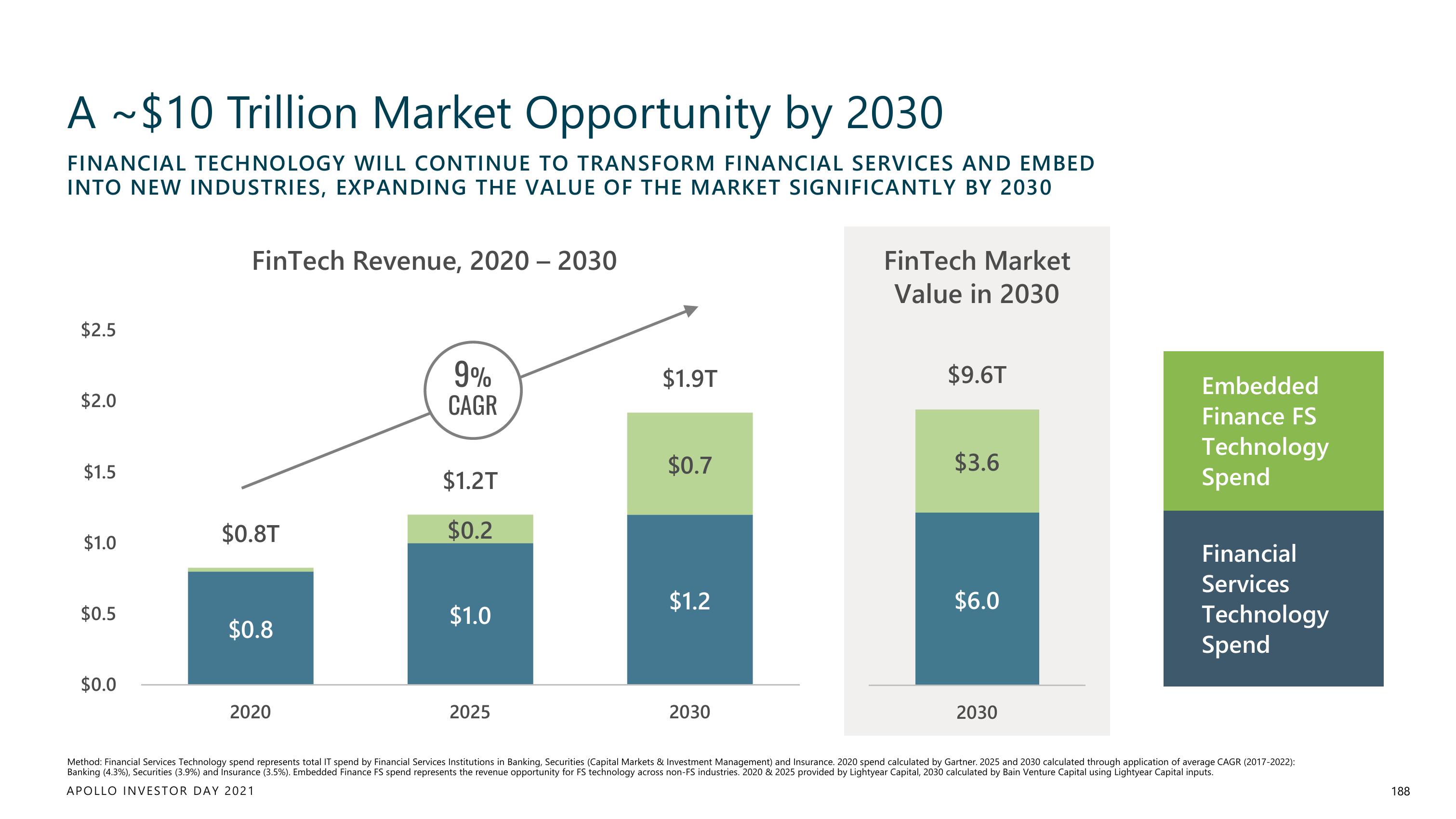

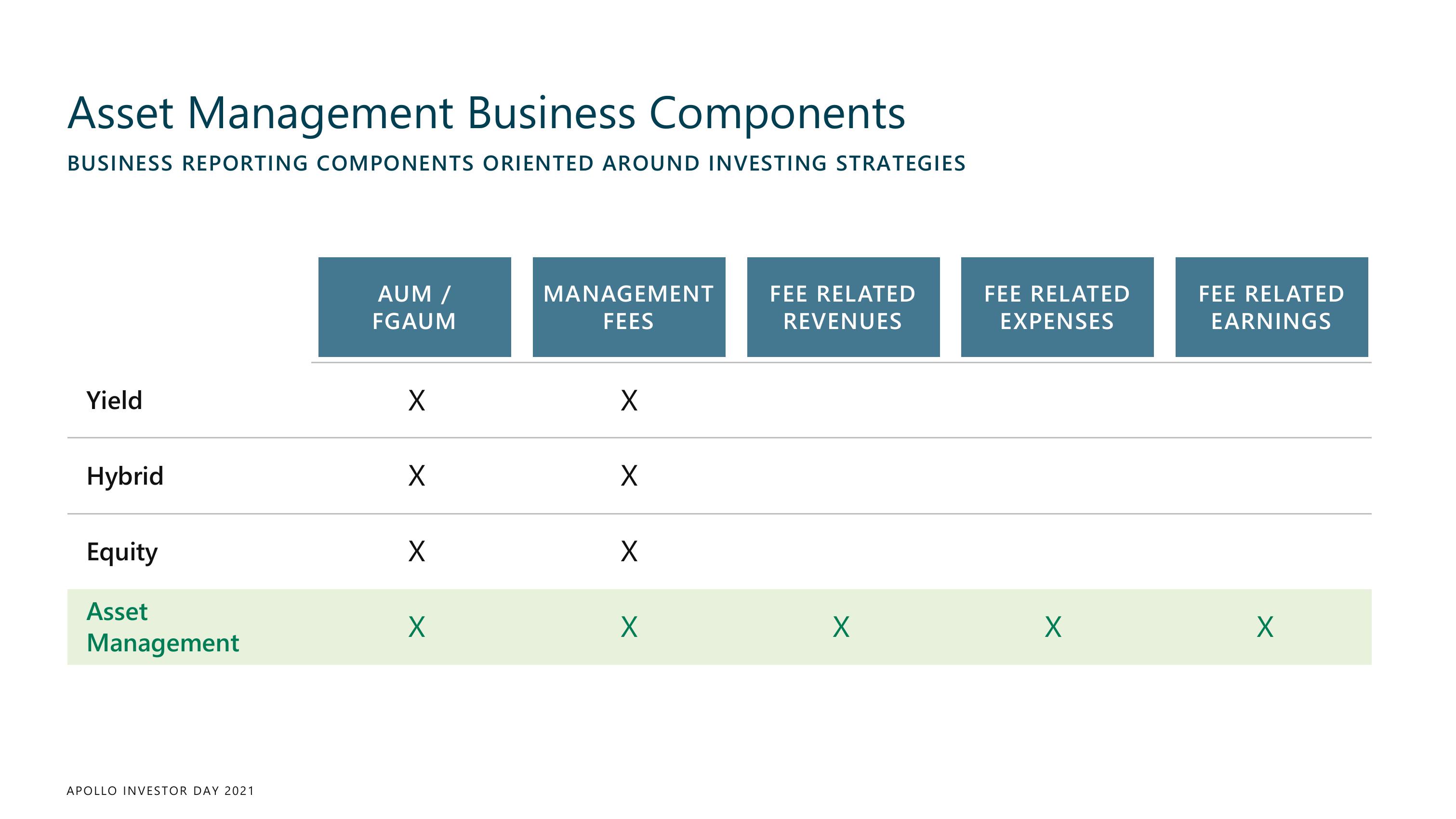

Apollo Global Management Investor Day Presentation Deck

