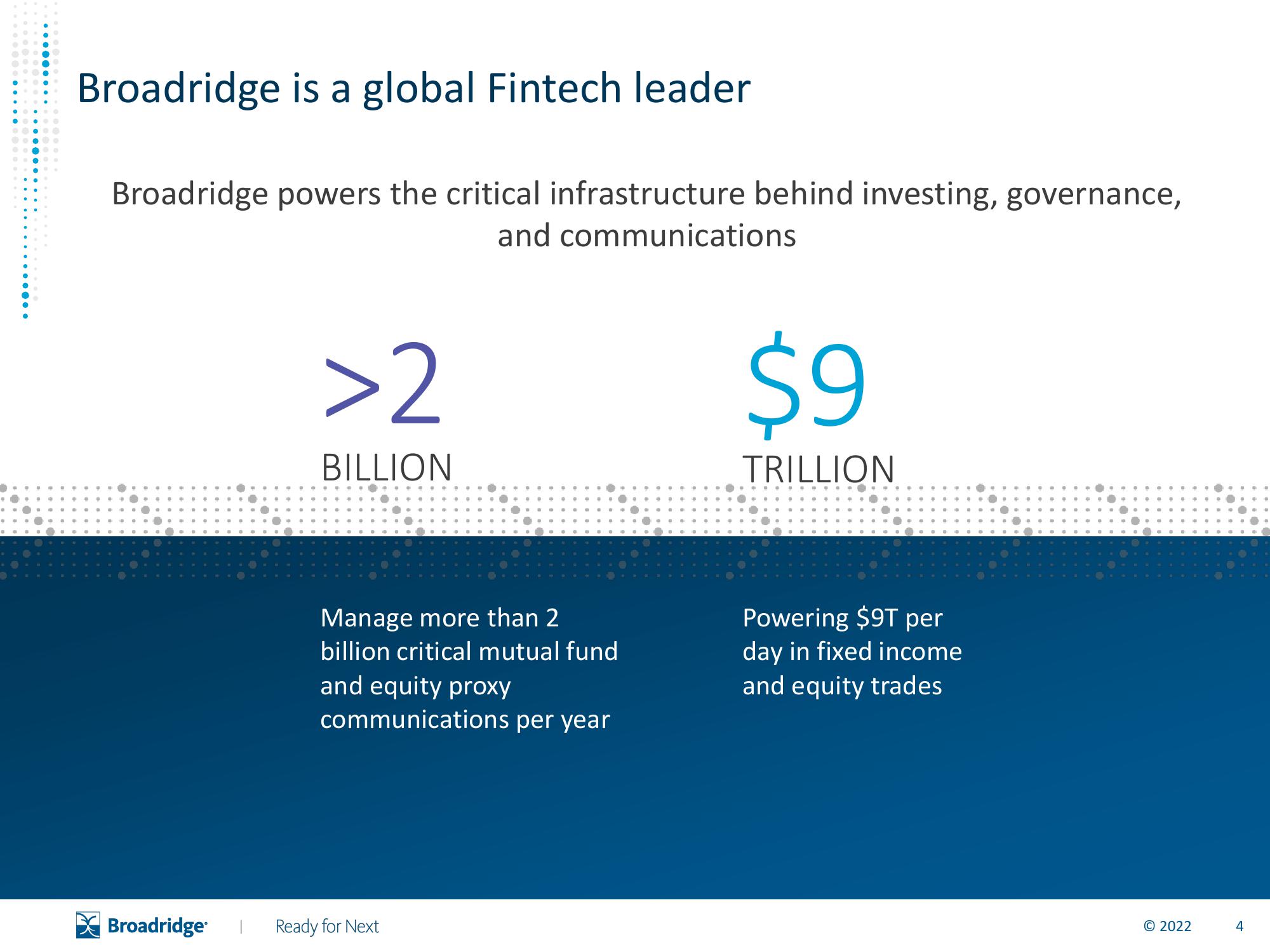

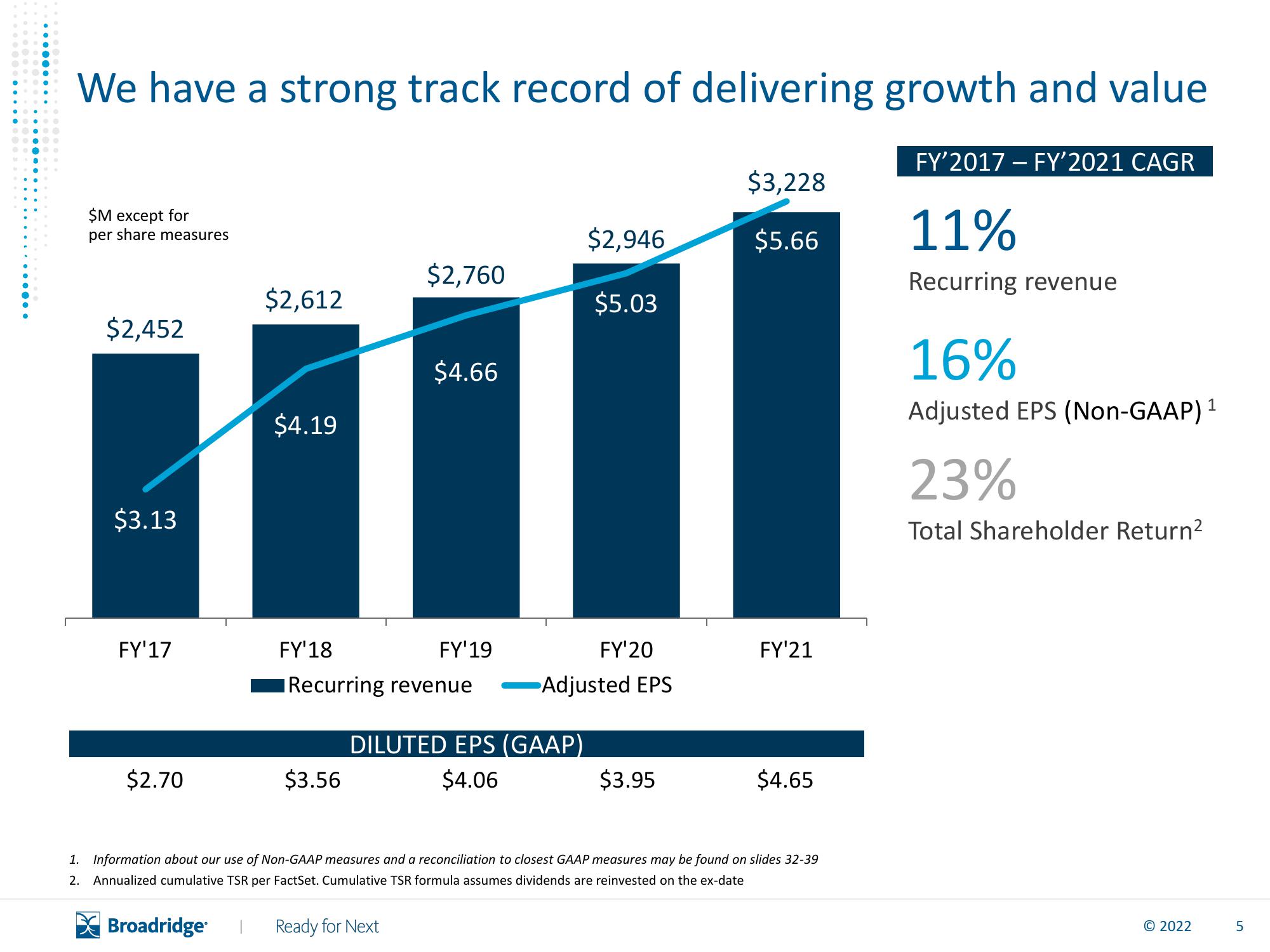

Broadridge Financial Solutions Results Presentation Deck

Made public by

Broadridge Financial Solutions

sourced by PitchSend

Creator

broadridge-financial-solutions

Category

Technology

Published

May 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related