Broadridge Financial Solutions Results Presentation Deck

0.

C

00.00

DO

D

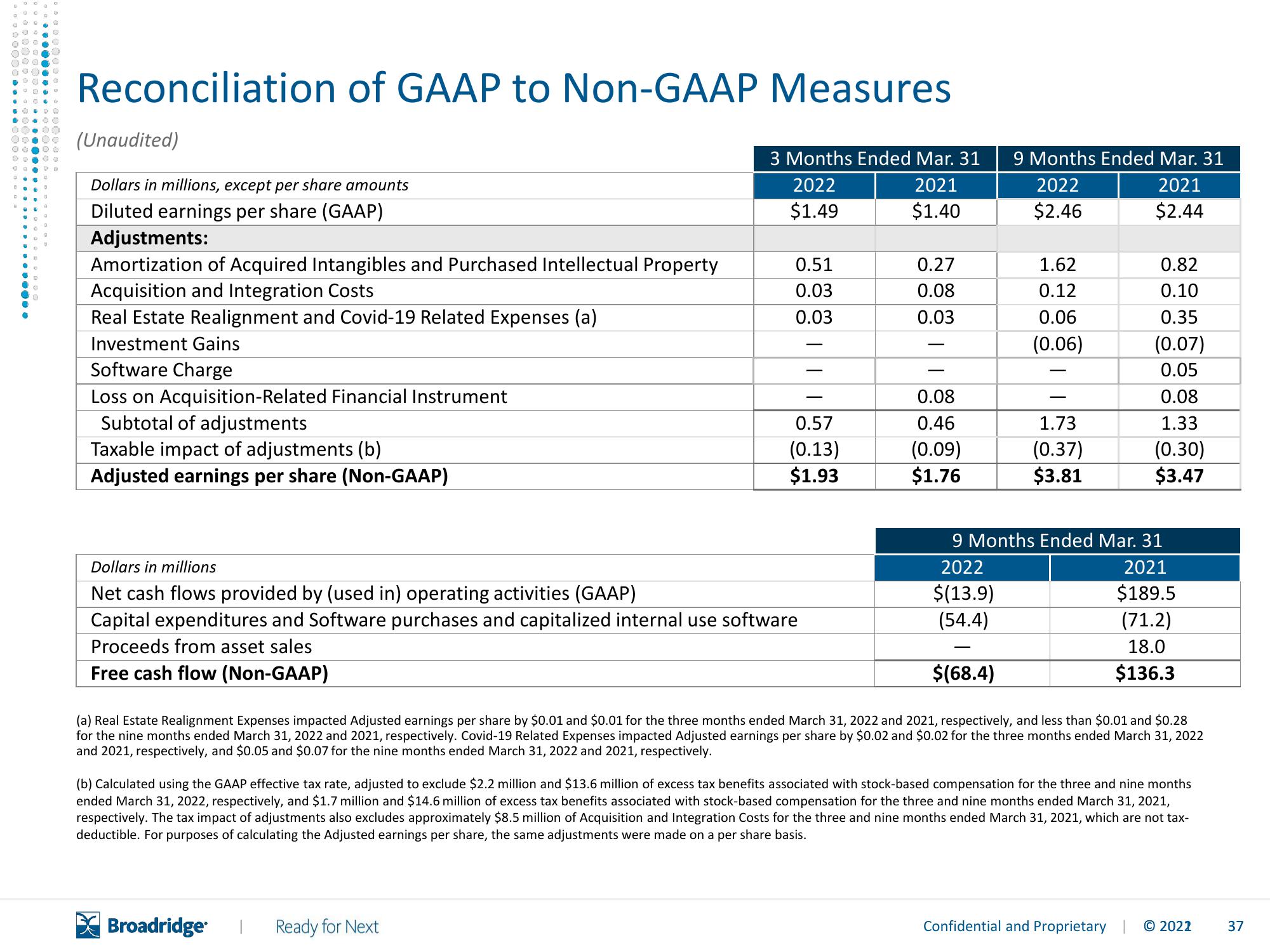

Reconciliation of GAAP to Non-GAAP Measures

3 Months Ended Mar. 31

2022

2021

$1.49

$1.40

(Unaudited)

Dollars in millions, except per share amounts

Diluted earnings per share (GAAP)

Adjustments:

Amortization of Acquired Intangibles and Purchased Intellectual Property

Acquisition and Integration Costs

Real Estate Realignment and Covid-19 Related Expenses (a)

Investment Gains

Software Charge

Loss on Acquisition-Related Financial Instrument

Subtotal of adjustments

Taxable impact of adjustments (b)

Adjusted earnings per share (Non-GAAP)

0.51

0.03

0.03

Dollars in millions

Net cash flows provided by (used in) operating activities (GAAP)

Capital expenditures and Software purchases and capitalized internal use software

Proceeds from asset sales

Free cash flow (Non-GAAP)

Broadridge

-

0.57

(0.13)

$1.93

Ready for Next

0.27

0.08

0.03

-

0.08

0.46

(0.09)

$1.76

9 Months Ended Mar. 31

2022

2021

$2.46

$2.44

1.62

0.12

0.06

(0.06)

-

9 Months Ended Mar. 31

2022

2021

$(13.9)

$189.5

(54.4)

(71.2)

18.0

$(68.4)

$136.3

(a) Real Estate Realignment Expenses impacted Adjusted earnings per share by $0.01 and $0.01 for the three months ended March 31, 2022 and 2021, respectively, and less than $0.01 and $0.28

for the nine months ended March 31, 2022 and 2021, respectively. Covid-19 Related Expenses impacted Adjusted earnings per share by $0.02 and $0.02 for the three months ended March 31, 2022

and 2021, respectively, and $0.05 and $0.07 for the nine months ended March 31, 2022 and 2021, respectively.

1.73

(0.37)

$3.81

(b) Calculated using the GAAP effective tax rate, adjusted to exclude $2.2 million and $13.6 million of excess tax benefits associated with stock-based compensation for the three and nine months

ended March 31, 2022, respectively, and $1.7 million and $14.6 million of excess tax benefits associated with stock-based compensation for the three and nine months ended March 31, 2021,

respectively. The tax impact of adjustments also excludes approximately $8.5 million of Acquisition and Integration Costs for the three and nine months ended March 31, 2021, which are not tax-

deductible. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis.

0.82

0.10

0.35

(0.07)

0.05

0.08

1.33

(0.30)

$3.47

Confidential and Proprietary

© 2022

37View entire presentation