Released by

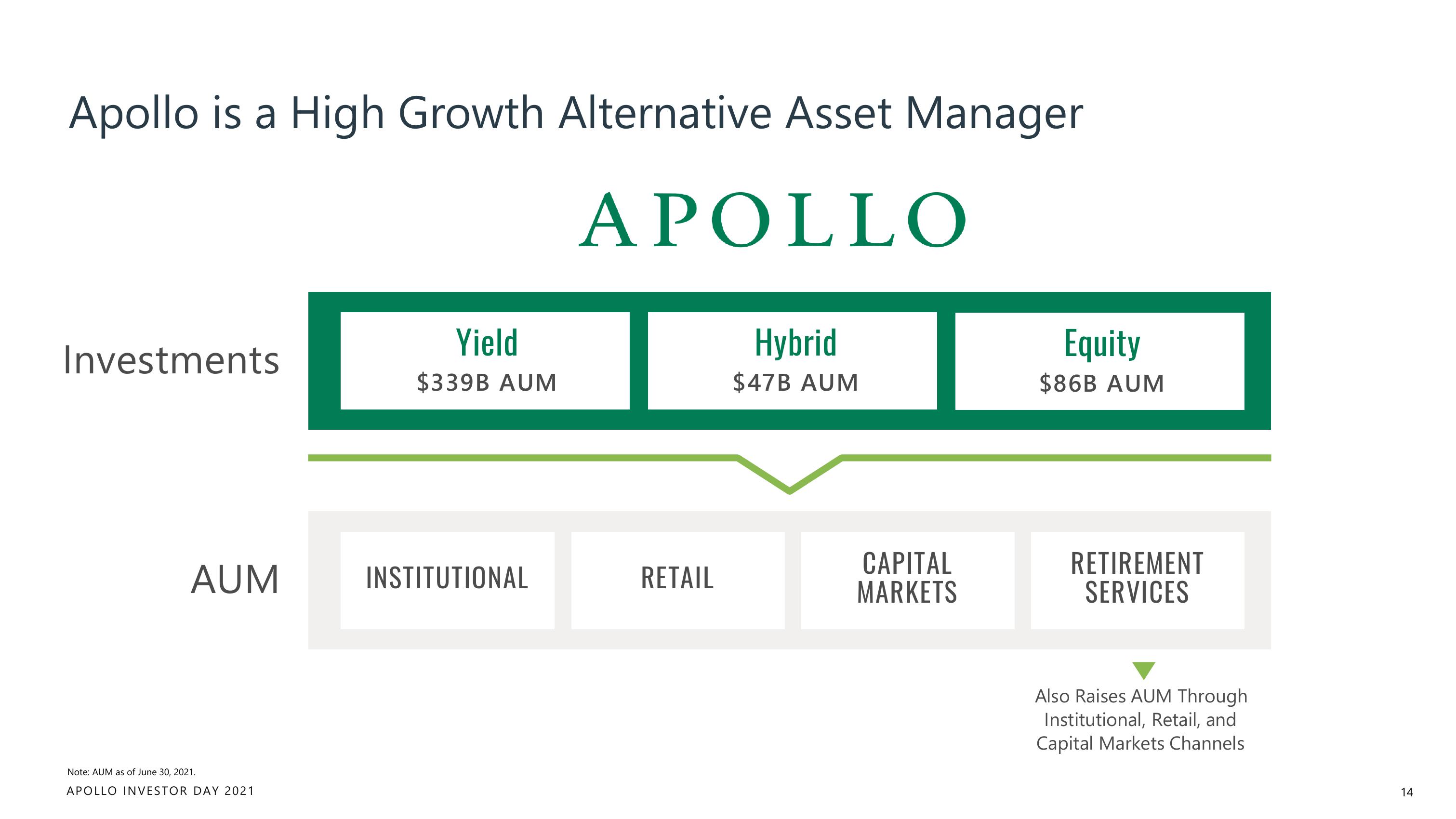

Apollo Global Management

Creator

apollo-global-management

