

▪ Evolving supply chains

KLAH Investor Day

129View entire presentation