Apollo Global Management Investor Day Presentation Deck

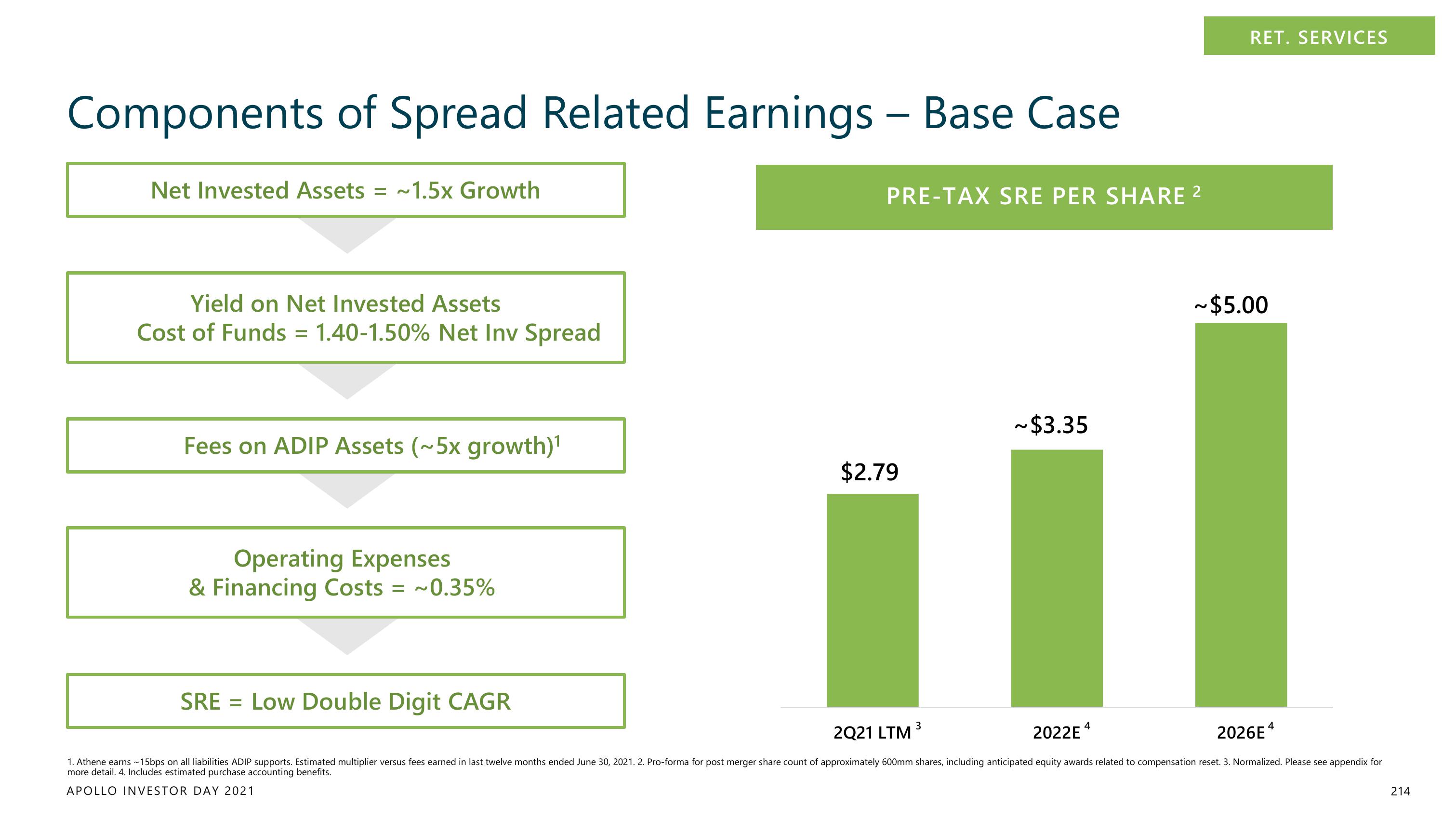

Components of Spread Related Earnings - Base Case

Net Invested Assets = ~1.5x Growth

Yield on Net Invested Assets

Cost of Funds = 1.40-1.50% Net Inv Spread

Fees on ADIP Assets (~5x growth)¹

Operating Expenses

& Financing Costs = ~0.35%

SRE Low Double Digit CAGR

PRE-TAX SRE PER SHARE 2

$2.79

2Q21 LTM

3

~$3.35

RET. SERVICES

~$5.00

2022E4

2026E4

1. Athene earns ~15bps on all liabilities ADIP supports. Estimated multiplier versus fees earned in last twelve months ended June 30, 2021. 2. Pro-forma for post merger share count of approximately 600mm shares, including anticipated equity awards related to compensation reset. 3. Normalized. Please see appendix for

more detail. 4. Includes estimated purchase accounting benefits.

APOLLO INVESTOR DAY 2021

214View entire presentation