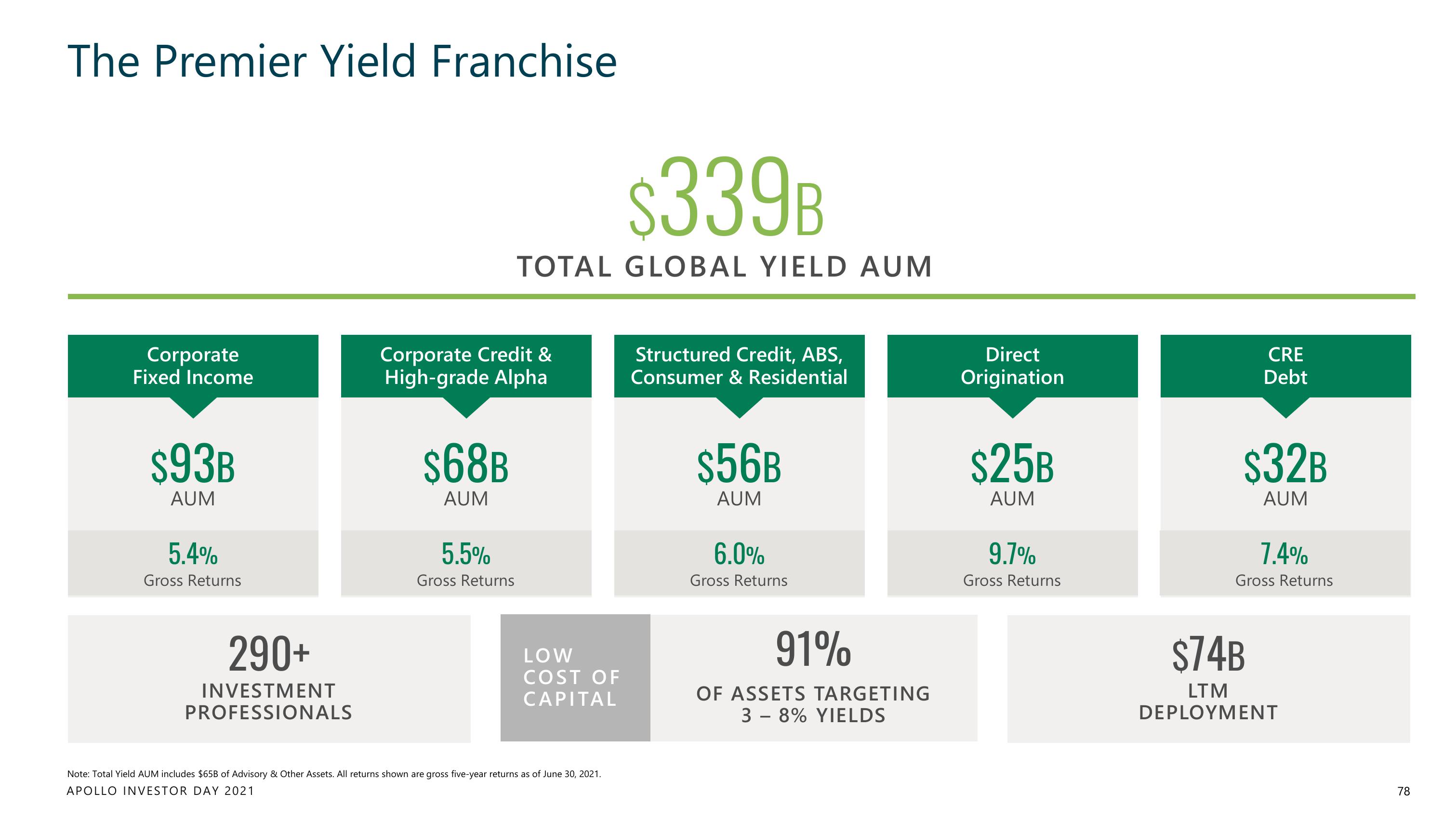

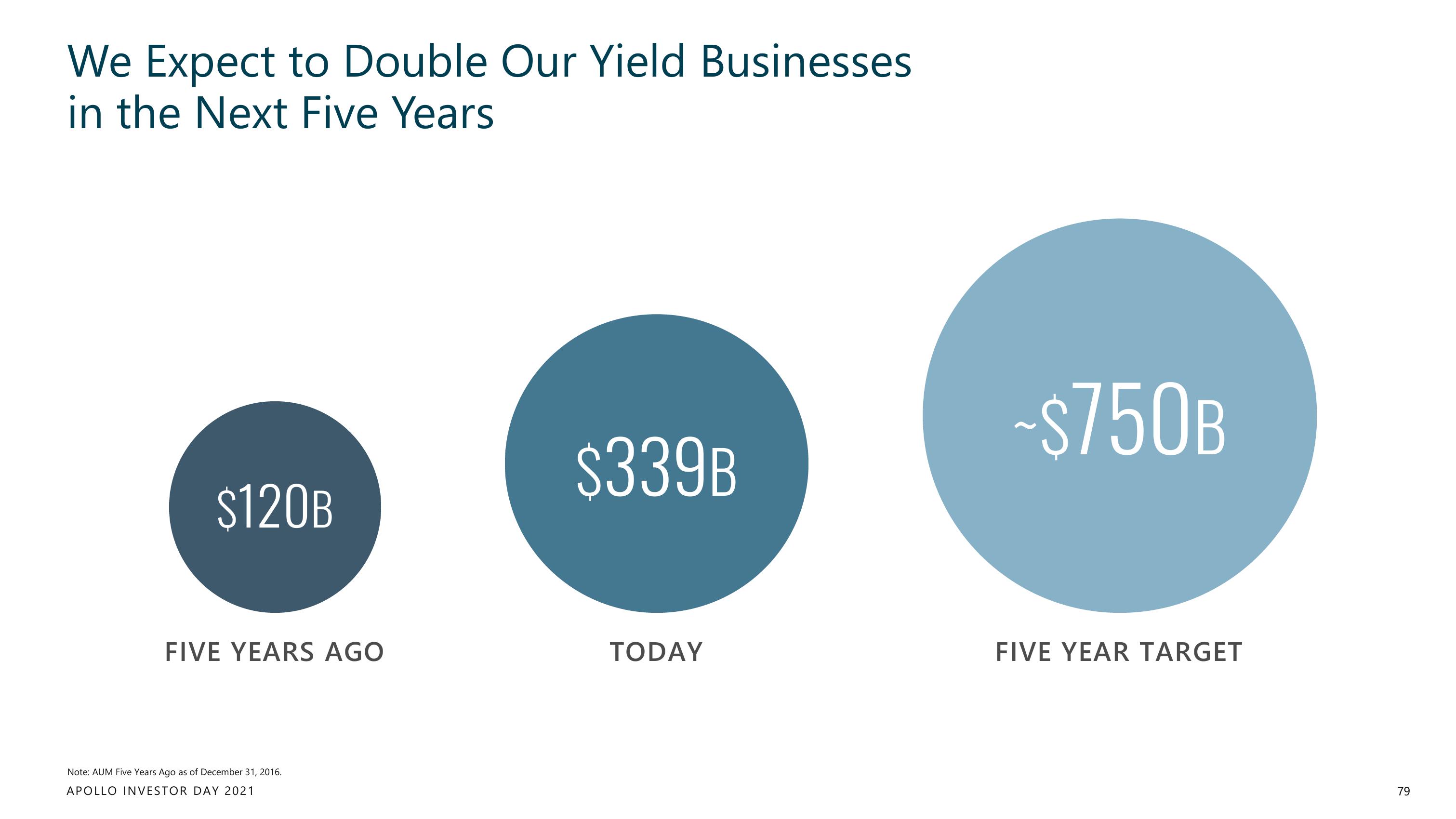

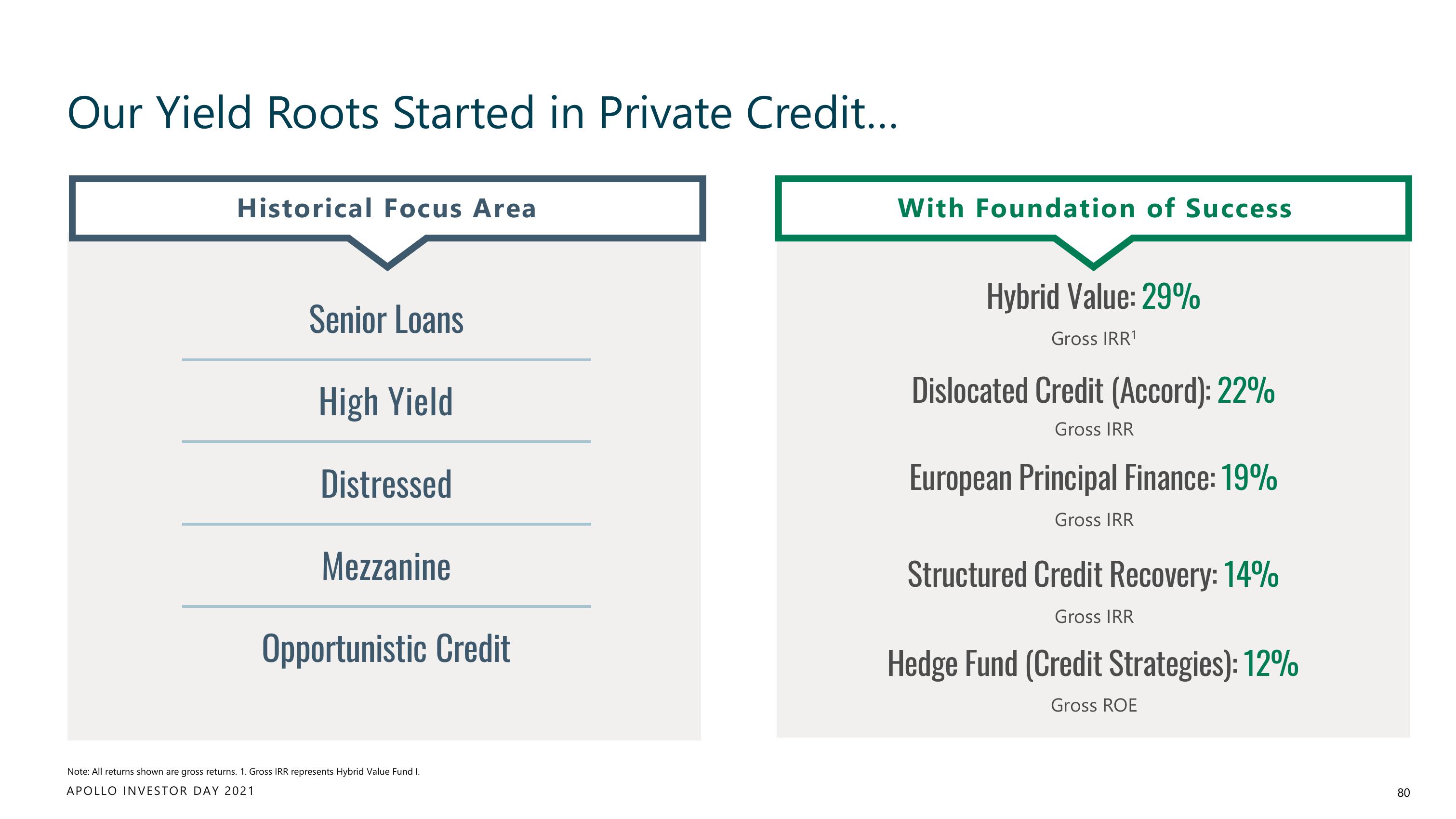

