Apollo Global Management Investor Day Presentation Deck

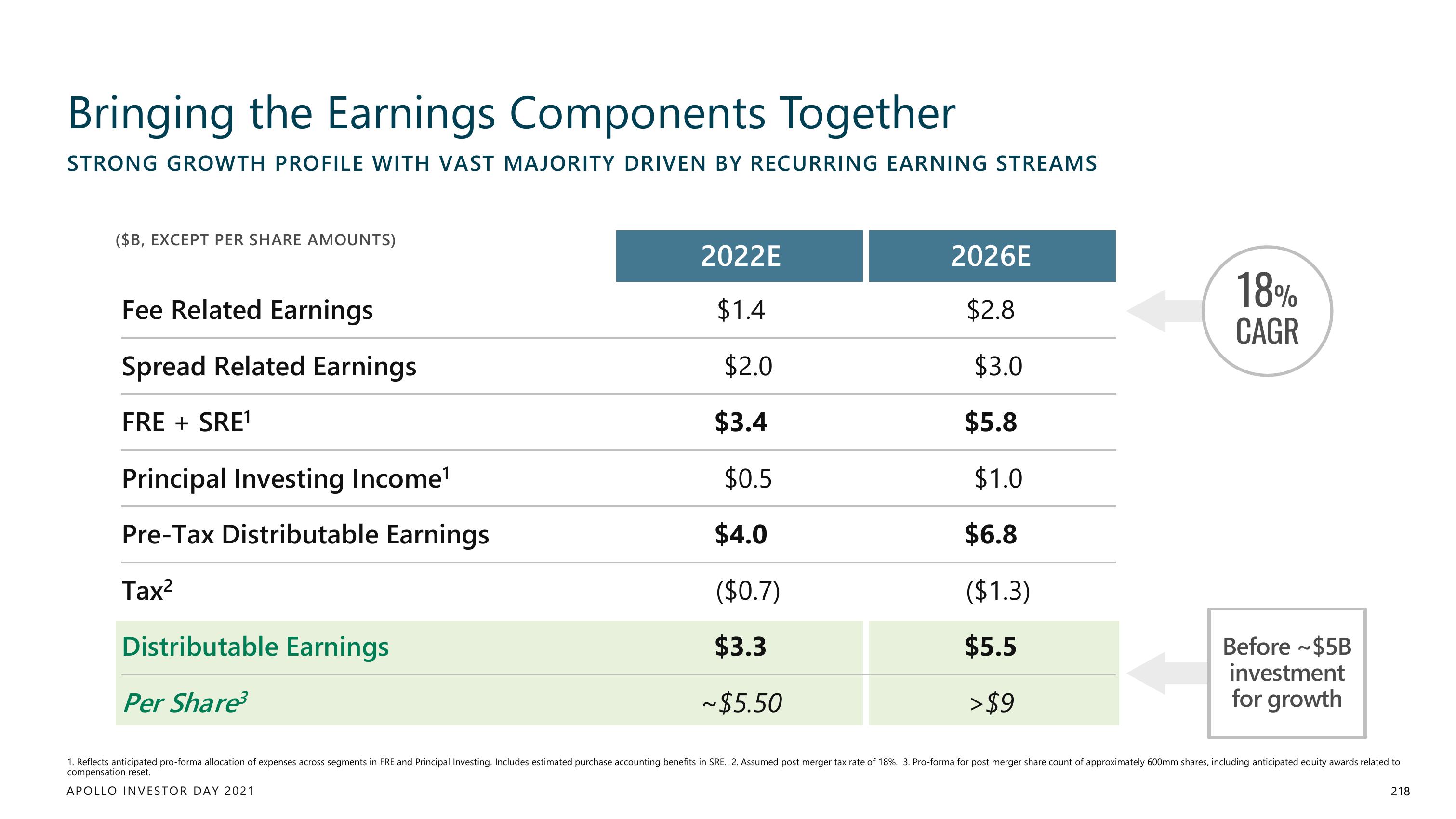

Bringing the Earnings Components Together

STRONG GROWTH PROFILE WITH VAST MAJORITY DRIVEN BY RECURRING EARNING STREAMS

($B, EXCEPT PER SHARE AMOUNTS)

Fee Related Earnings

Spread Related Earnings

FRE + SRE¹

Principal Investing Income¹

Pre-Tax Distributable Earnings

Tax²

Distributable Earnings

Per Share³

2022E

$1.4

$2.0

$3.4

$0.5

$4.0

($0.7)

$3.3

~$5.50

2026E

$2.8

$3.0

$5.8

$1.0

$6.8

($1.3)

$5.5

> $9

18%

CAGR

Before ~$5B

investment

for growth

1. Reflects anticipated pro-forma allocation of expenses across segments in FRE and Principal Investing. Includes estimated purchase accounting benefits in SRE. 2. Assumed post merger tax rate of 18%. 3. Pro-forma for post merger share count of approximately 600mm shares, including anticipated equity awards related to

compensation reset.

APOLLO INVESTOR DAY 2021

218View entire presentation