Category

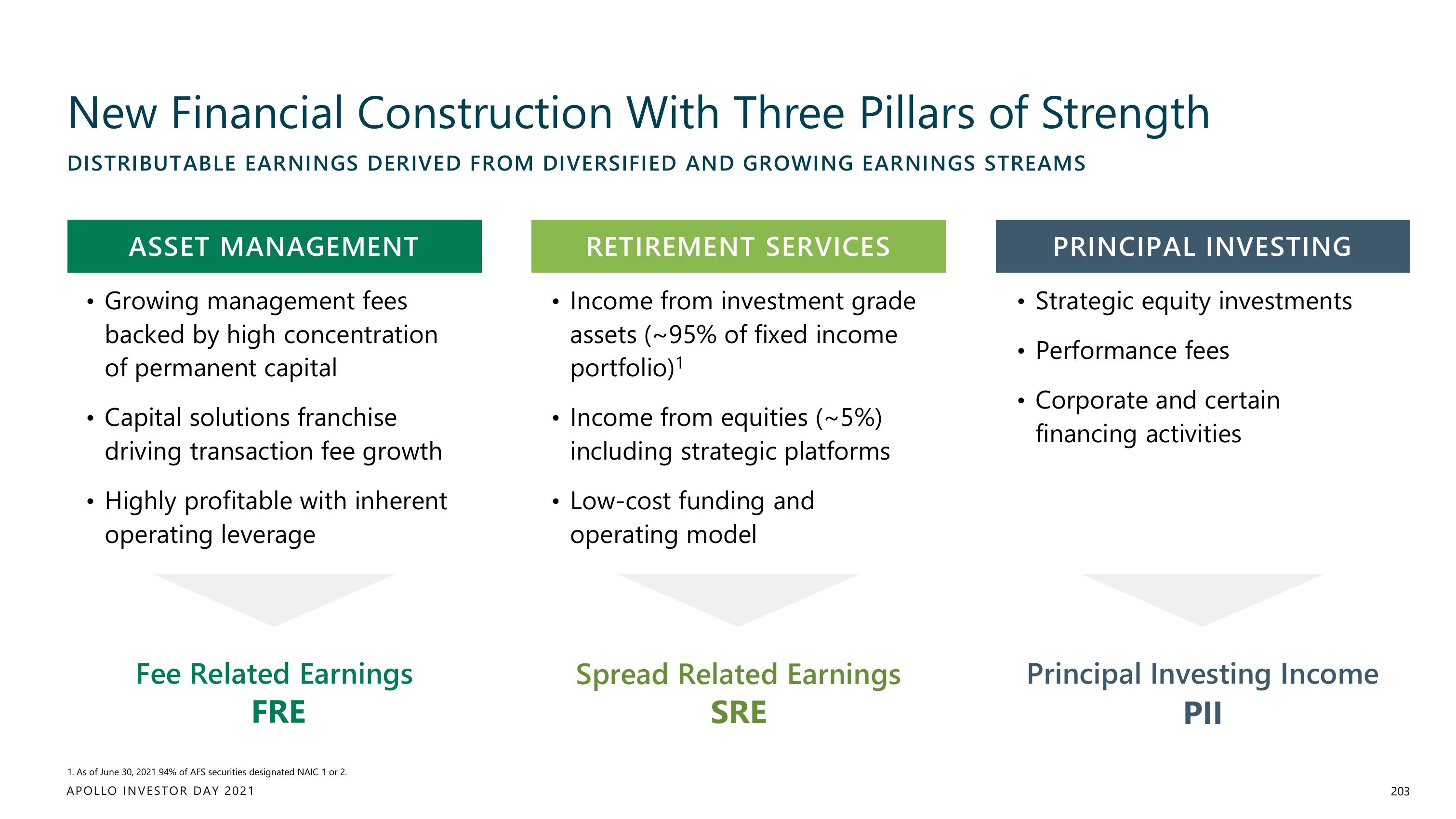

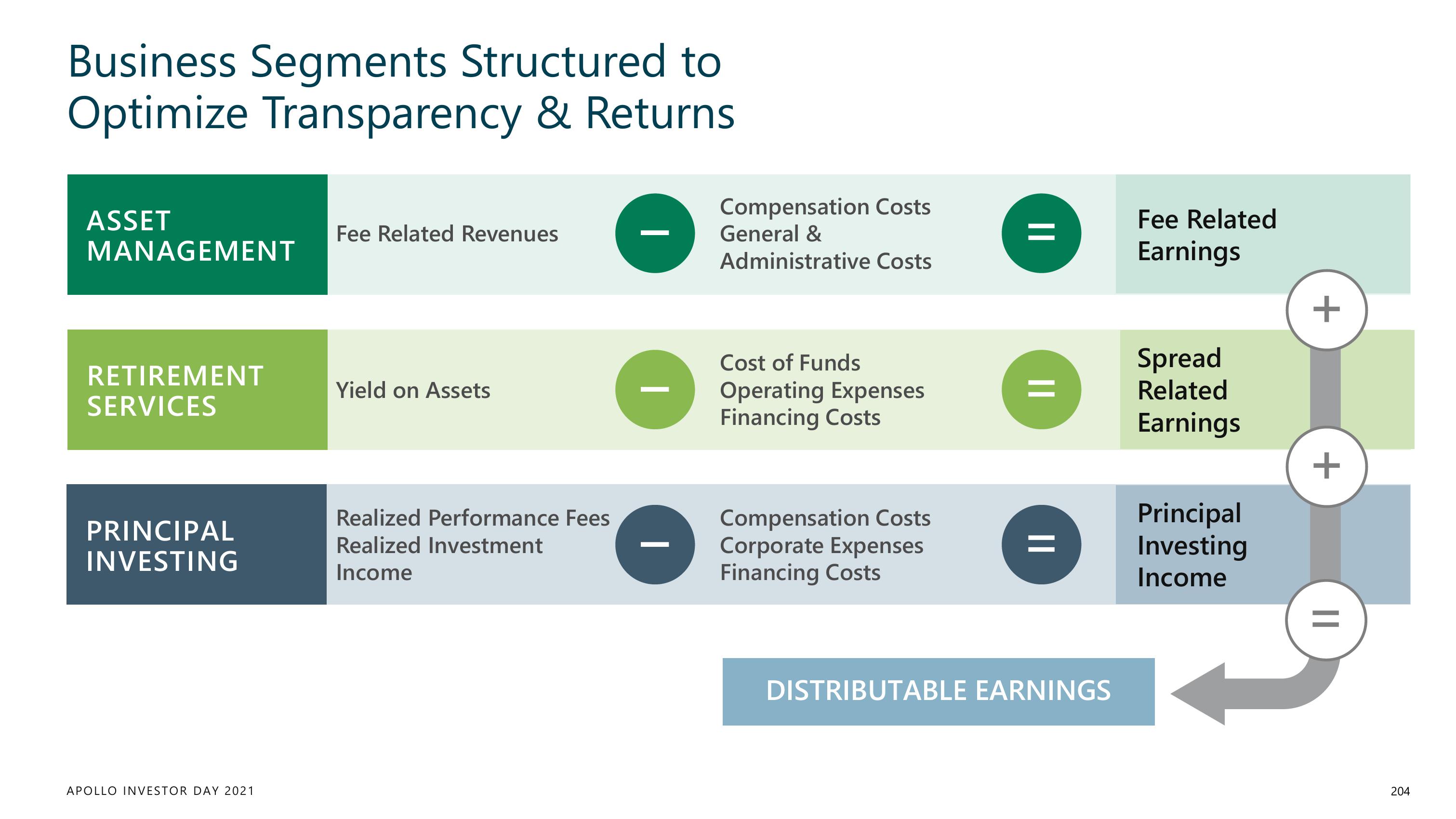

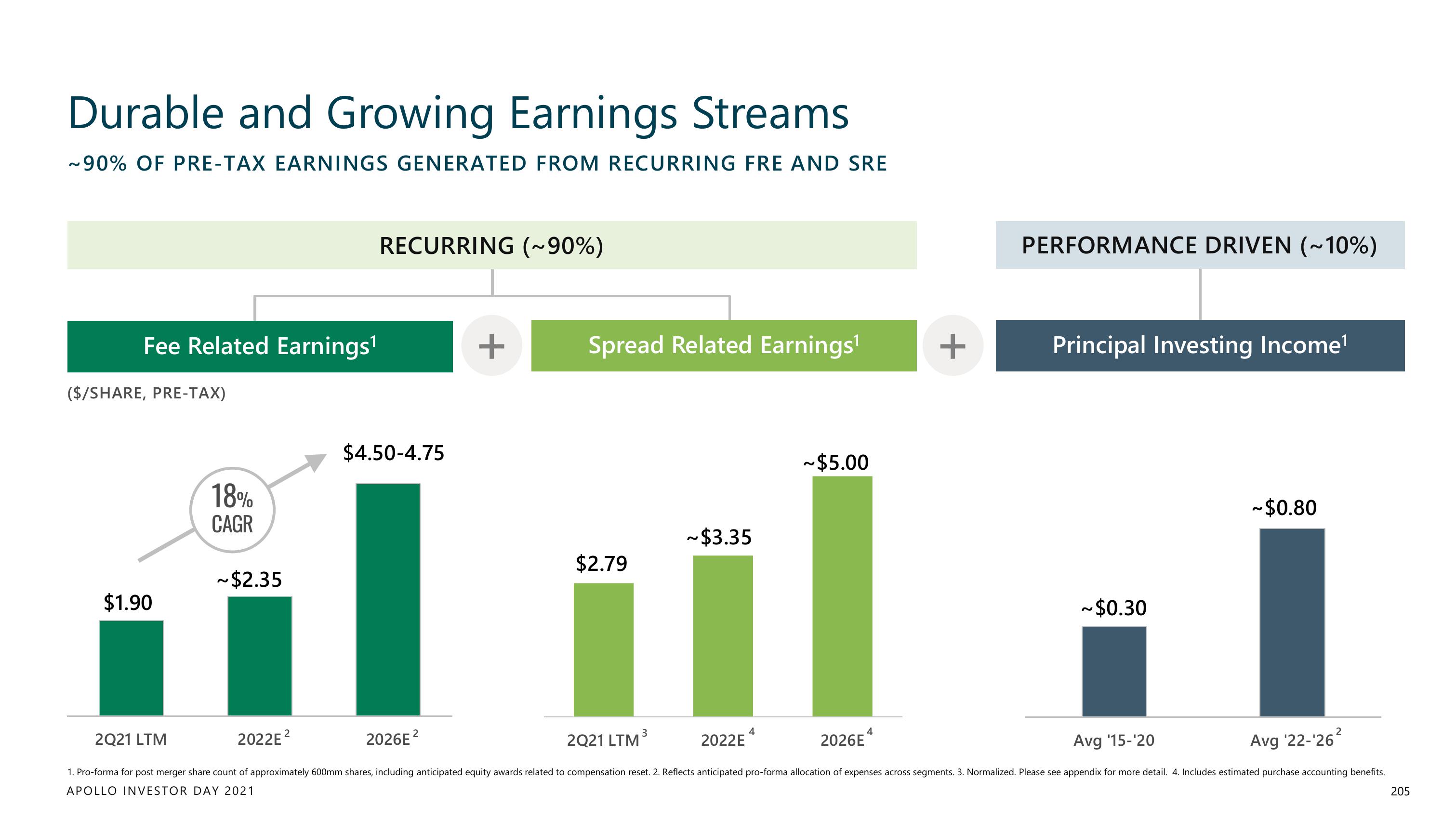

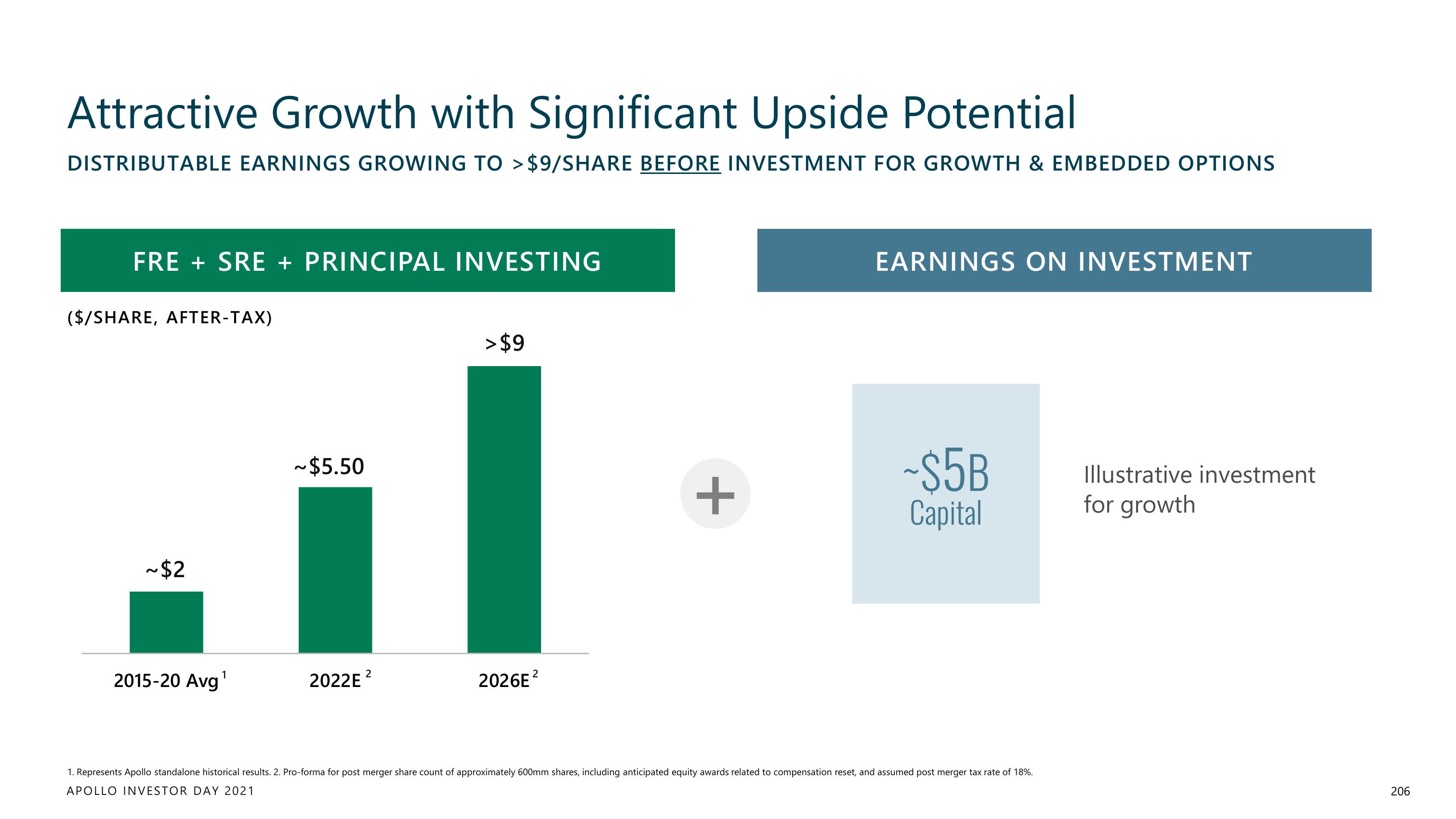

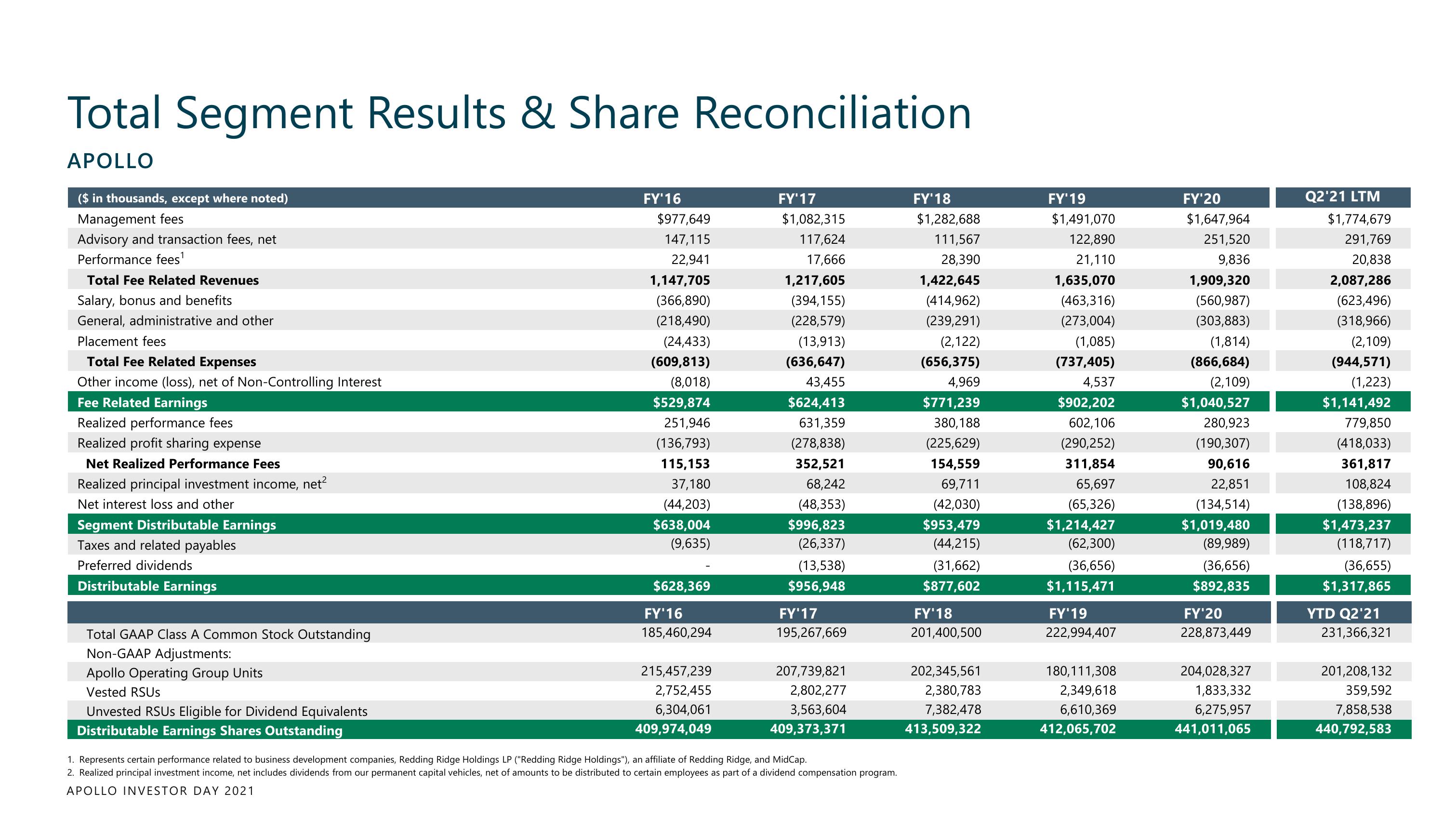

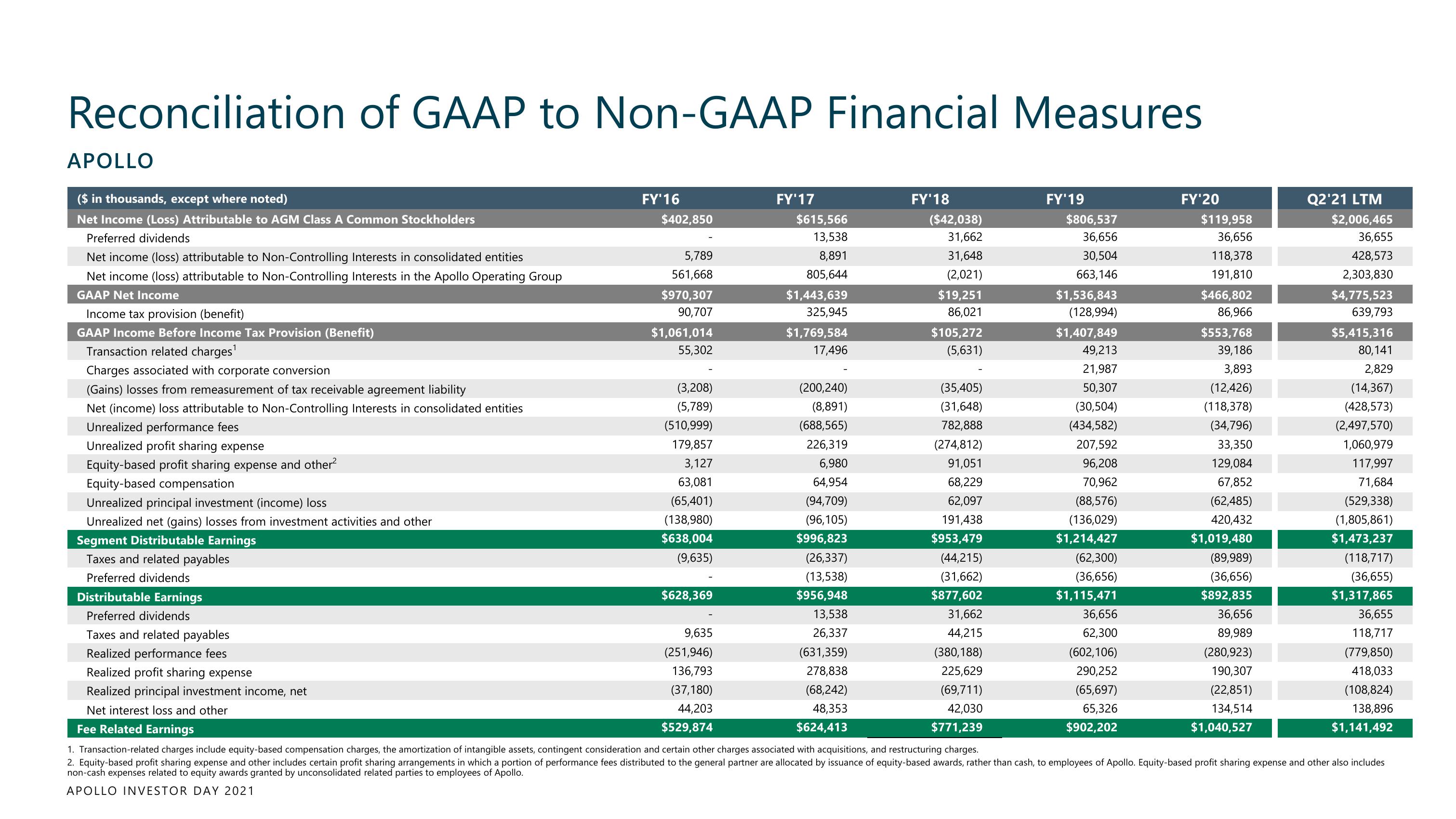

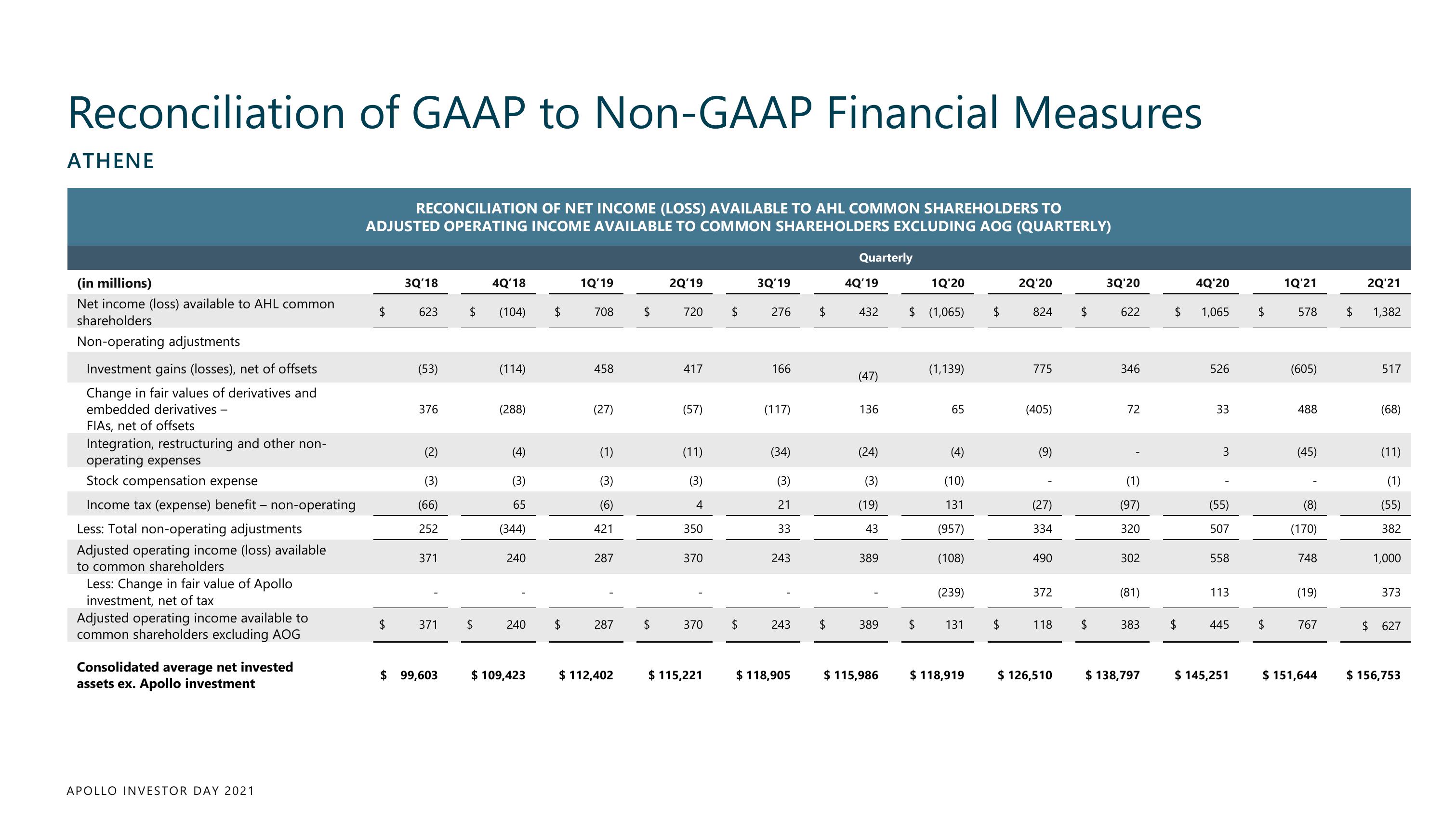

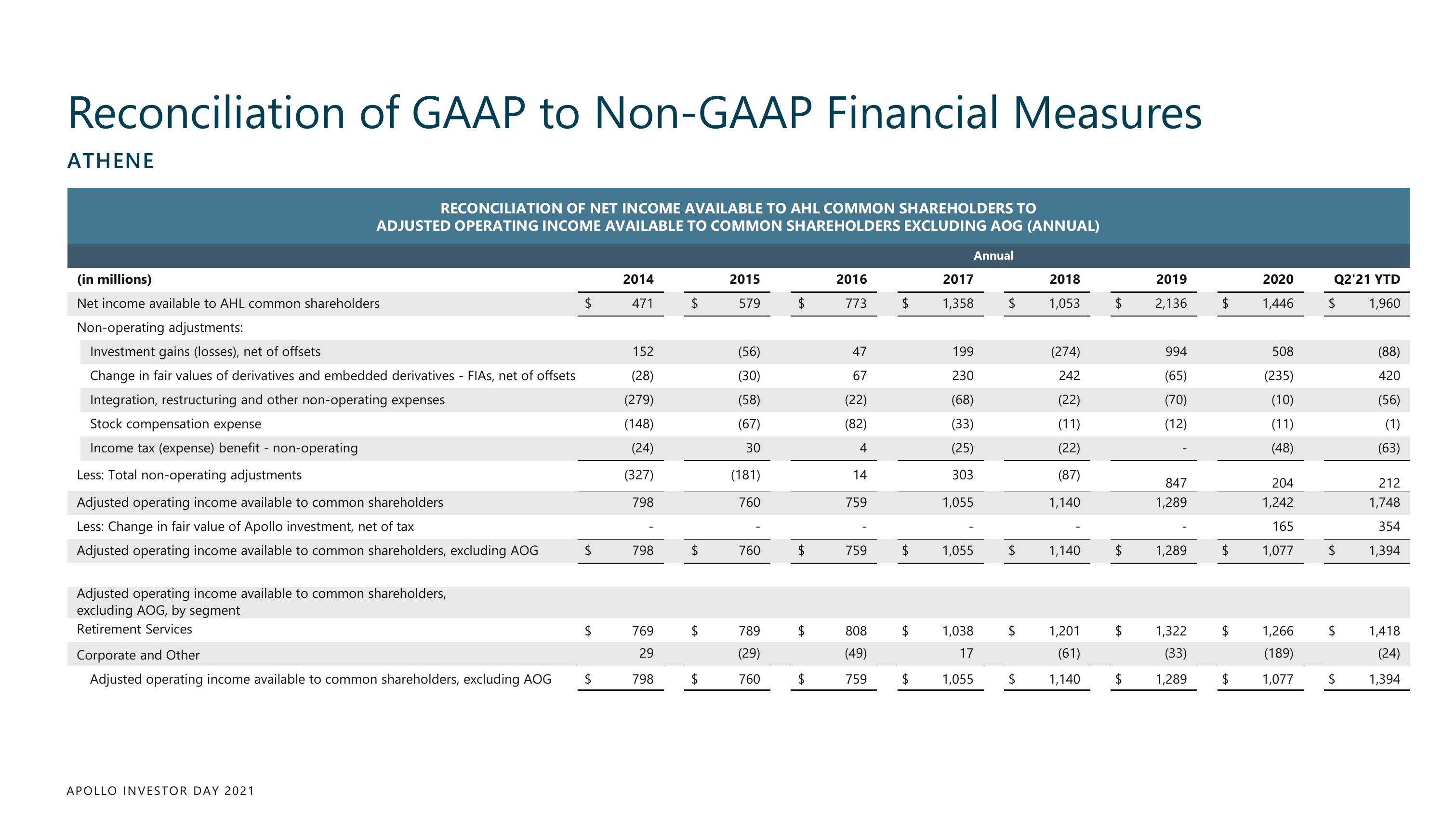

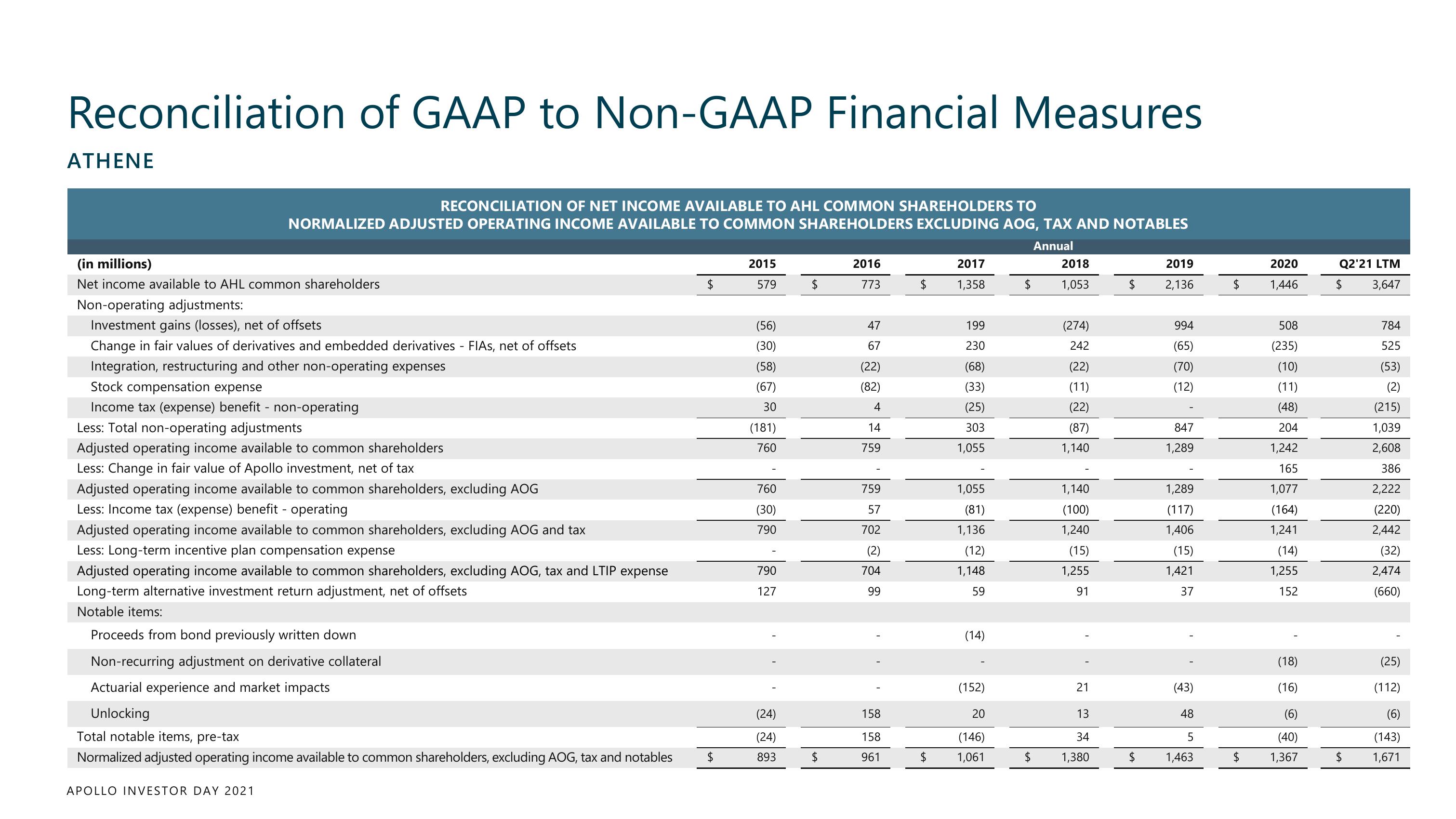

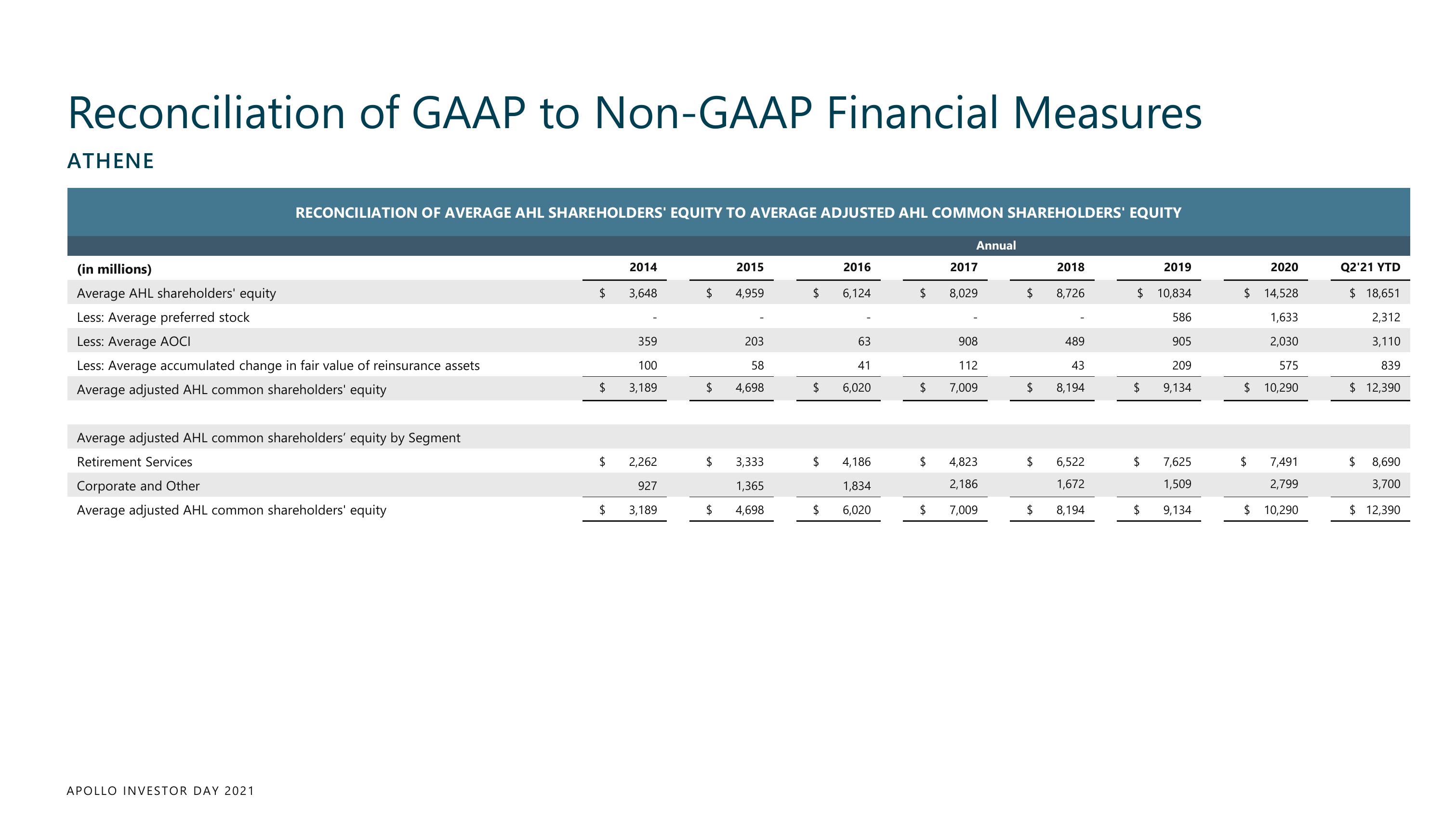

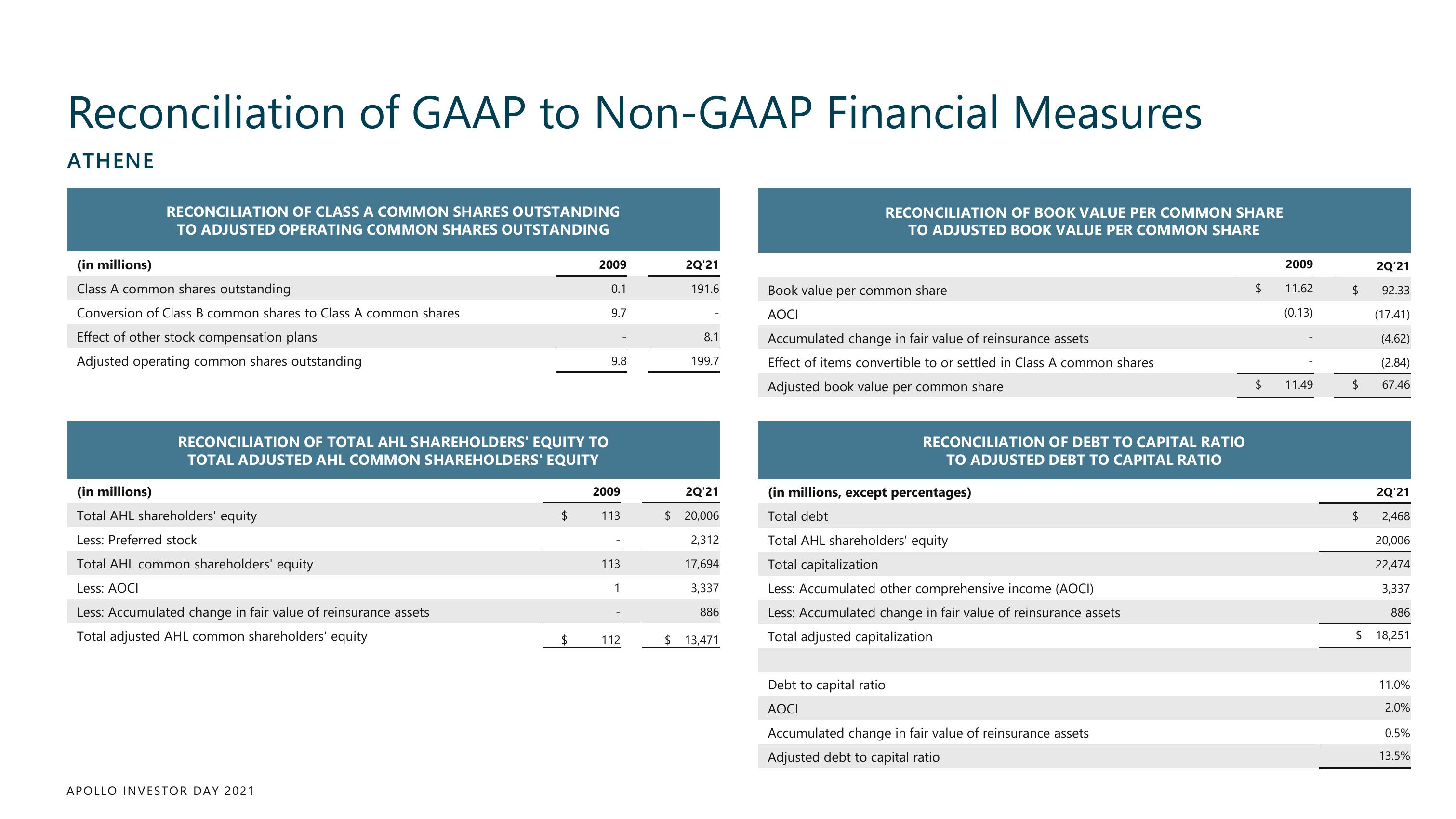

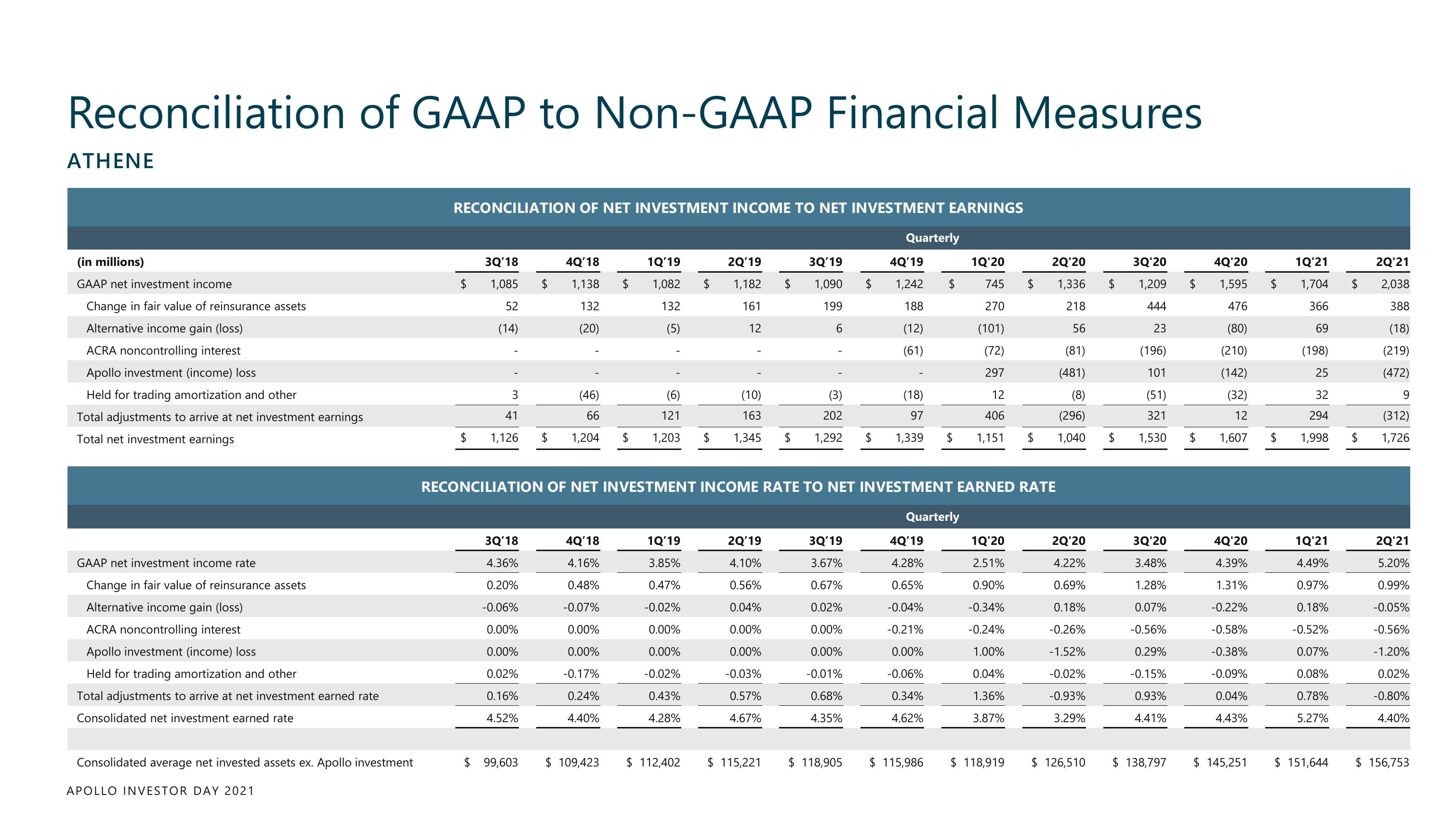

Financial

Published

October 2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related